Japan’s First All-time High since 1990 - Key Drivers and What it Means

Issue 28;

The world index made another all-time high. The ByteTrend Score remains a very solid 5, and a weaker dollar helped.

World Index – Developed Markets – Daily

I’ll jump straight into Japan, as it’s the story of 3 ½ decades. For the last three weeks, the regional CAPR chart has seen Japanese stocks lead the world. It was easy to write this off as an advantage of base effects, whereby Japanese stocks faced the yen crisis a year ago, but 9% outperformance vs the world is too much to ignore. Japan is on a tear. The US market is now 1% behind the world over a year, EM 1% ahead, and Europe catching up again, following a pullback.

CAPR: Europe, USA, Emerging Markets and Japan - Past Year

The Japanese stockmarket has just made an all-time high after a 35 year wait. Some will write this off as a cheap yen story, but the yen is at roughly the same level as it was in 1990, and 2 ½ time higher than it was in 1970.

Japan TOPIX Index since 1970 in JPY

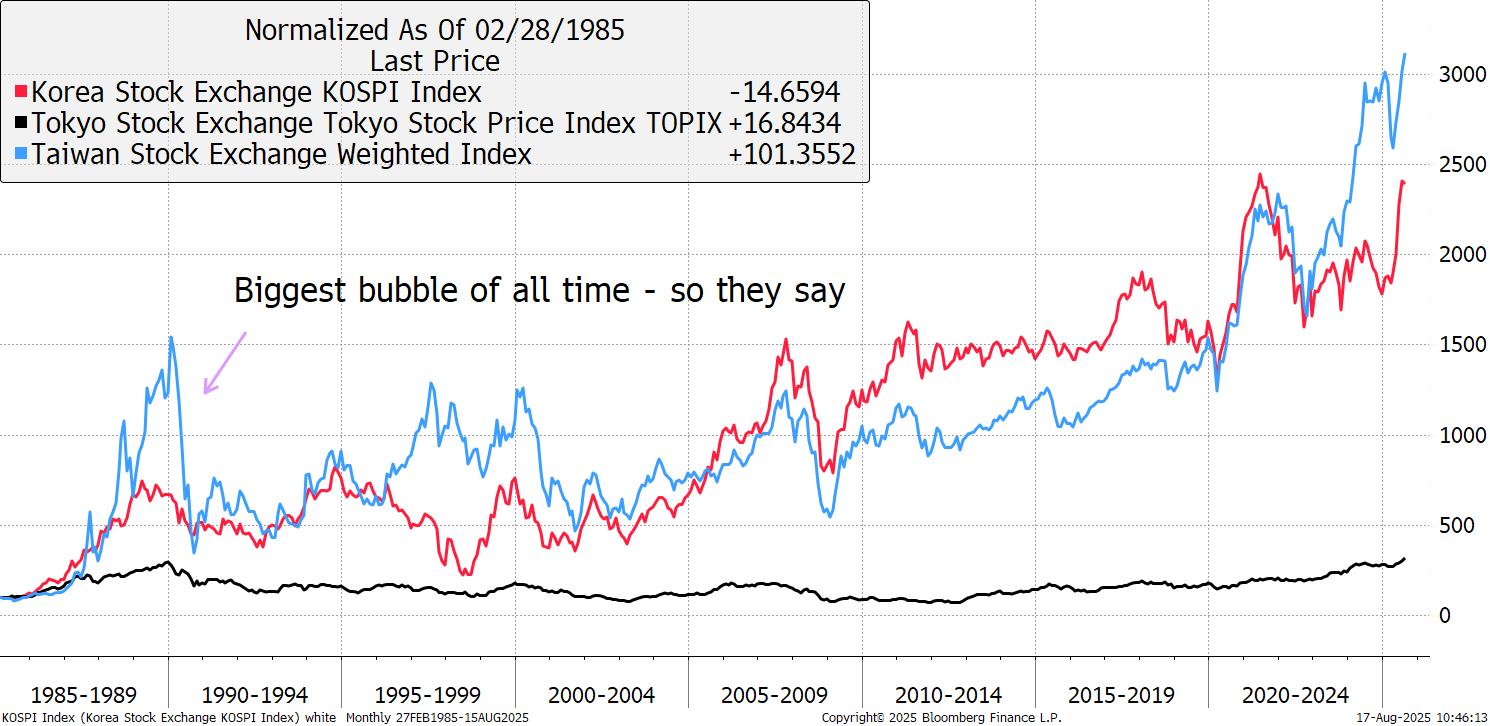

Korea’s KOSPI and Taiwan’s TAIEX, also made significant highs in 1990. Korea made its next high in 2005, and Taiwan, 2021. They say that the fast-growing Asian nations saw the greatest bubble of all time back in 1990. Back then, Japanese stocks made up nearly 50% of the world index, and the Emperor’s garden was worth more than California. It’s a great reminder how dangerous bubbles are and how long it can take to get your money back.

Japan, Taiwan, Korea 1990 Bubble – local currency

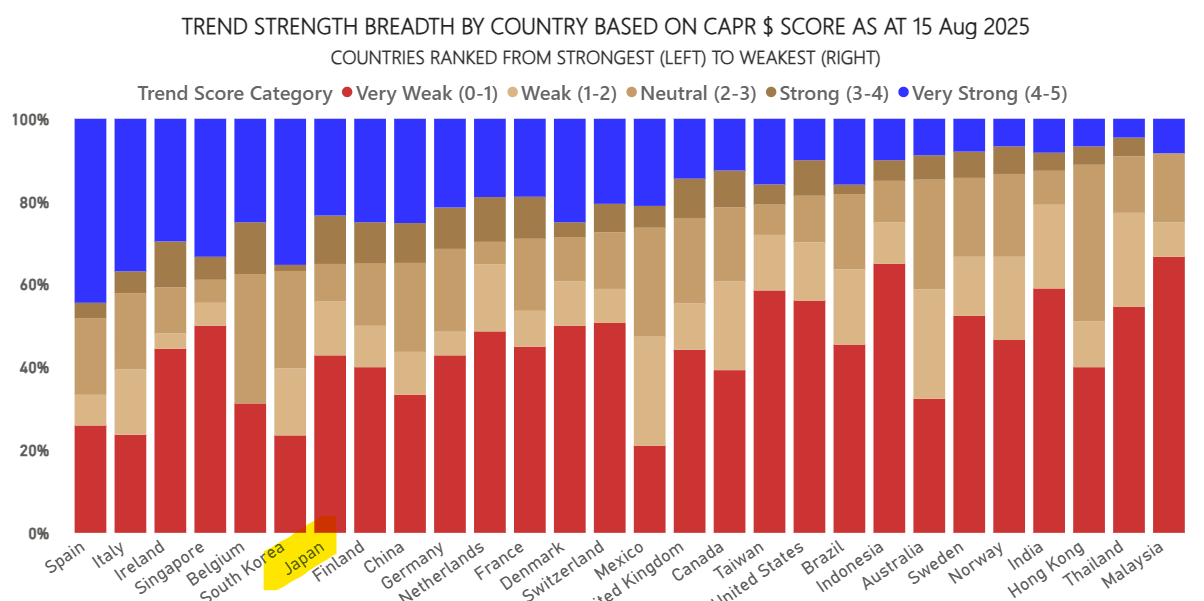

In terms of CAPR strength, Japan is climbing the leaderboard and is the strongest major market.

I was eager to see the key drivers of the Japanese market last week. In the attached GTI: Top 200 spreadsheet, there are eight Japanese stocks featured. Most are in rude health, but Toyota has to face the realities of being a car company at a tough time.

| Ticker | Company Name | CAPR |

| 7203 | Toyota Motor Corporation | 0 |

| 8306 | Mitsubishi UFJ Financial Group, Inc. | 5 |

| 6758 | Sony Group Corporation | 3 |

| 9984 | SoftBank Group Corp. | 5 |

| 6501 | Hitachi, Ltd. | 5 |

| 7974 | Nintendo Co., Ltd. | 5 |

| 8316 | Sumitomo Mitsui Financial Group, Inc. | 5 |

| 9983 | Fast Retailing Co., Ltd. | 2 |

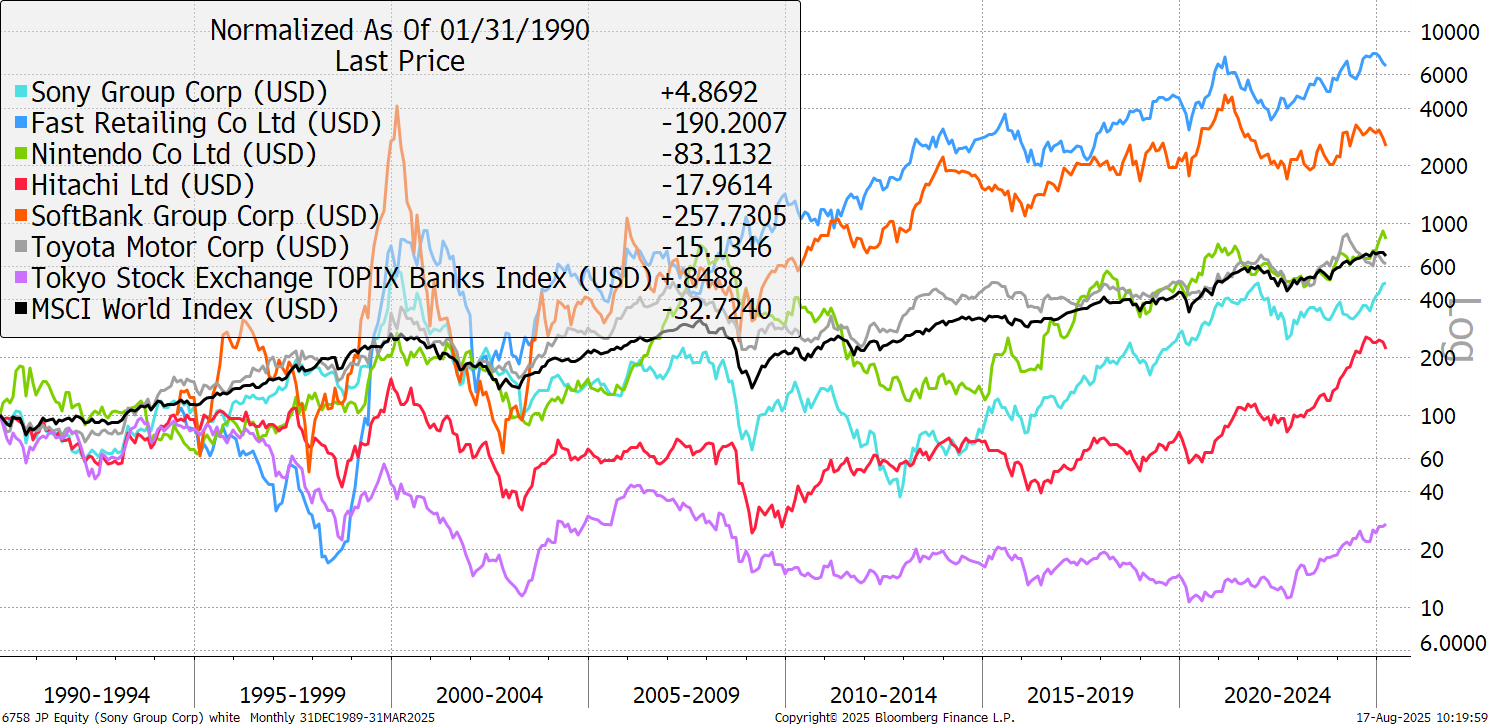

I show these stocks since 1990 in USD vs the world index. Naturally there will be many stocks which were large back then but have faded away. These are the survivors. I have substituted the banks for the Topix Banks Index due to corporate actions, mergers etc. which have interfered with price history. The banks turned $100 into $28 over 35 years but have finally risen back above book value.

The Japanese Eight since 1990 - USD Log Scale

Mega tech investor Softbank listed in July 1994, so was a late starter, but has done well. The winner was Fast Retailing, better known as UNIQLO, Japan’s Zara. Nintendo and Toyota kept up with the world index, while Hitachi and Sony lagged.

In the Premium spreadsheet https://globaltrends.bytetree.com/tag/gti-premium/ , 154 Japanese stocks are featured, with 36 stocks with a CAPR score of 5, and 22 with 30 week CAPR highs.

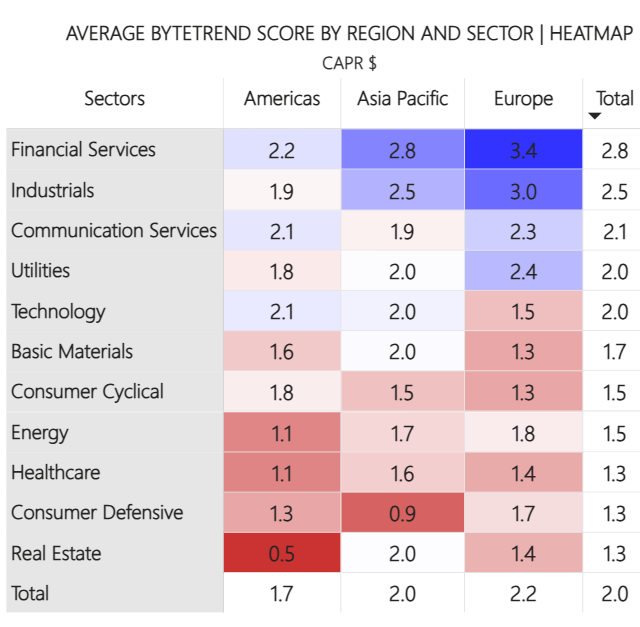

The world matrix favours financials around the world, which remain firmly in the lead.

Average ByteTrend Score by Region and Sector Heatmap - CAPR

Nine of the world’s ten largest companies are American, and four of them have ByteTrend Scores of 5. The group commands $23.7 trillion of market cap, yet none of them make this week’s leaderboard. Contrast that with Japan’s total market value of $4.9 trillion. Investors are underweight Japan, and it has plenty of room to move higher.

| Ticker | FX | CAPR | |

| NVDA | USD | NVIDIA Corporation | 5 |

| MSFT | USD | Microsoft Corporation | 5 |

| AAPL | USD | Apple Inc. | 1 |

| GOOGL | USD | Alphabet Inc. | 4 |

| AMZN | USD | Amazon.com, Inc. | 4 |

| META | USD | Meta Platforms, Inc. | 5 |

| 2222 | SAR | Saudi Arabian Oil Company | 0 |

| AVGO | USD | Broadcom Inc. | 5 |

| TSLA | USD | Tesla, Inc. | 0 |

| BRK-B | USD | Berkshire Hathaway Inc. | 1 |

Leading Trends with New Highs

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of 5. All charts shown are CAPR rebased to 100.

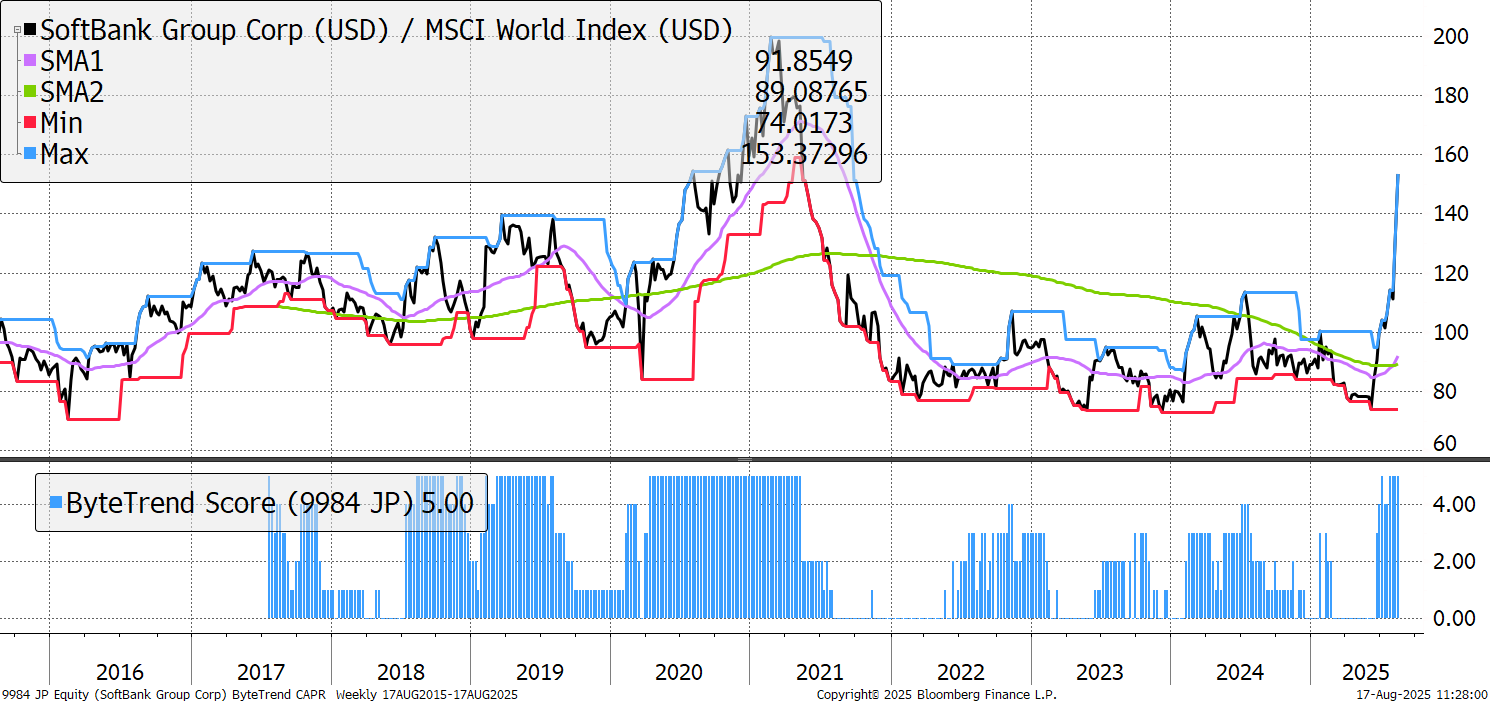

| 9984 | JPY | SoftBank Group Corp. |

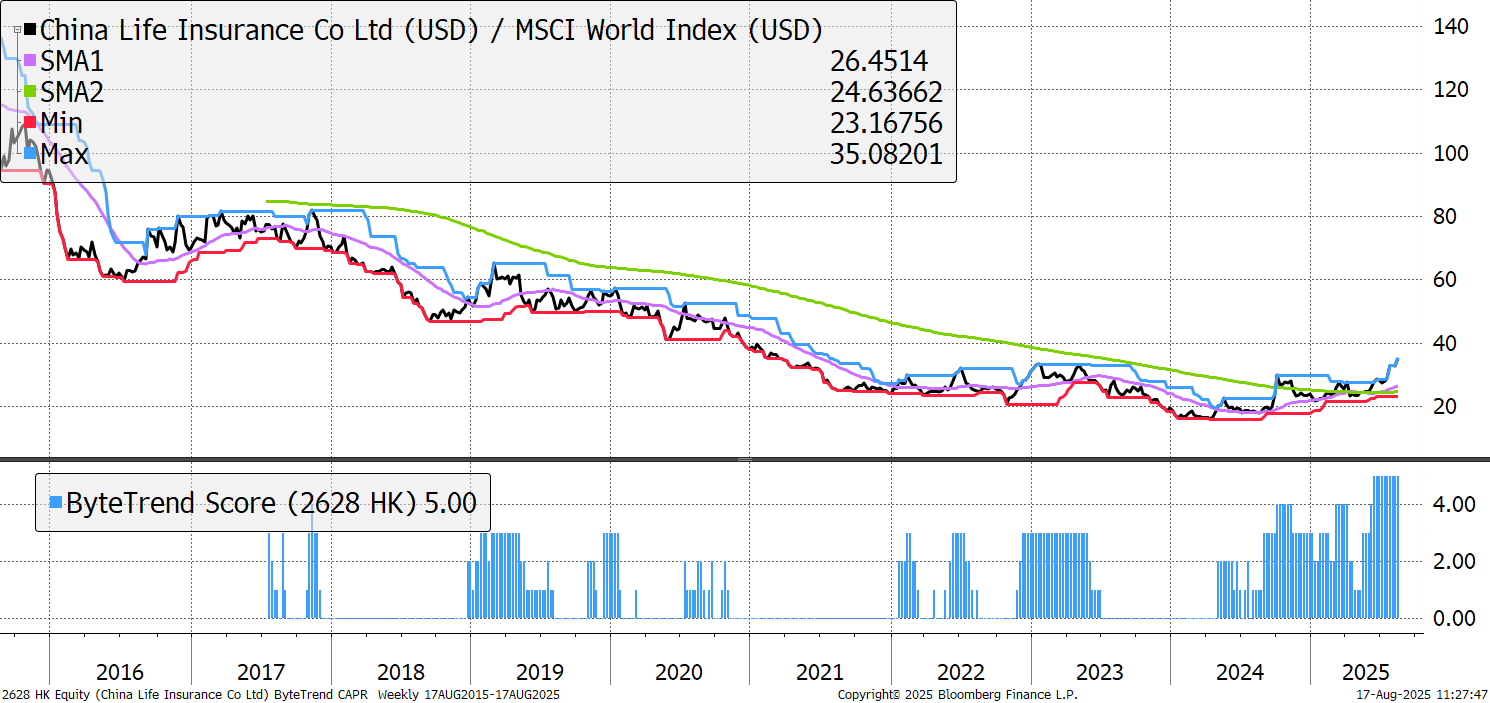

| 2628 | HKD | China Life Insurance Company Limited |

| SAN | EUR | Banco Santander, S.A. |

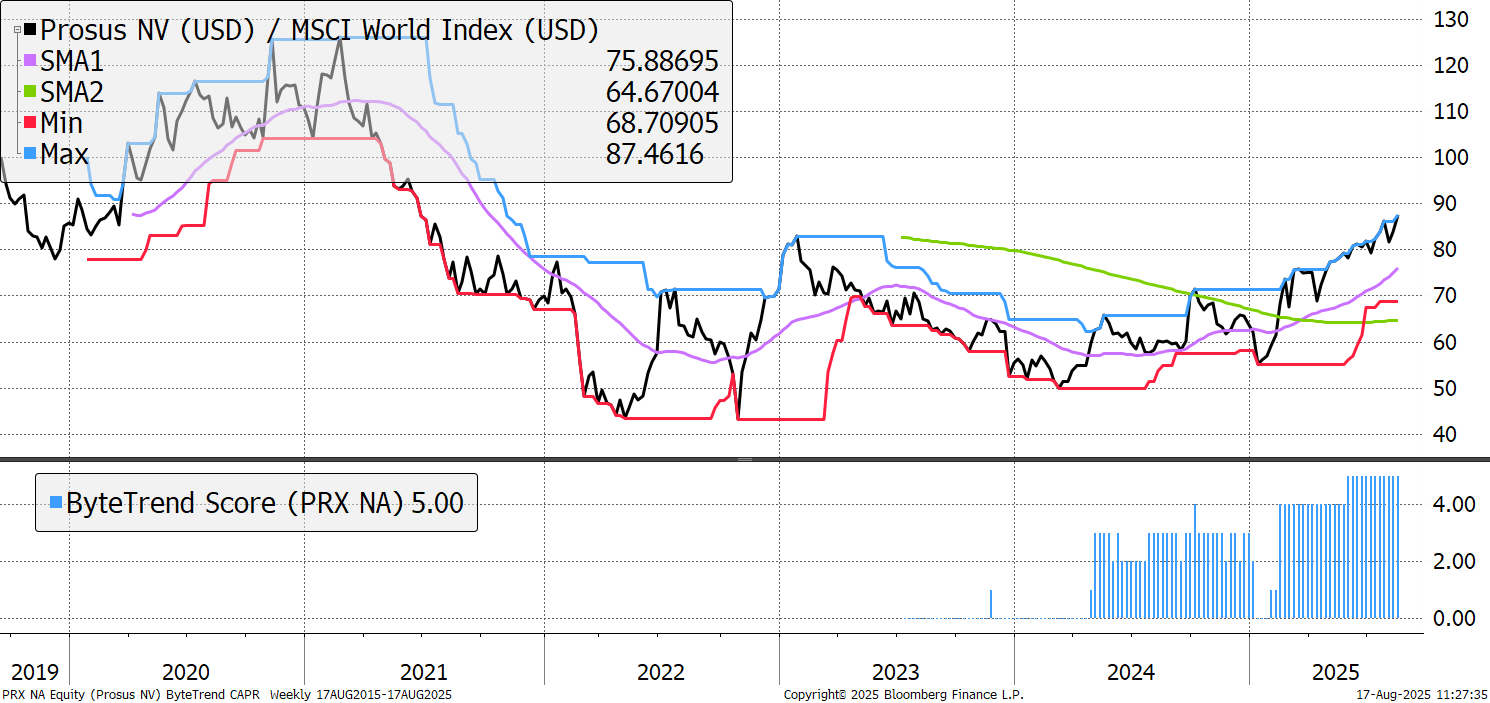

| PRX | EUR | Prosus N.V. |

| UCG | EUR | UniCredit S.p.A. |

| ISP | EUR | Intesa Sanpaolo S.p.A. |

| BBVA | EUR | Banco Bilbao Vizcaya Argentaria, S.A. |

SoftBank’s recent rally has been extraordinary. It is not a company that does things in half measures. In price terms, it has more than doubled in the last ten weeks, an extreme move for a $170bn company. Its Vision Fund is the world’s largest tech-focused VC fund, and in 2019, they launched a second one. These have made AI the core of their strategy, reflected in aggressive investments spanning from hardware (semiconductors, chips) to infrastructure (data centres) and applications (software, superintelligence platforms). Its US listing of PayPay has taken a step forward this week, with a good valuation estimated, which would help fund some of this AI spending.

SoftBank

China Life Insurance Co is a state-owned insurer. It has only just become a leading trend after a very long period of underperformance. Along with the others, it will be buying up large amounts (up to $9bn) of domestic equities following a regulatory directive. This is what Russell Napier predicts will come for many western nations too, where our pensions are directed towards state interests, in this case, supporting the stock market. The share of its assets invested in stocks has risen by 4.3pp to 7.7% since the start of the year, the lowest of its peer group.

China Life Insurance

Global consumer internet group Prosus has been featured in GTI: Top 200 for a few months now, first as an emerging trend and now as a leader. Its main asset is a large stake in Tencent, and its other focal areas are classifieds, payments and fintech, food delivery, and ed tech. The company is known for its significant stake in Tencent, which is up 60% over the last year, helping Prosus in turn. It has set itself very aggressive financial targets and is trying to buy Just Eat, a deal the European Commission has just approved after Prosus agreed to sell down its stake of rival Delivery Hero.

Prosus

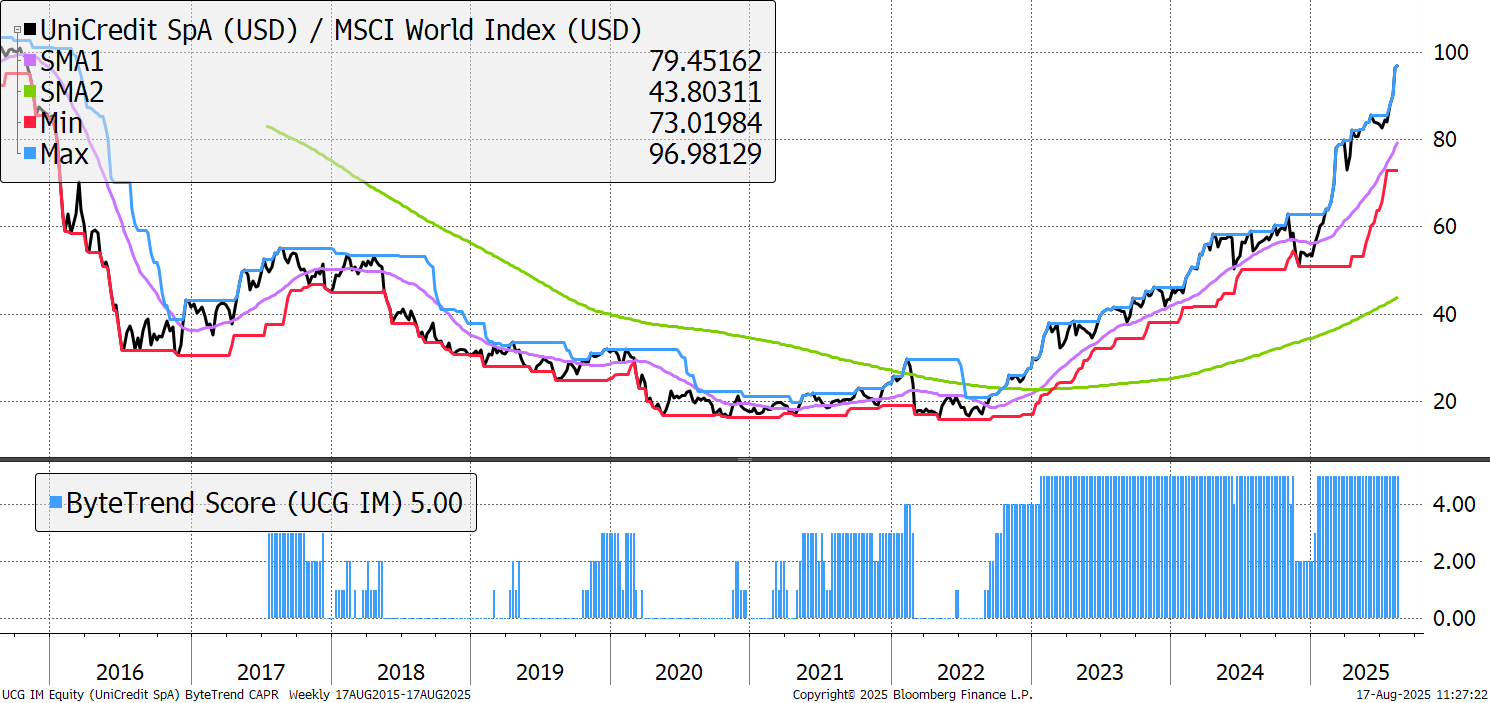

UniCredit is a pan-European commercial bank known for its extensive corporate and investment banking, commercial banking, and wealth management operations. It reported record-breaking Q2 results, reflecting the incredible strength of European financials. It raised guidance, increased buybacks, and hiked its dividend. However, it has pulled out of its proposed Banco BPM acquisition due to Italian regulatory issues. Meanwhile, it has integrated FX payments with technology from the British fintech firm, Wise.

UniCredit SpA

There are 98 additional leading trends with new highs in the GTI universe, with 13 from Japan. It’s heavy with financials followed by industrials. It is dominated by Europe and Asia, with just a few stocks from the US including a house builder. Asset allocators should take note.

Emerging Trends

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of less than 5. They don’t have to be in an uptrend, just emerging. All charts shown are CAPR rebased to 100.

For the first time since we started publishing GTI 200, there are no emerging trends in the top 200 stocks. As a bonus, I show the three Jananese stocks that made the cut from the full universe.

| 9022 | JPY | Central Japan Railway Company |

| 3659 | JPY | NEXON Co., Ltd. |

| 7259 | JPY | Aisin Corporation |

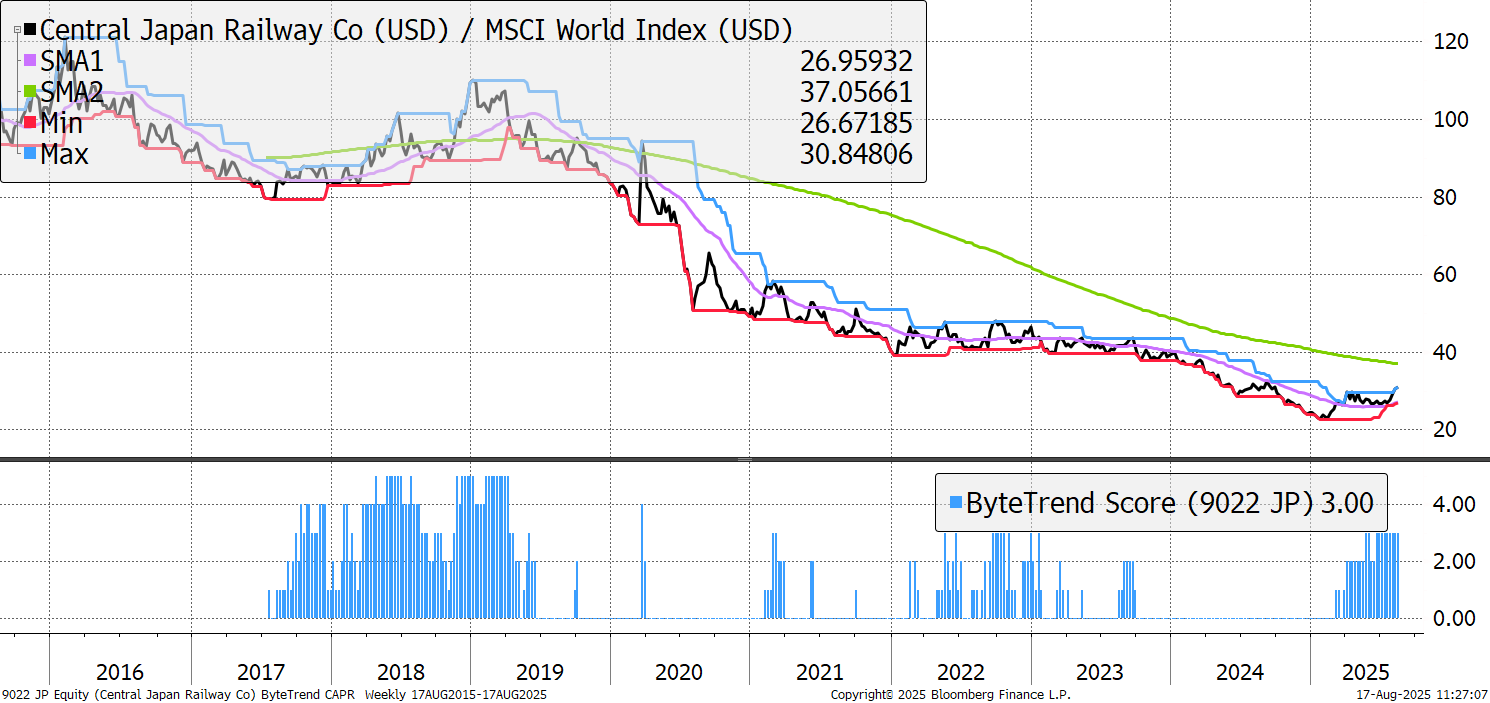

A decade of underperformance could be coming to an end for Central Japan Railway. It was founded in 1987 as part of rail privatisation. It operates key bullet train (shinkansen) lines between Tokyo, Nagoya, and Osaka, serving almost 400k passengers daily. It’s part of the maglev project, to build the next generation of high speed rail in Japan by 2034 (originally planned for 2027 – it isn’t just Britain struggling with major high speed rail projects).

Central Japan Railway