Biotech and Gold

Issue 31;

It’s an interesting issue this week as change is underfoot. The ascent of the World Index is slowing for a start, as the largest stocks slow down, with smaller stocks taking on a more leading role.

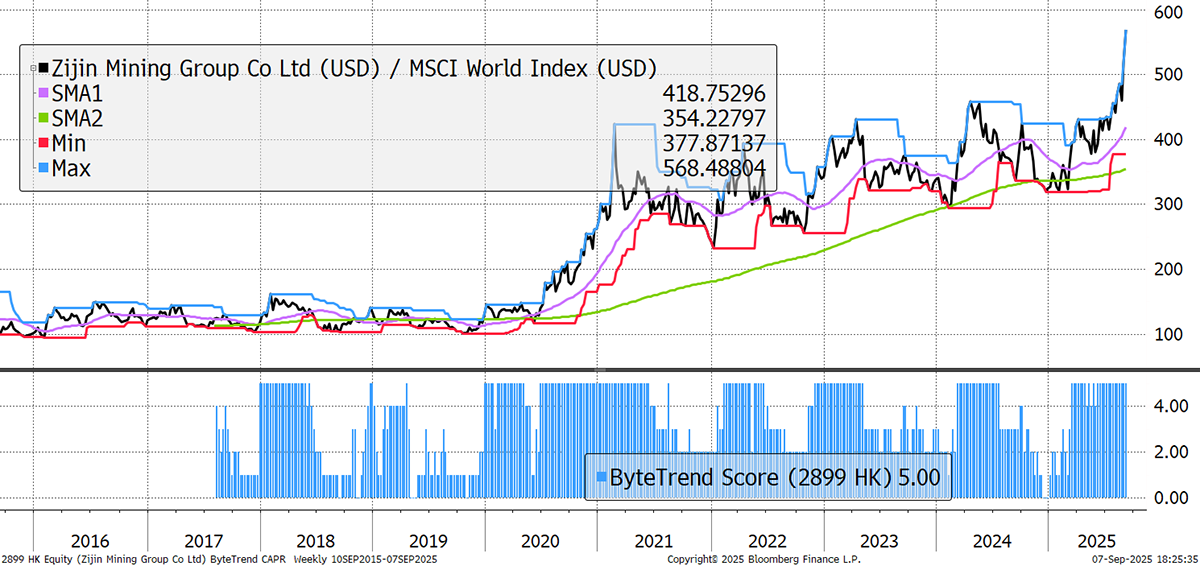

Secondly, Europe, financials, and utilities, which have driven the markets for much of 2025, are fading out of the Leading and Emerging categories. The rally in asset managers, which we highlighted some months ago, is also slowing down. Many global brands like Coca-Cola (highlighted last week) continue to drift. They are being replaced by gold, basic materials, and biotech, which are suddenly appearing in greater numbers, such as Zijin Mining or Danish Genmab.

Meanwhile, the geographical weakness in Southeast Asia might also be on the turn, as Thailand’s politics takes a step in the right direction, taking its stockmarket with it.

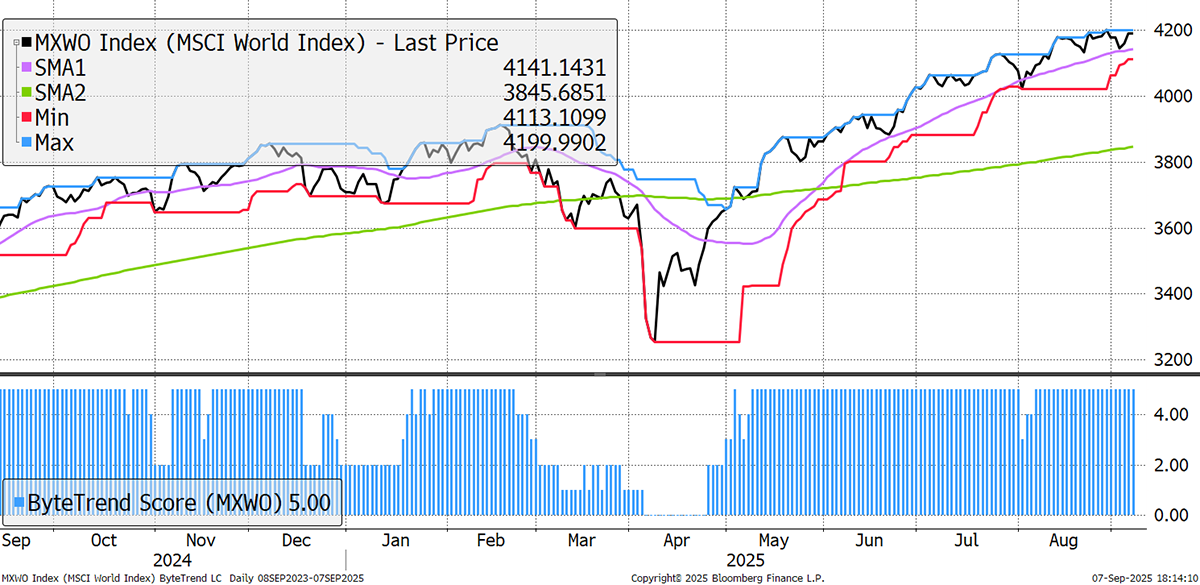

The World Index is still strong with a ByteTrend Score of 5, yet that trend is slowing down. We mustn’t ignore the wealth illusion, which is the tailwind from a weak dollar.

World Index – Developed Markets – Daily

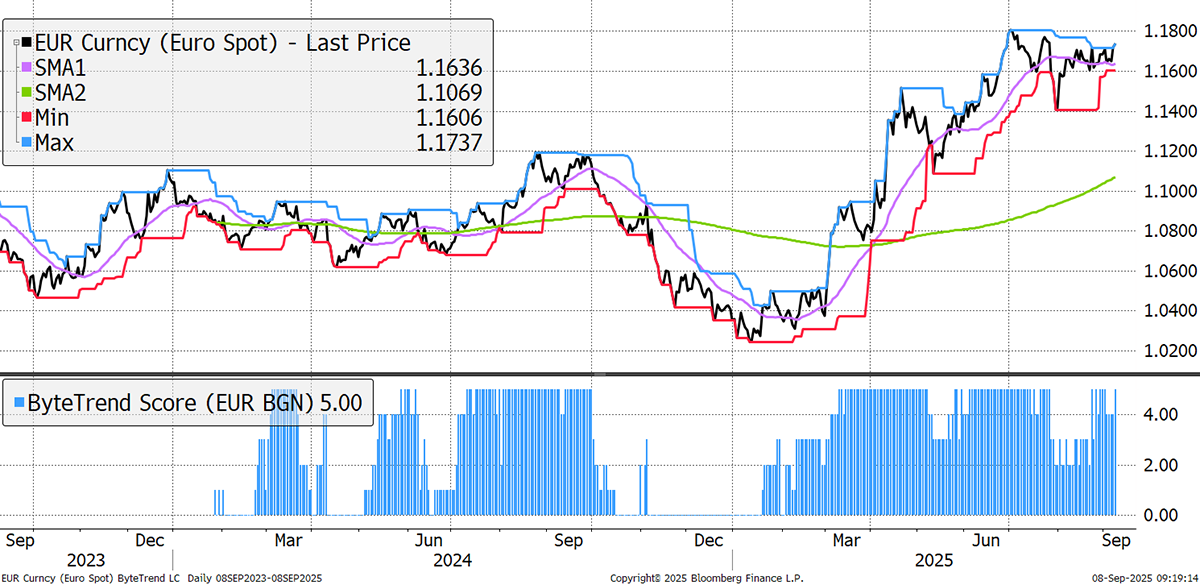

The euro is the main alternative to the dollar, and a new high seems likely.

Euro – Daily

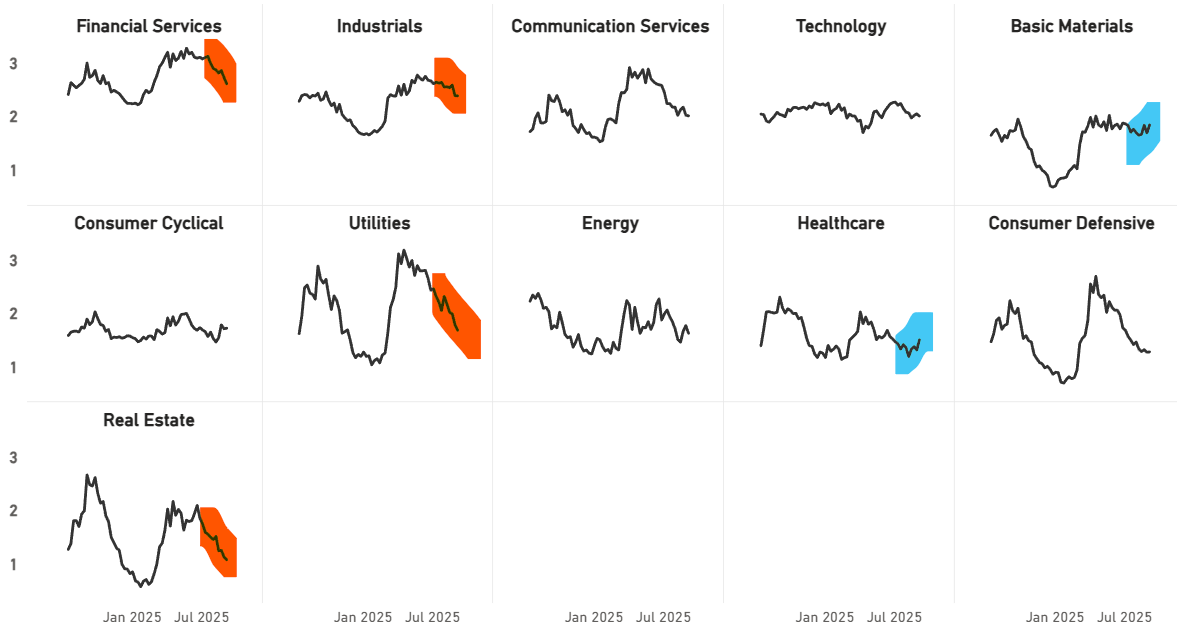

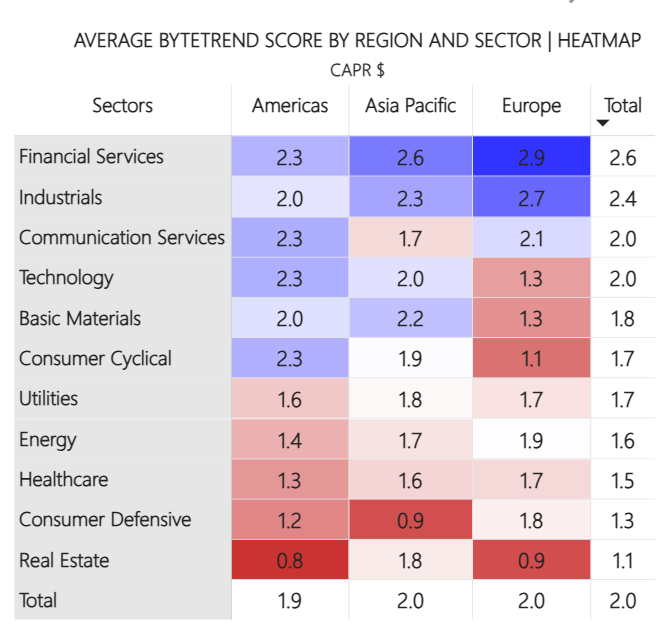

Looking at the sectors, financials, industrials, and even utilities, the leaders of recent months are rolling over. In their place come materials and healthcare. Within materials, the gold stocks stand out as the gold price has made another all-time high. Within healthcare, it’s biotech.

ByteTrend: Weekly Breadth Signal – Local Currency

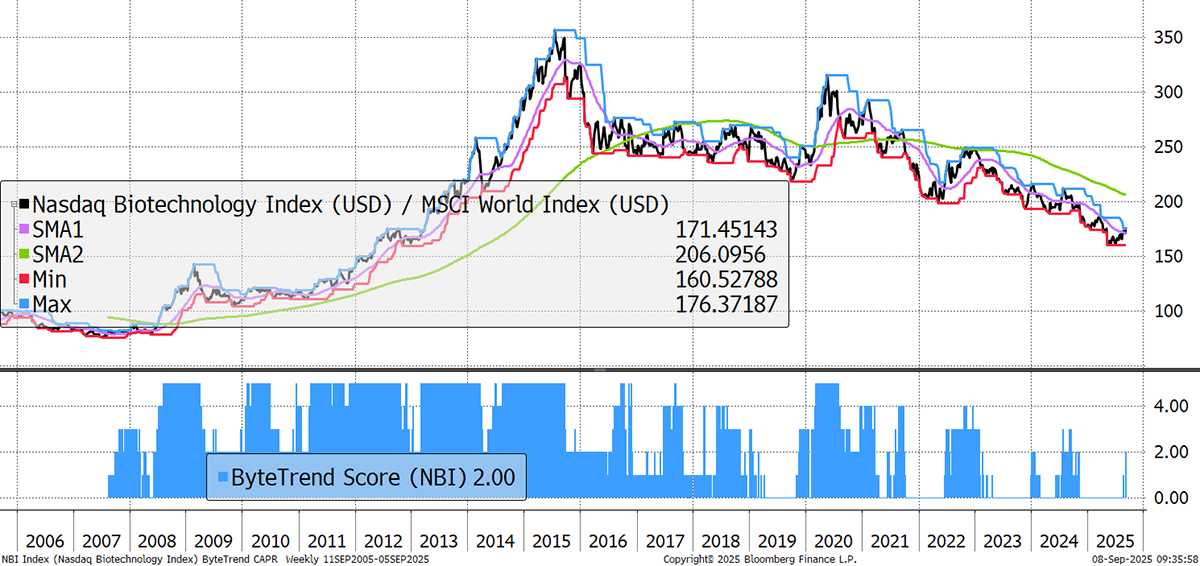

This week, we highlight some biotech stocks below. Many companies are showing leadership and making new CAPR highs. This is important because the Nasdaq biotech index hasn’t ridden a wave since 2015. Those were the days.

Nasdaq Biotech Index CAPR

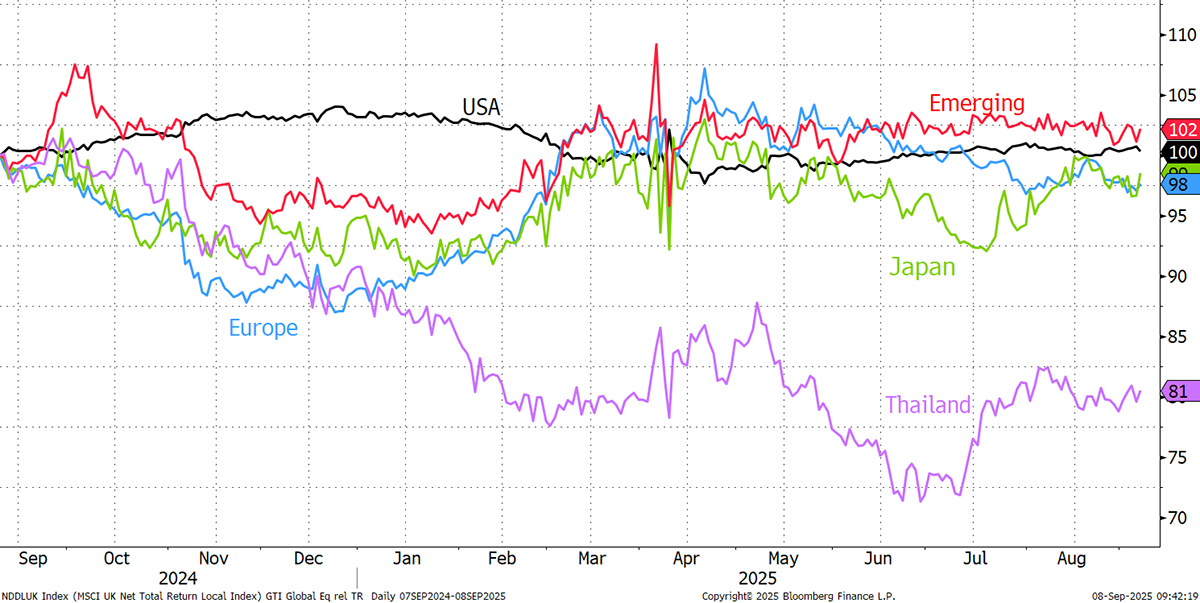

This week’s guest nation is Thailand, which has seen a sharp rally since the Paetongtarn Shinawatra (daughter of Thaksin) government fell. Last week, they voted in a new prime minister, Anutin Charnvirakul, another business tycoon, who is focused on economic recovery, prioritising tourism, digital, and foreign investment. A stabilising force is bullish for Thailand, which has lagged the World Index since 2018.

As for the major markets, they have been closely packed together over the past year.

CAPR: Europe, USA, Emerging Markets, Japan, Thailand - Past Year

Basic materials and healthcare are the winners, as stated earlier. Materials are better off in the Americas and Asia, whereas healthcare has seen the most strength in Europe.

Yet overall, Europe is down compared to the world once again, with France, Germany and the UK giving background. That said, Spain, Ireland, and Italy still rank highly. One notable deterioration has been European real estate. The rebound we saw last seems to have fizzled out.

Average ByteTrend Score by Region and Sector Heatmap - CAPR

Leading Trends with New Highs

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of 5. All charts shown are CAPR rebased to 100.

| GOOGL | USD | Alphabet Inc. |

| AVGO | USD | Broadcom Inc. |

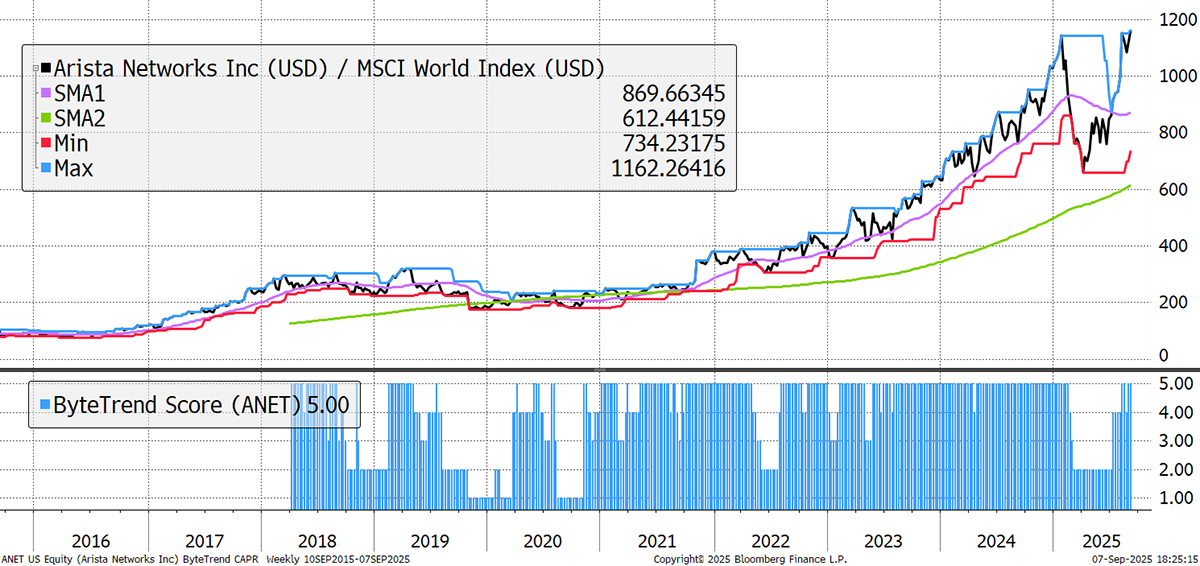

| ANET | USD | Arista Networks, Inc. |

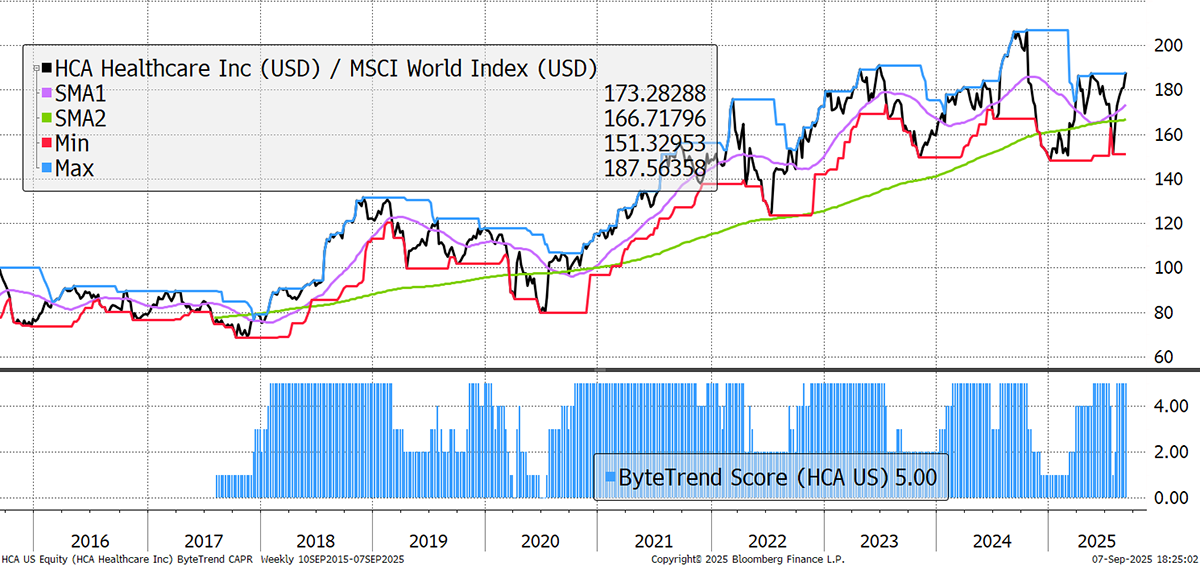

| HCA | USD | HCA Healthcare, Inc. |

| 2899 | HKD | Zijin Mining Group Company Limited |

Arista Networks took a brutal hit at the start of the year, but with the market bounce back from the tariff situation, it has more than recovered its relative losses. Its data centre, cloud, and AI networking solutions are globally recognised, and revenue growth is picking back up again. Since 2023, it’s also materially grown its free cash flow generation, as it has been able to slow down on R&D spending as it matures.

Arista Networks

HCA owns and operates hospitals and other healthcare sites in the US. It grows steadily, is highly profitable, and has been successfully reducing its use of debt over the past 15 years. Analyst price targets are rising again, alongside revenue growth, after a brief dip. This is despite some segments slightly missing expectations in 2025 so far. Medicaid and self-pay are both delivering quite weak growth, around 1-2%, when 3-4% was what they had guided for, but overall growth of 6.4% in Q2 was taken positively.

HCA Healthcare

Zijin Mining is a Chinese company focused on copper and gold, and other metals too, with a $94bn market cap. It is highly integrated, covering mining, refining, trading and other related services too. With the gold price soaring, all financials are moving quickly in the right direction. It had to pause operations at its huge Kamoa-Kakula project in the DRC recently due to mine tremors, reducing the estimated reserves as a result. It shares ownership with Ivanhoe Mines and the DRC government.

Zijin Mining

There are 83 additional leading trends with new highs in the GTI universe. Gold stocks dominated the list, but we also see Japanese conglomerates and biotech. The banks, which have dominated this list for months, have gone. Auto, parts, dealers, makers are all there, and Ralph Lauren, too.

Find out more about GTI: Premium