Hints of Danger

Issue 35;

- Chip stocks build the future.

- Consumer defensives are now in a 10-year bear market.

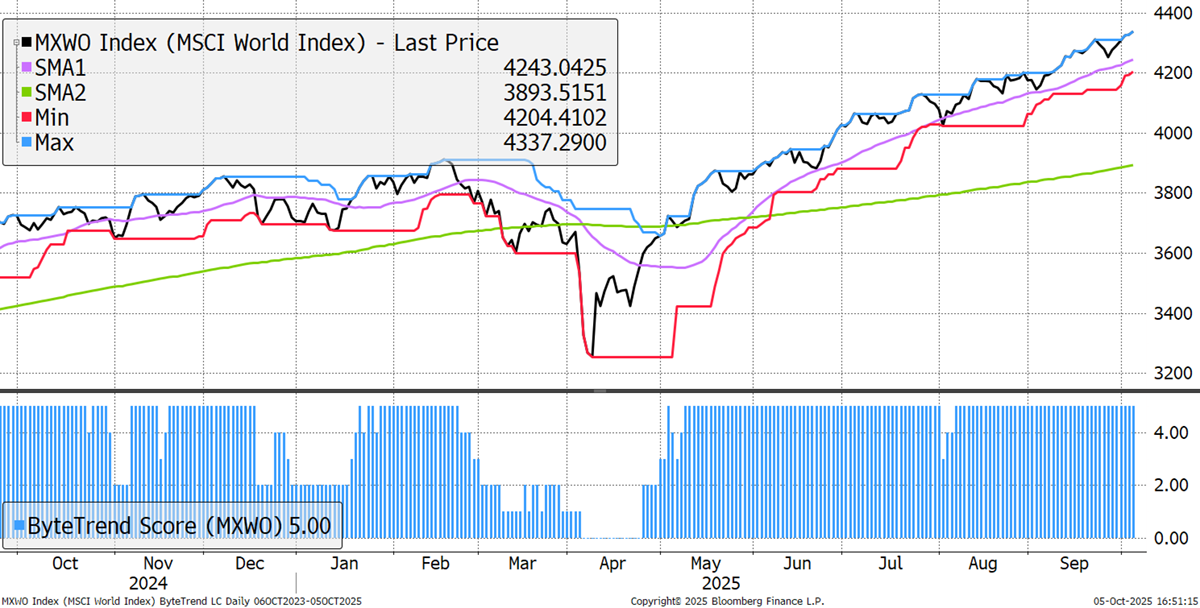

The World Index seems to be unstoppable, maintaining its ByteTrend Score of 5 with only a brief interruption since May. It is still not particularly overbought.

World Index – Developed Markets – Daily

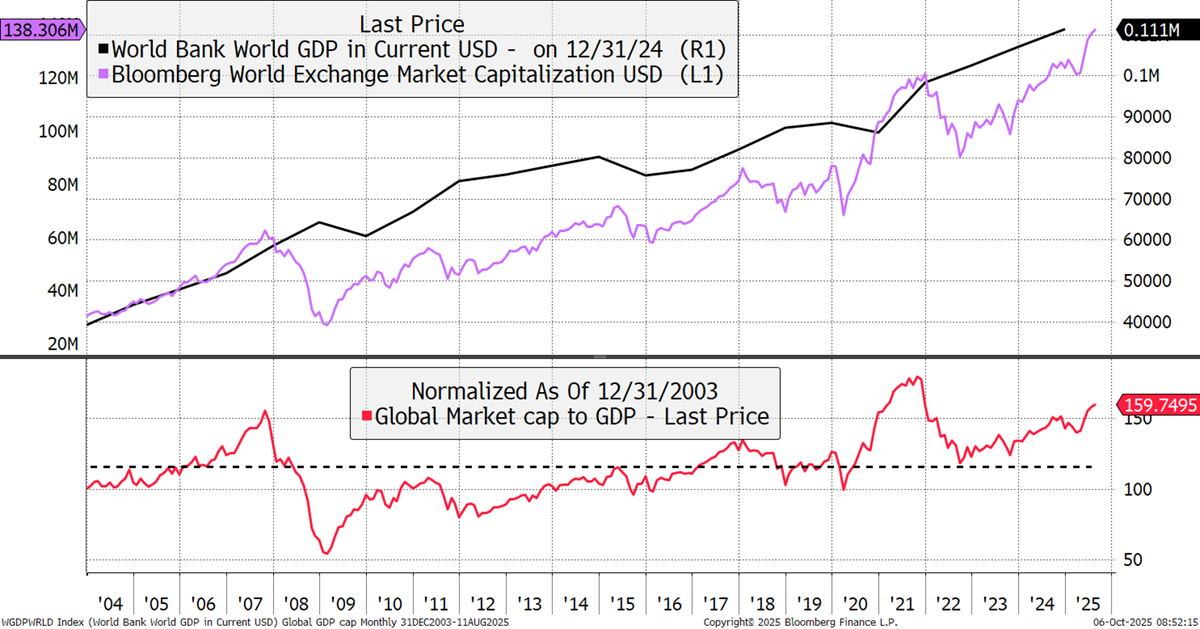

We highlighted the chart below in the recent Multi-Asset Investor Quarterly Review. The market cap to GDP ratio is said to be one of Warren Buffett’s favourite market valuation measures. There can be no doubt that we are entering a period of high valuations.

Global Market Cap to GDP

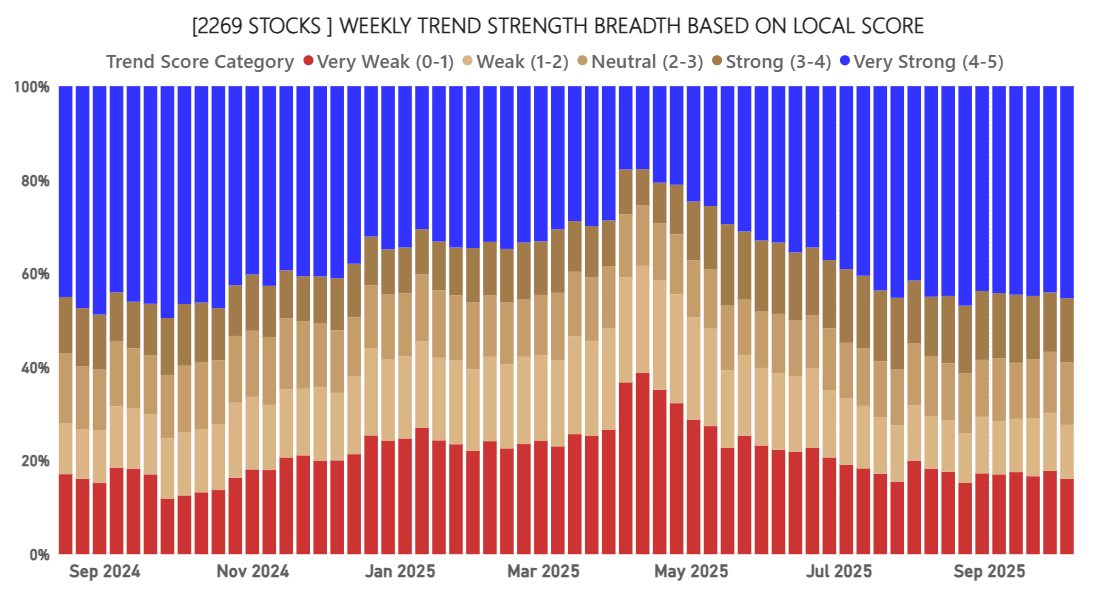

Yet, global equity breadth remains healthy, which is vital to monitor each week, given the market's strength. A reduction in bullish trends (blue), with an increase in bearish trends, as we saw in late 2024, would be a warning sign. It’s not yet happening.

ByteTrend: Weekly Breadth Signal – Local Currency

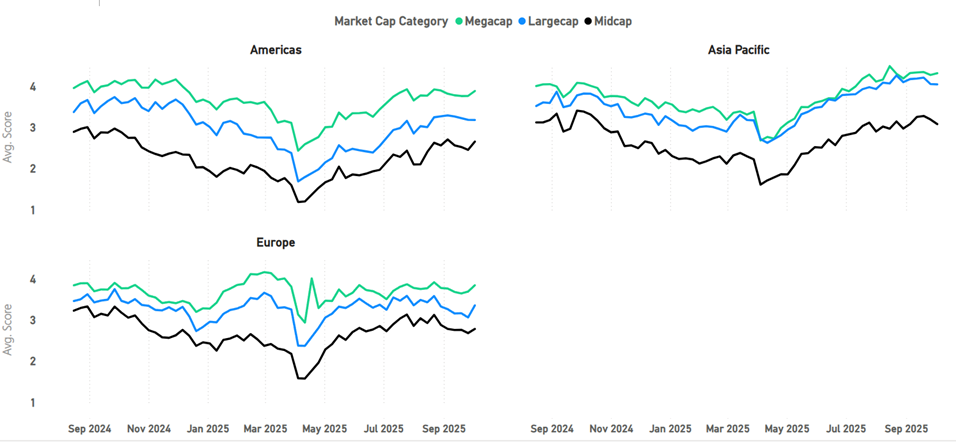

The other risk to the index would be a deterioration in the mega-caps, which have led this rally. In all regions, the mega-caps lead the large-caps, which lead the mid-caps. At some point, this will change, and the thought is that the mid-caps may provide sanctuary.

Regional Performance by Size

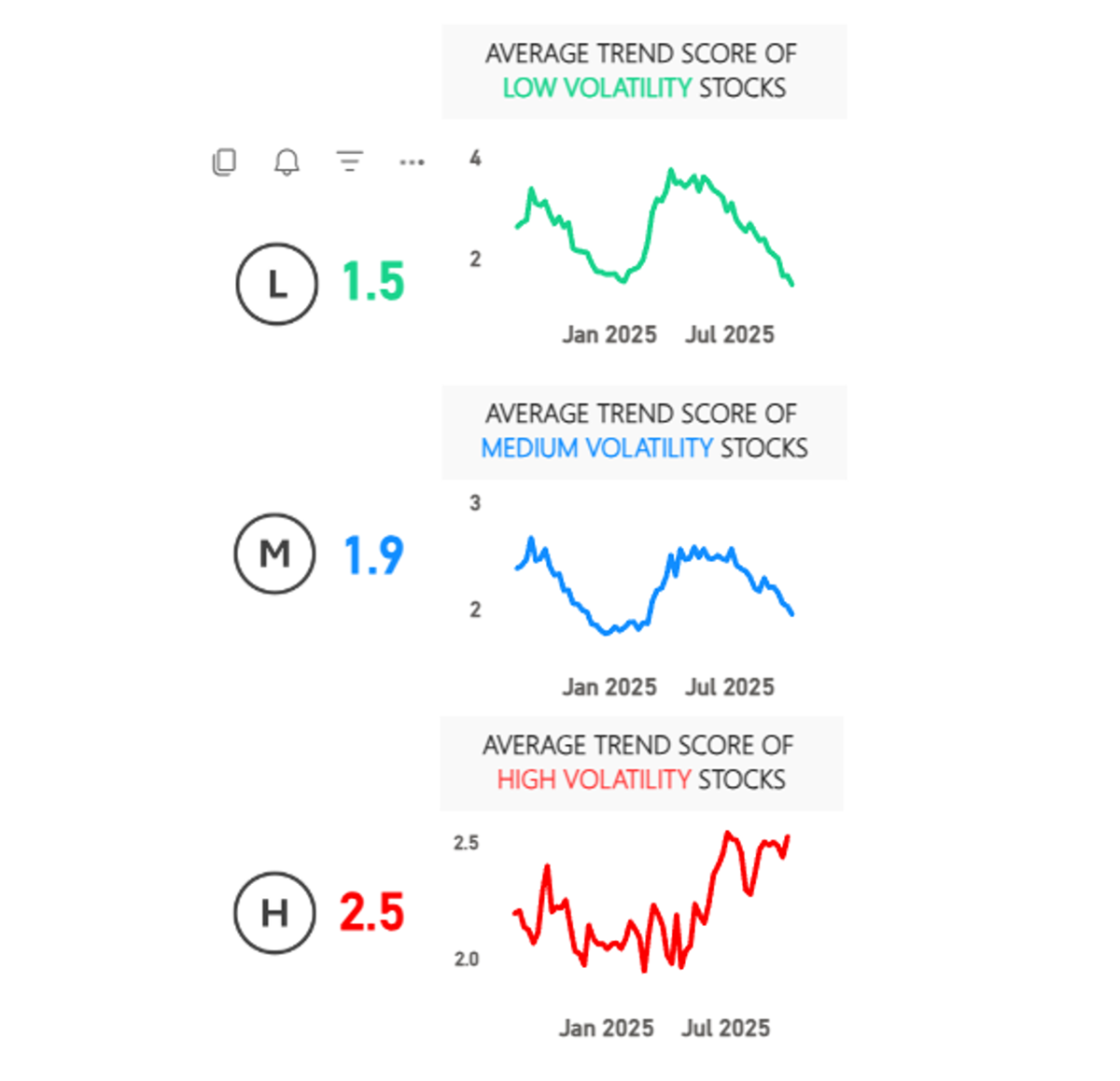

Volatility also stands out. Low volatility stocks, normally the safest, are lagging the market quite severely. Medium volatility stocks are also lagging, while the market is being led by the most volatile stocks.

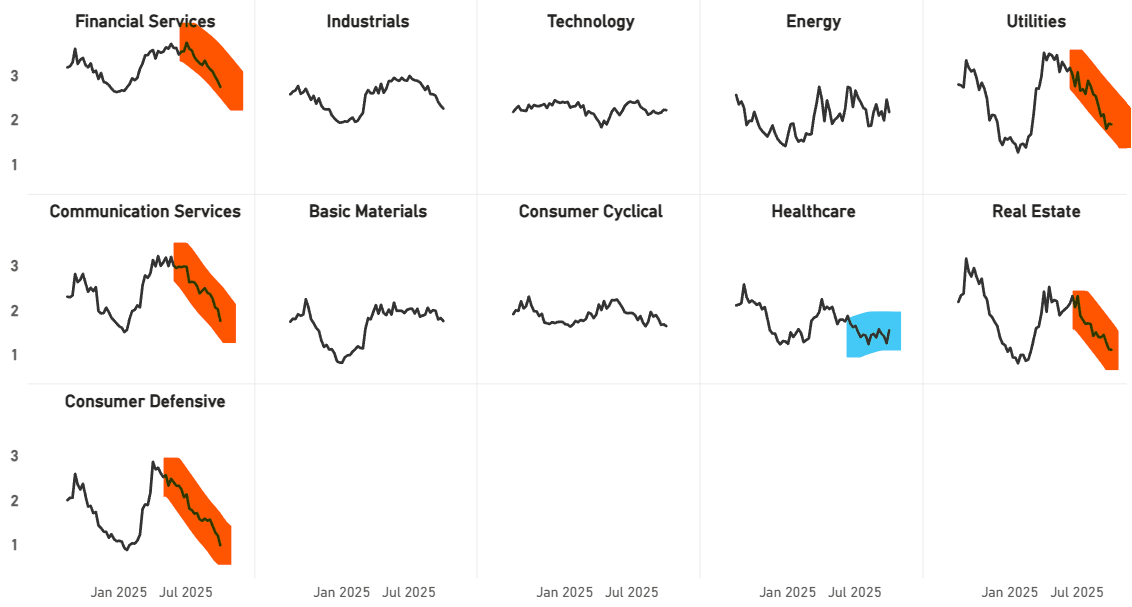

Technology is the most stable sector when measured in currency-adjusted price relative (CAPR) terms. Financial services are weakening from a position of strength. Utilities, communications, real estate, and consumer defensives are also weakening. Healthcare is the standout bull case this week, having been weak over the summer. Energy, highlighted last week, may have seen its worst.

Global Sector Performance in CAPR

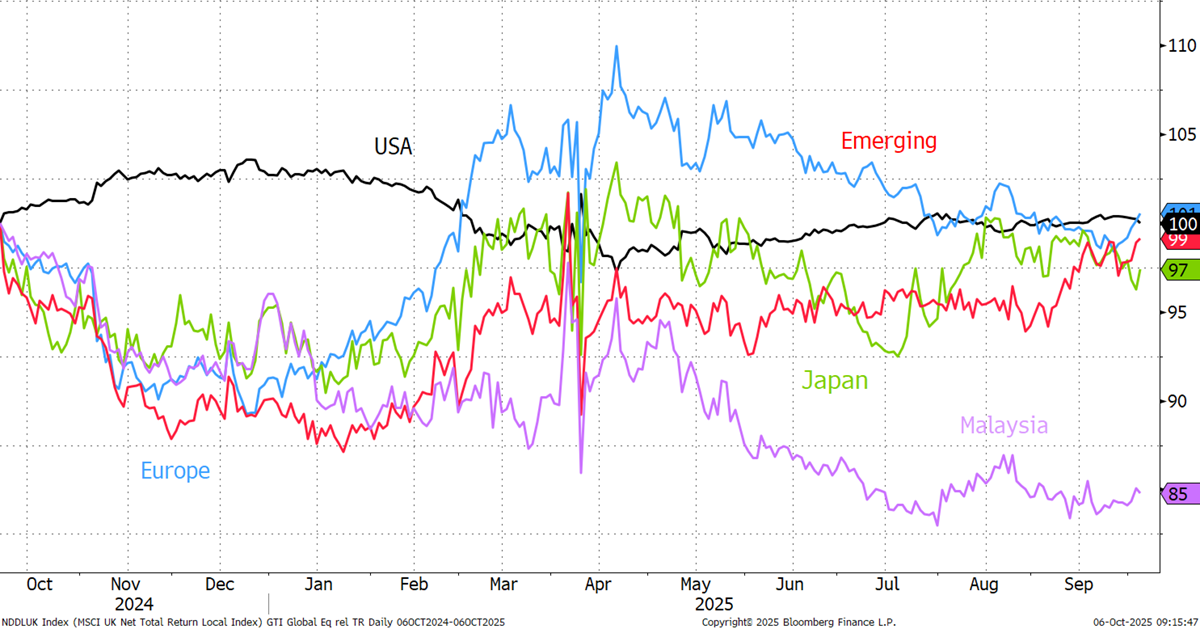

Our guest market this week is Malaysia, which led the increase in trend classification this week, meaning it had more improving trends than deteriorating trends – a net winner. Emerging markets and Europe are a little stronger, but the main observation is that the major markets continue to trade in a tight pack. With a new prime minister, Japan is the great hope.

CAPR: Europe, USA, Emerging Markets, Japan, and Malaysia - Past Year

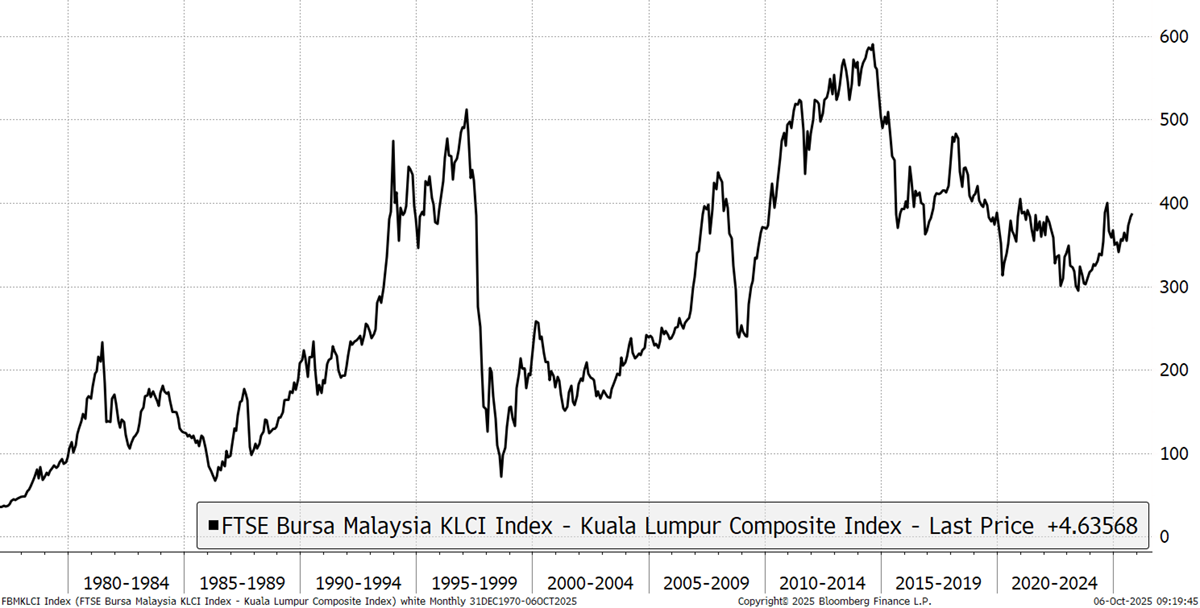

It’s odd to think that Malaysian stocks traded at current levels in 1993. The 1998 devaluation was brutal. More recently, the last bull market peaked in 2014, and it looks as if the market has found support. One for value investors to consider.

Malaysian Stockmarket in USD since 1975

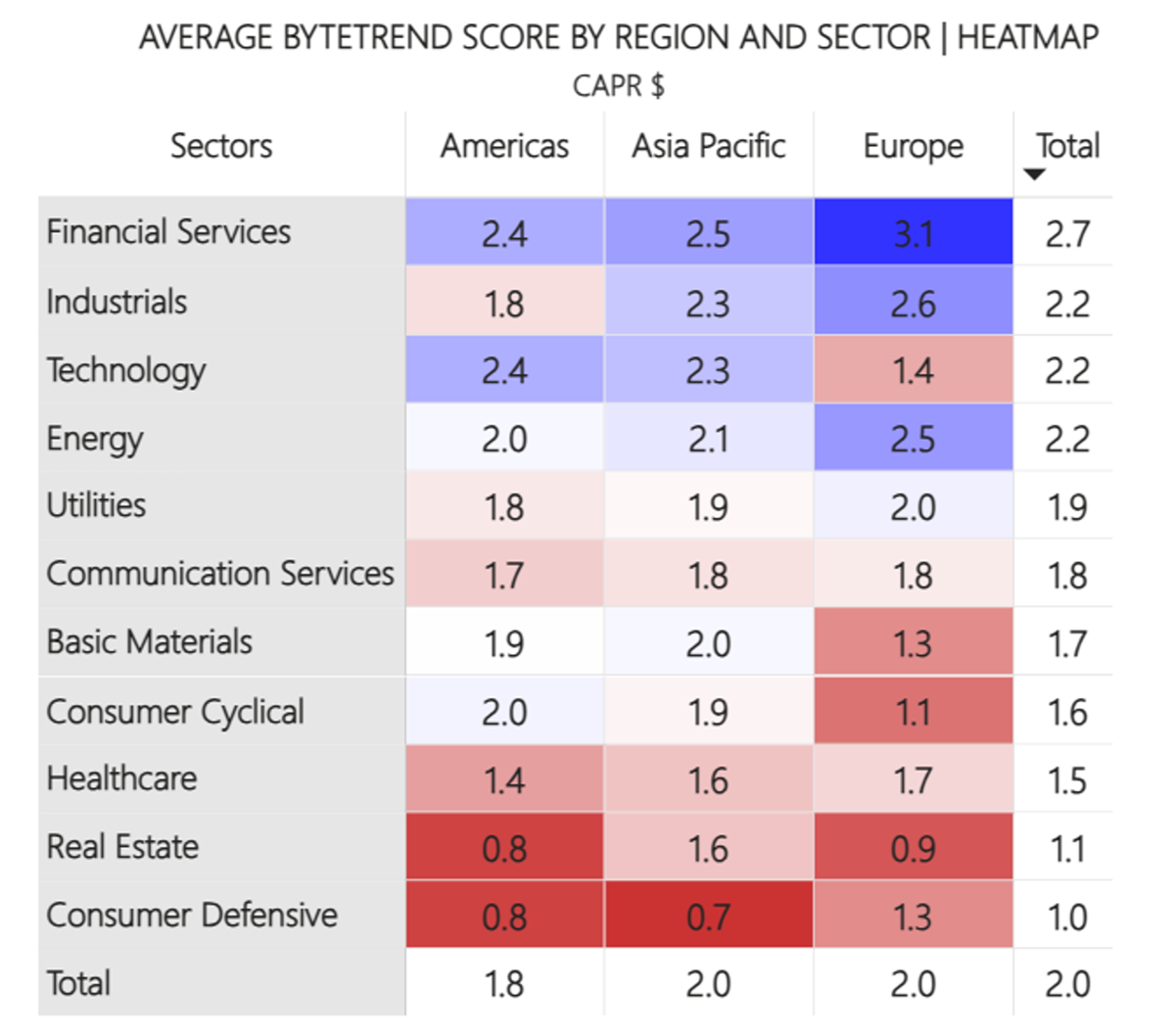

The world matrix still holds European financials in the lead, but the pace is slowing for global financials in general. Industrials are slightly weaker than last week, and technology is stable. Consumer defensives (staples) haven’t been this out of favour for a very long time.

Average ByteTrend Score by Region and Sector Heatmap - CAPR

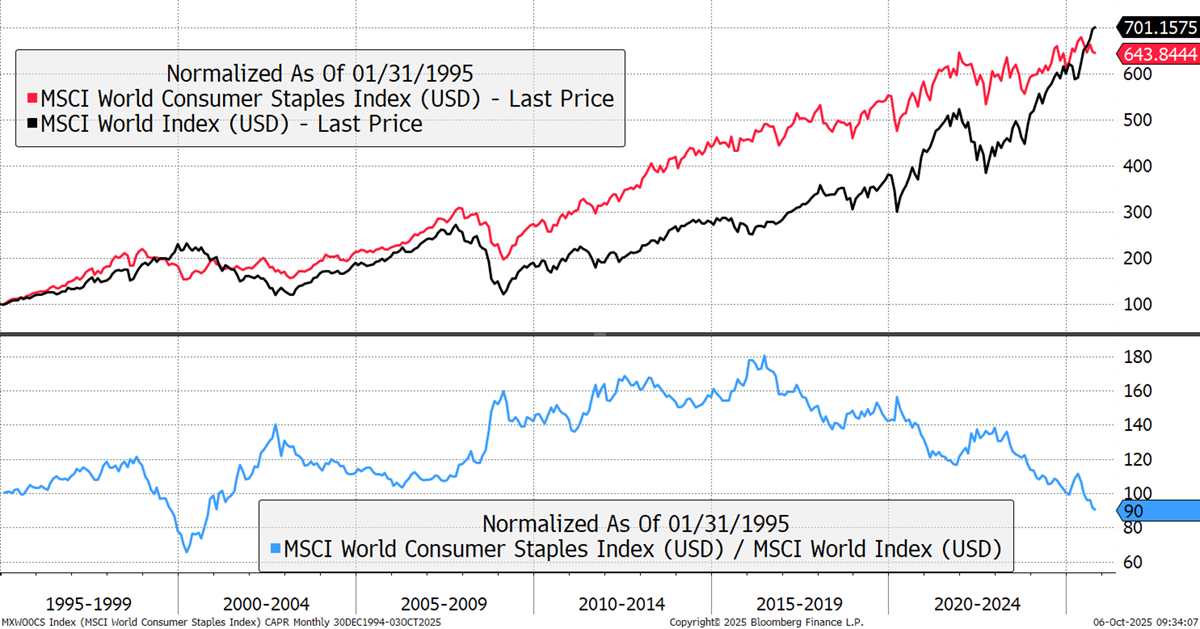

Consumer staples lagged the market in the roaring 1990s technology boom, and then again ahead of the financial crisis. This time they have lagged since 2016 and appear to be out of favour like never before. Another contrarian buy ahead of the market turn – whenever that comes.

World Consumer Staples CAPR since 1995

Leading Trends with New Highs

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of 5. All charts shown are CAPR rebased to 100.

| 2330 | TWD | Taiwan Semiconductor Manufacturing Company Limited |

| 700 | HKD | Tencent Holdings Limited |

| 9988 | HKD | Alibaba Group Holding Limited |

| NPN | ZAc | Naspers Limited |

| HSBA | GBp | HSBC Holdings plc |

| CAT | USD | Caterpillar Inc. |

| APP | USD | AppLovin Corporation |

| MU | USD | Micron Technology, Inc. |

| 660 | KRW | SK hynix Inc. |

| 9984 | JPY | SoftBank Group Corp. |

| AIR | EUR | Airbus SE |

| LRCX | USD | Lam Research Corporation |

| AMAT | USD | Applied Materials, Inc. |

| PRX | EUR | Prosus N.V. |

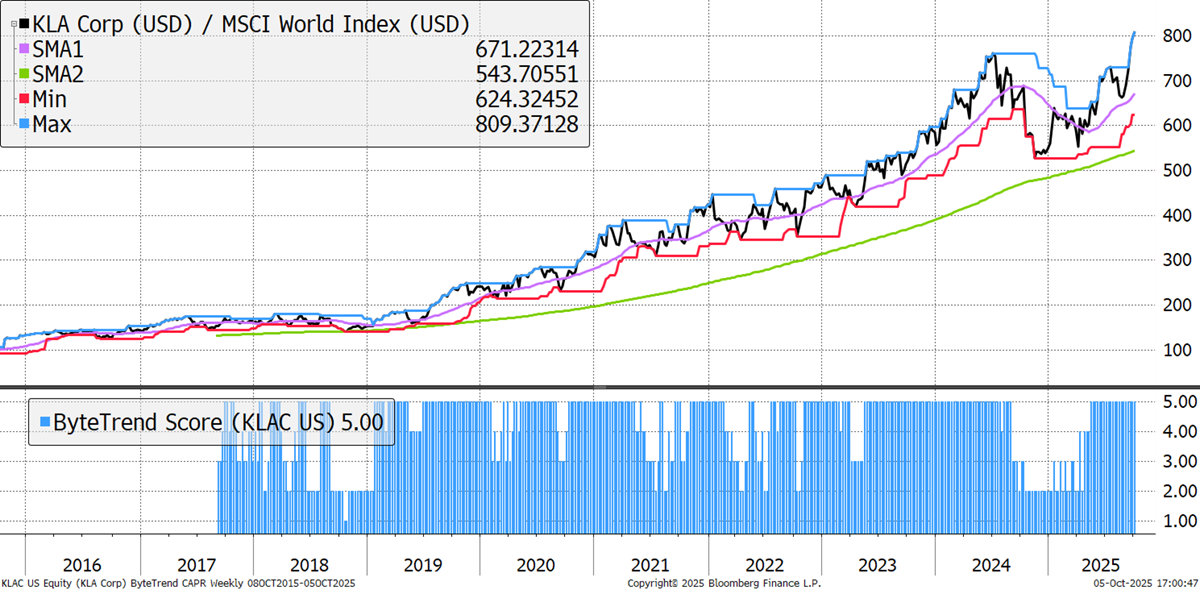

| KLAC | USD | KLA Corporation |

| ABBN | CHF | ABB Ltd |

| HOOD | USD | Robinhood Markets, Inc. |

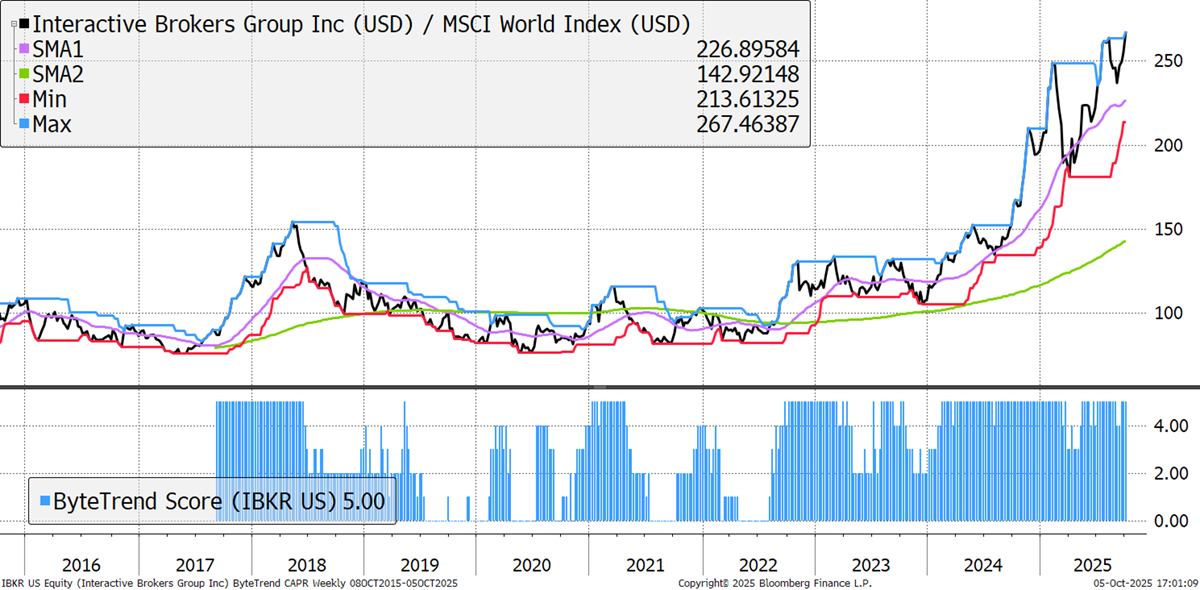

| IBKR | USD | Interactive Brokers Group, Inc. |

| 2899 | HKD | Zijin Mining Group Company Limited |

| 2317 | TWD | Hon Hai Precision Industry Co., Ltd. |

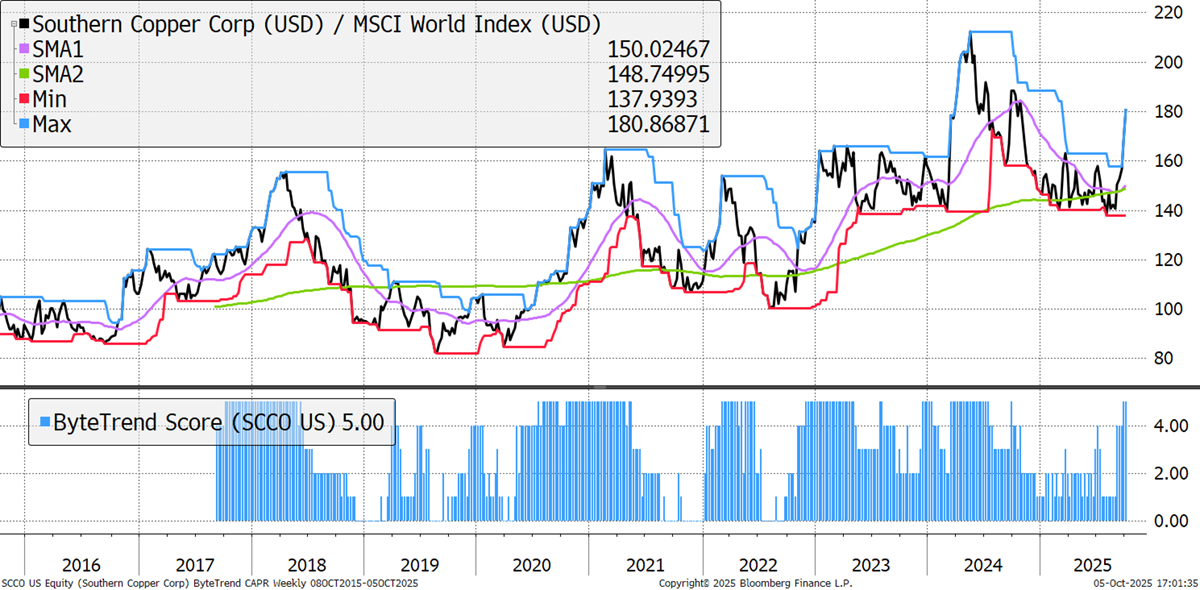

| SCCO | USD | Southern Copper Corporation |

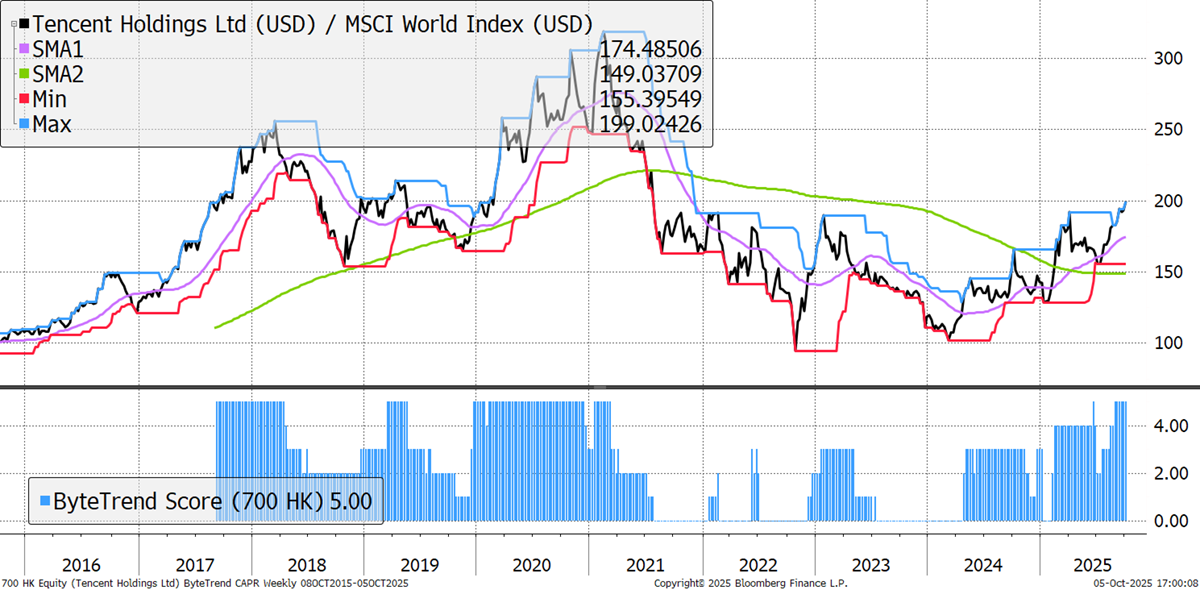

Tencent

Tencent is up over 50% this year, driven by growth in gaming, AI advertising, cloud services, and fintech. It’s investing heavily in AI-integration across its platforms and remains a market leader in video and music. It suffered from broader Chinese weakness in 2022/23, with quarterly revenues briefly falling, but it has steadily returned to double-digit growth ever since. It reached its lowest valuation multiples in this period, but these have since normalised.

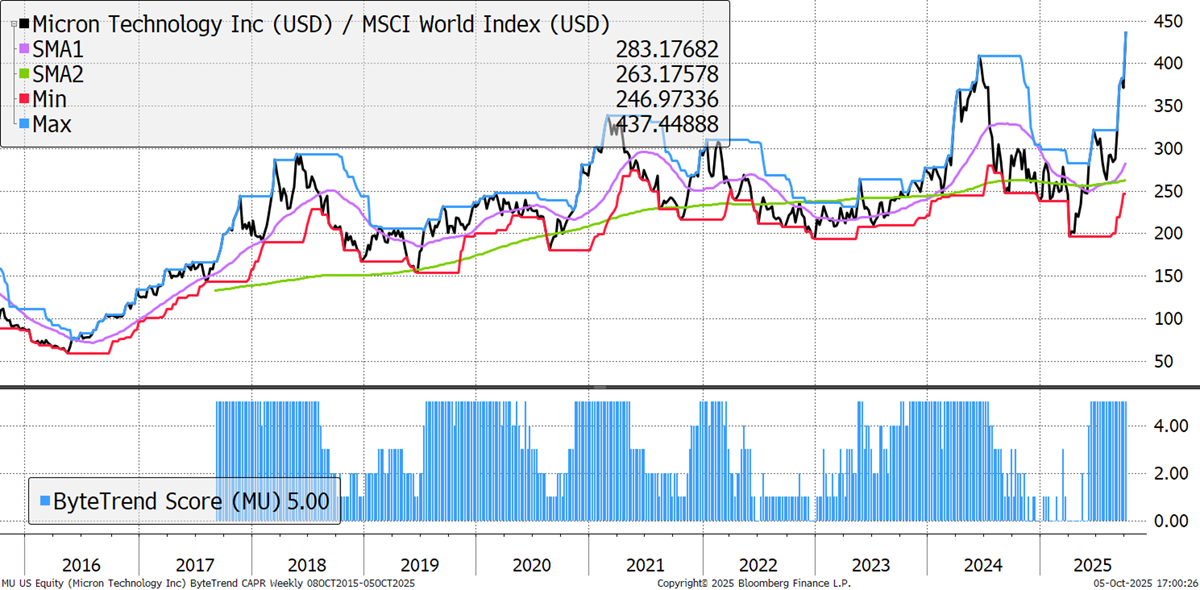

Micron

Micron is one of the largest semiconductor companies in the world, specialising in memory and storage chips. It delivered record financial results in FY2025, driven by AI-related demand for its solutions. It reported Q4 revenue of $11.32 billion, up 46% YoY, but capex is also rising sharply to build out data centres.

KLA Corp

Semiconductor equipment manufacturer KLA Corp has enjoyed a strong decade of outperformance, driven by high growth and returns on capital of 30-40%. Everyone always talks about TSMC, but KLA has outperformed it since just before the pandemic. After revenue growth turned negative in 2024, it suffered a dip, but growth has returned to over 20% in the last three quarters, explaining its return to form.

Interactive Brokers

It was voted best broker in our Broker Survey, scoring highly across multiple metrics. Sometimes, it’s as simple as recognising that a company makes the product that customers prefer, and in online investment platforms, IB is it. It has high returns on capital and has grown steadily over the long term, but it now trades on historically high multiples as a result.

Southern Copper

The brief tariff shock in the summer tanked the copper price, but it’s back on the rise and reapproaching all-time highs. Inflation round two incoming? Southern Copper is one of the world’s largest producers with huge operations in Mexico and Peru. Majority-owned by Grupo Mexico, it also produces zinc, silver, and molybdenum (used to strengthen steel for aircraft, vehicles, and industrial uses).

There are 91 additional leading trends with new highs in the GTI universe. Many leading stocks are listed in Hong Kong. There’s also a heavy showing from materials, especially gold. Financials have shrunk markedly. Industrials feature with a focus on electricity infrastructure.

Emerging Trends

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of less than 5. They don’t have to be in an uptrend, just emerging. All charts shown are CAPR rebased to 100.

| 5930 | KRW | Samsung Electronics Co., Ltd. |

| ASML | EUR | ASML Holding N.V. |

| SHOP | CAD | Shopify Inc. |

| INTC | USD | Intel Corporation |

| TD | CAD | The Toronto-Dominion Bank |