Not a Gentleman’s Bull Market

Issue 24;

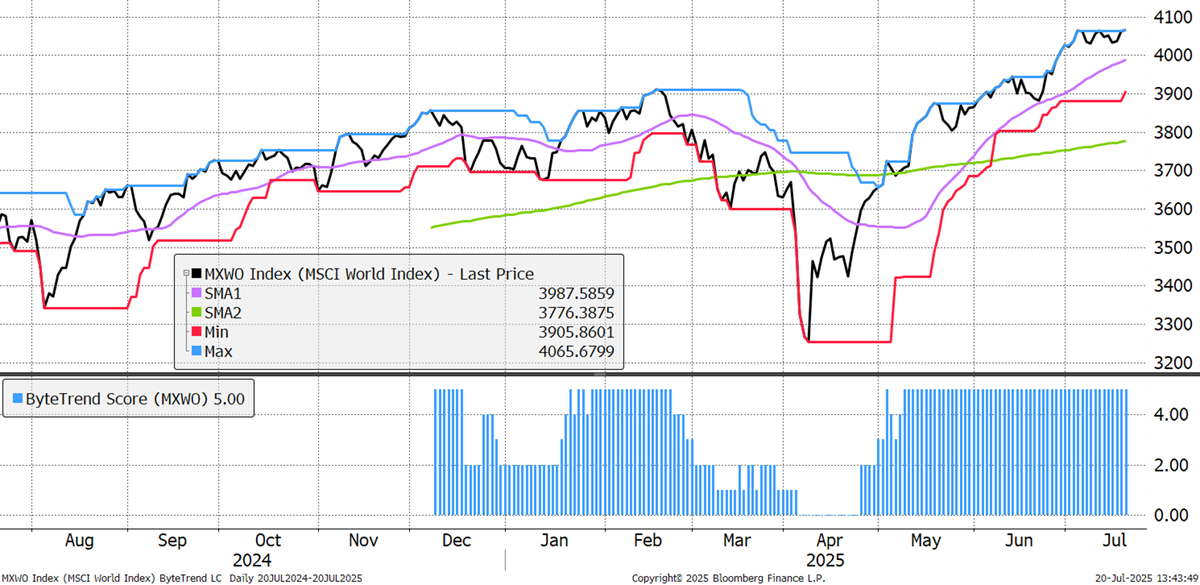

The world index makes another all-time high, despite a new round of tariffs. Moreover, it did that during a rebound month for the US dollar. This should be taken seriously and is bullish.

World Index – Developed Markets – Daily

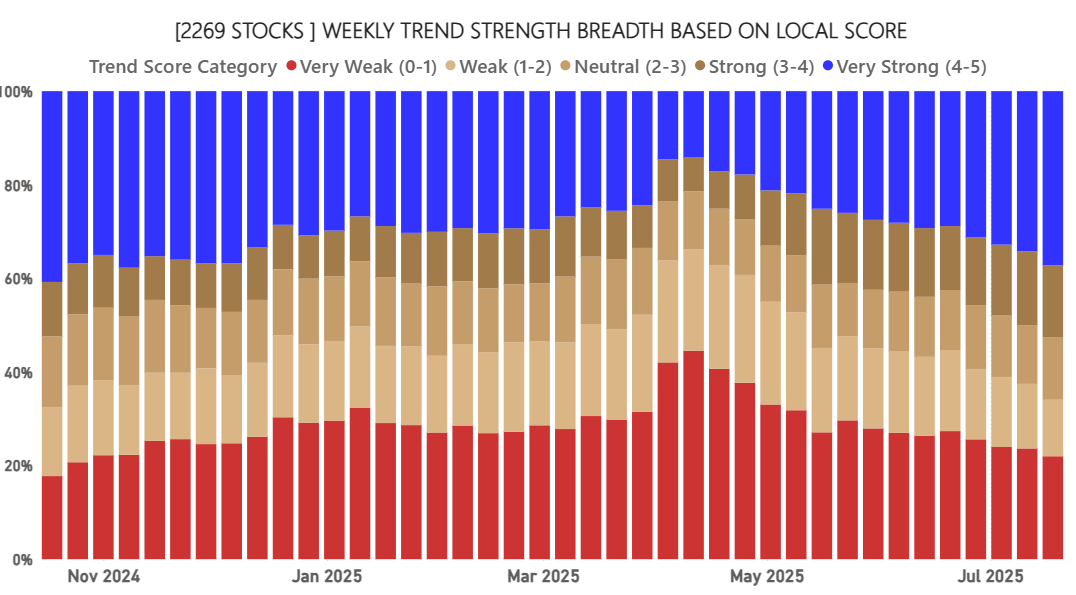

Yet again, breadth has improved, with nearly 40% of stocks holding a ByteTrend score of 5 (uptrend in blue) in local currency terms. A little over 20% have scores of zero (downtrends in red).

ByteTrend: Weekly Breadth Signal – CAPR

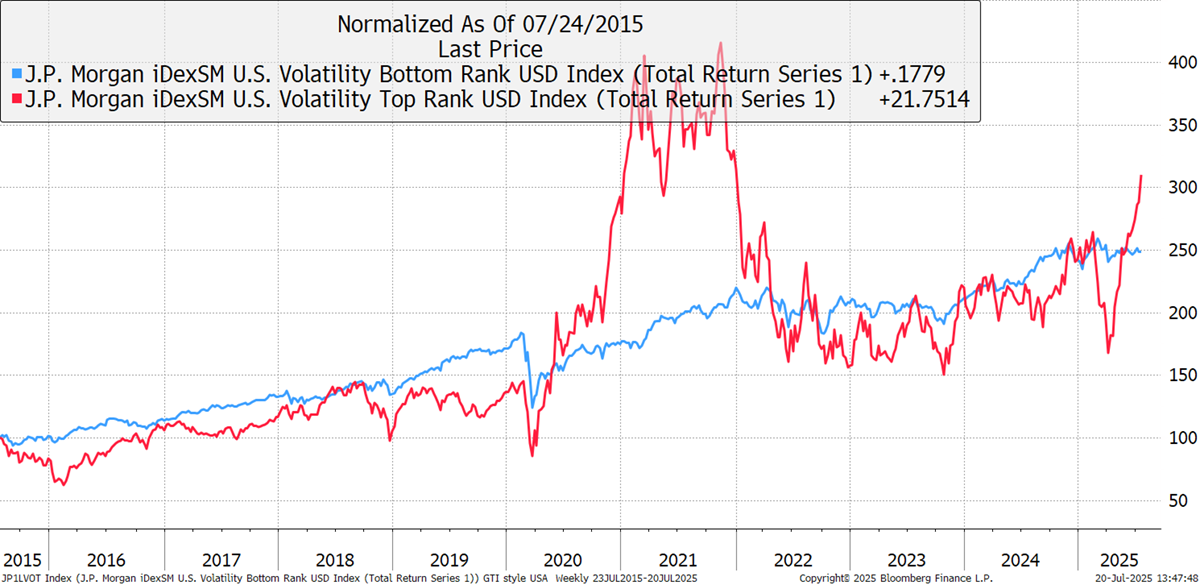

Be sure, this is a bull market, but there is nothing gentlemanly about it. As said by Andrew Mellon, the US Treasury Secretary in the 1920s, “Gentlemen prefer bonds.” Quality equity has much in common with bonds, as they are interest rate-sensitive stocks. Not only has quality been slow this year, but there has also been heavy selling of the leading names, as you’ll see below in the bear list. This market is being led by high volatility stocks, the hooligans of the market, and it is not a good time for gentlemen.

Gentlemen vs Hooligans

The exciting part of this is that when the music stops, we know exactly what to buy.

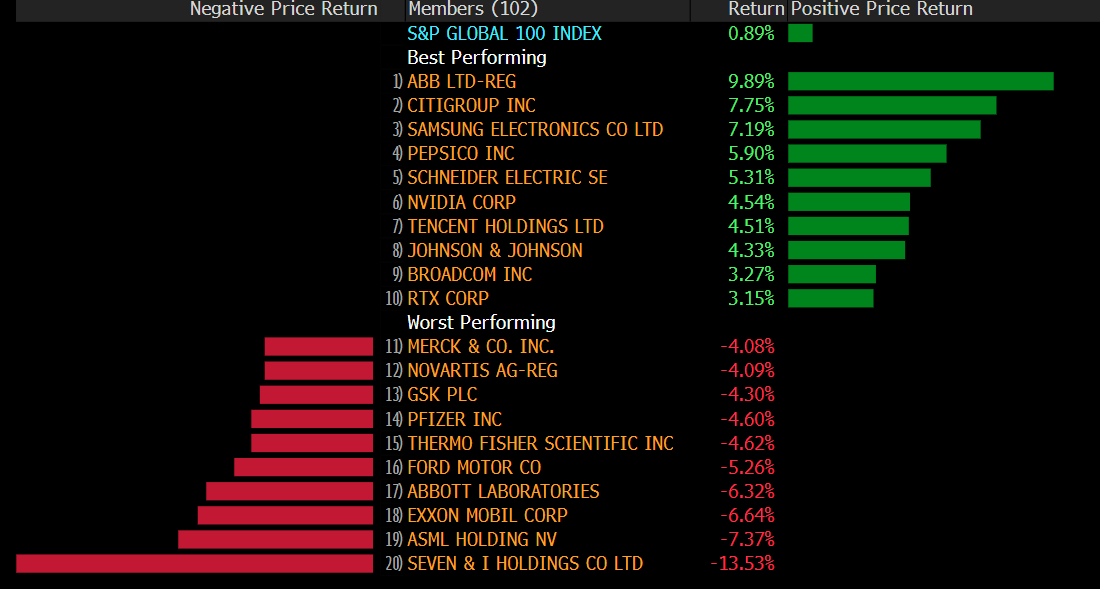

Leaders and Laggards

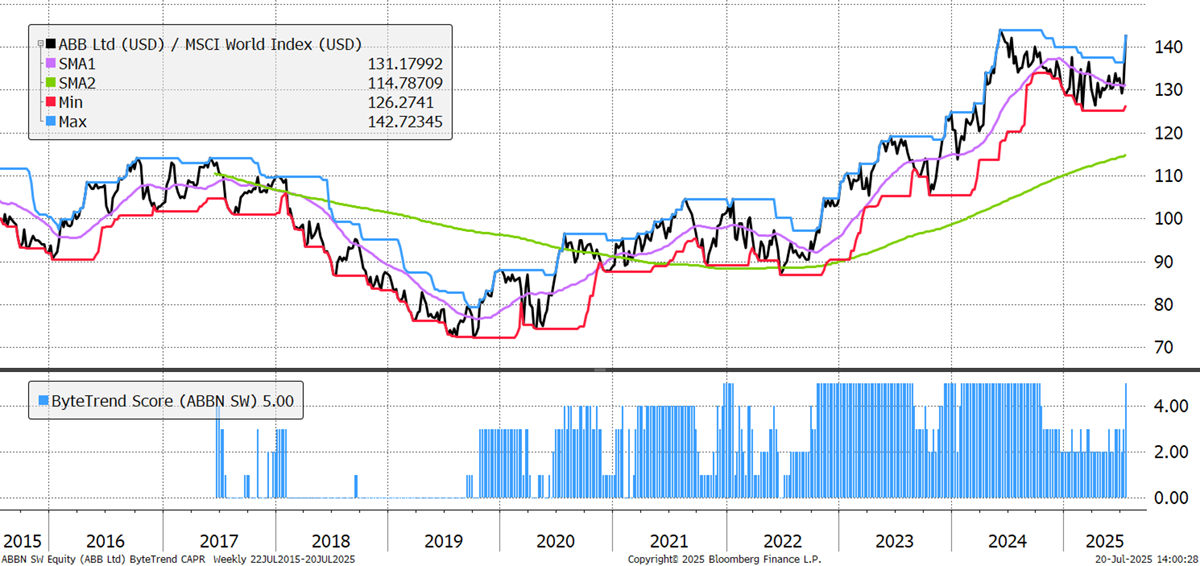

Swiss engineering giant ABB, joined by Schneider Electric, tops the leaderboard following a strong set of results as they upgrade the world’s electricity grid. Both stocks trade on record valuations. Johnson & Johnson and PepsiCo, two of this year’s laggards, manage a brief fight back. However, the leading and emerging categories are still dominated by tech.

The laggards look familiar, dominated by pharmaceuticals, another high-quality sector. Canada's Alimentation Couche-Tard dropped plans to buy 7-Eleven. Luckily, there is a bank holiday in Japan today, halting the selling pressure.

Developed Markets Leaders and Laggards

The regional CAPR chart sees weakness in Japan continuing, not helped by the weekend’s election result, which saw diminished support for the government. The emerging markets are improving.

CAPR: Europe, USA, Emerging Markets and Japan - Past Year

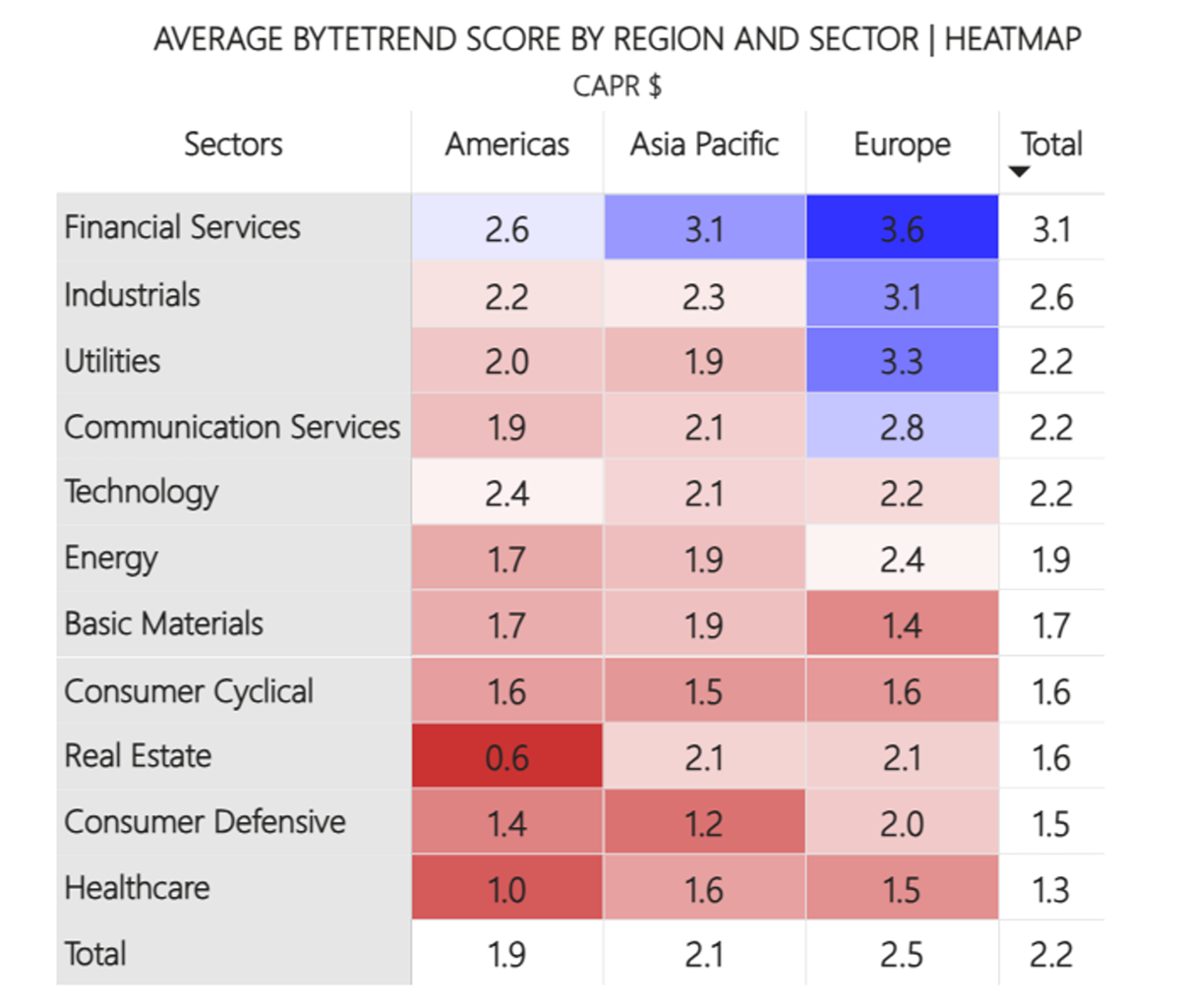

The world matrix sees US financials turn blue, which is positive. Financials still lead the world, supported by the high-rate environment. Utilities have improved slightly while industrials are stable. Consumer defensives and healthcare, both quality sectors, are weaker again.

Average ByteTrend Score by Region and Sector Heatmap - CAPR

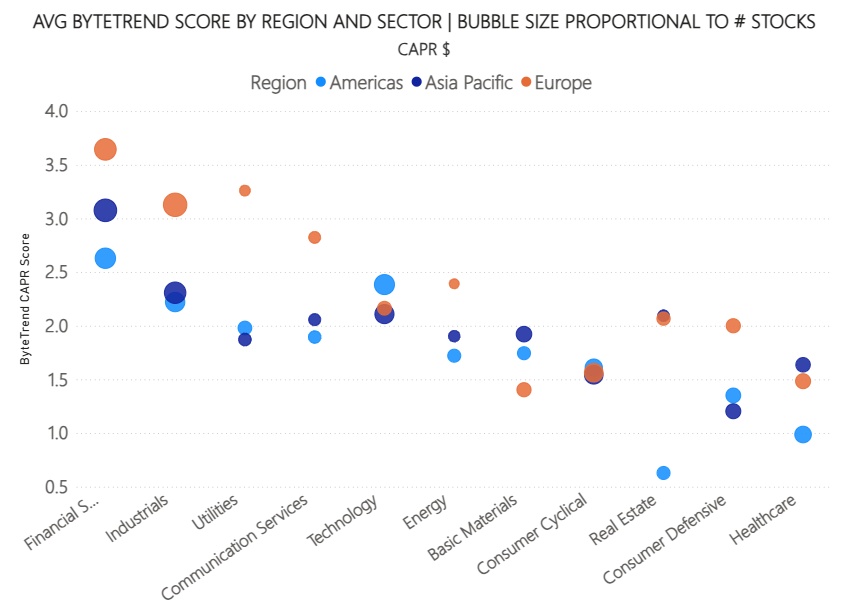

Another way to view the table is by region, with the bubble size representing the number of stocks. For example, there are lots of financials and industrial stocks, with fewer in utilities and energy. The height of the bubbles indicates strength, and in the case of real estate, the US is low, while Asia and Europe are stronger. That also stands out in European utilities. In technology, it is no surprise that the Americas are stronger.

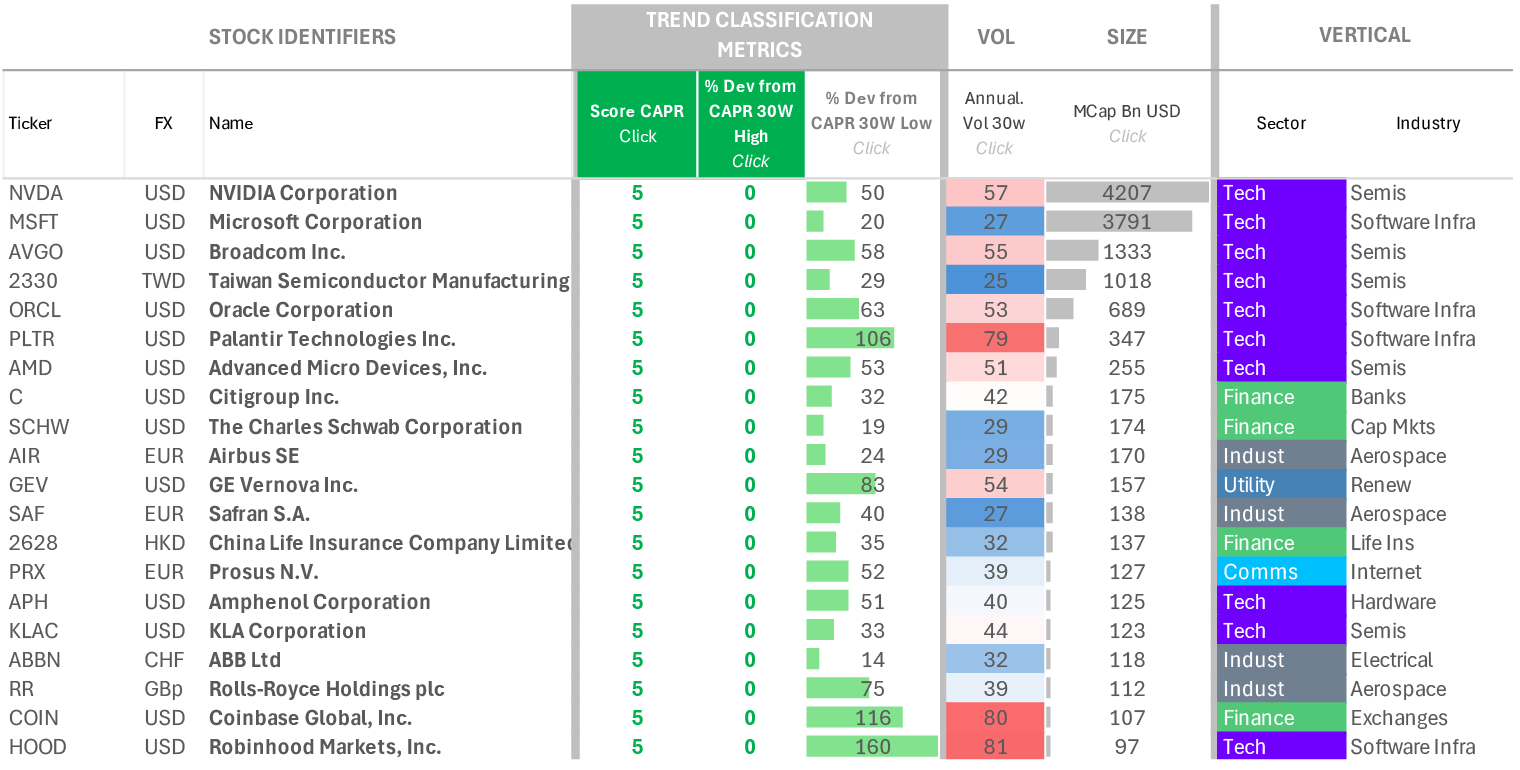

Leading Trends with New Highs

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of 5. All charts shown are CAPR rebased to 100.

Full details are in the GTI: 200 Spreadsheet, at the end of this issue.

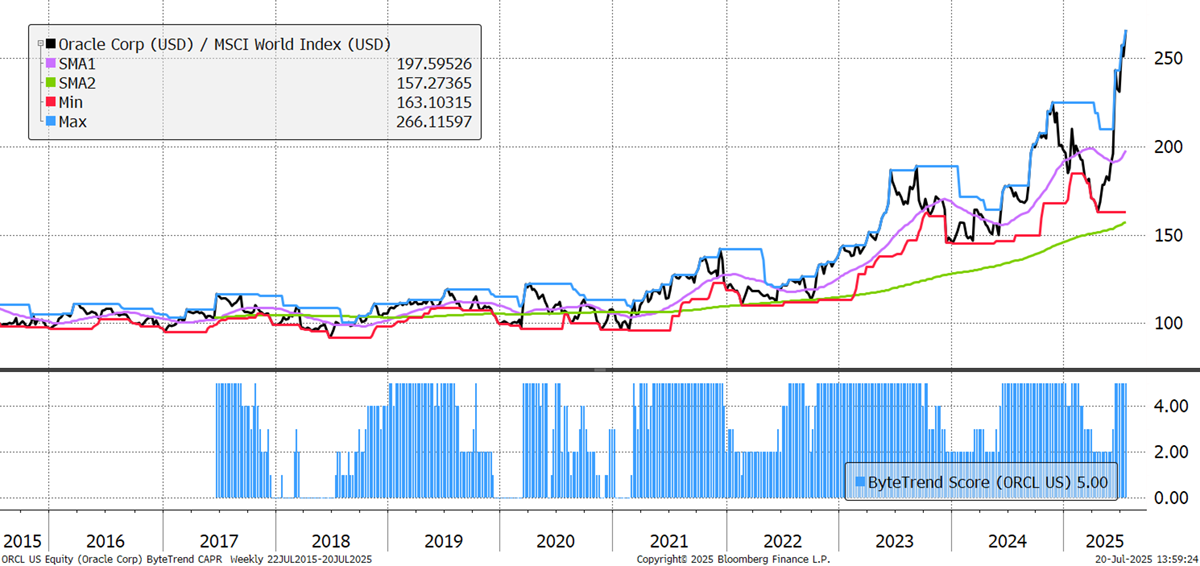

Oracle serves governments and large corporations with scalable and secure cloud-based software, distinguished by its full-stack cloud, automation, and database strengths. It lost a third of its value during the first quarter of 2025, but the market reversal that came with the postponement of the harshest tariffs has seen it soar back to even greater heights. Its one-year volatility has risen from 26% to 43%, reflecting the larger, swifter moves. The bull case relies on translating exceptional cloud growth and capex into sustained cash flow and margin expansion as cloud scale matures.

Oracle Corp

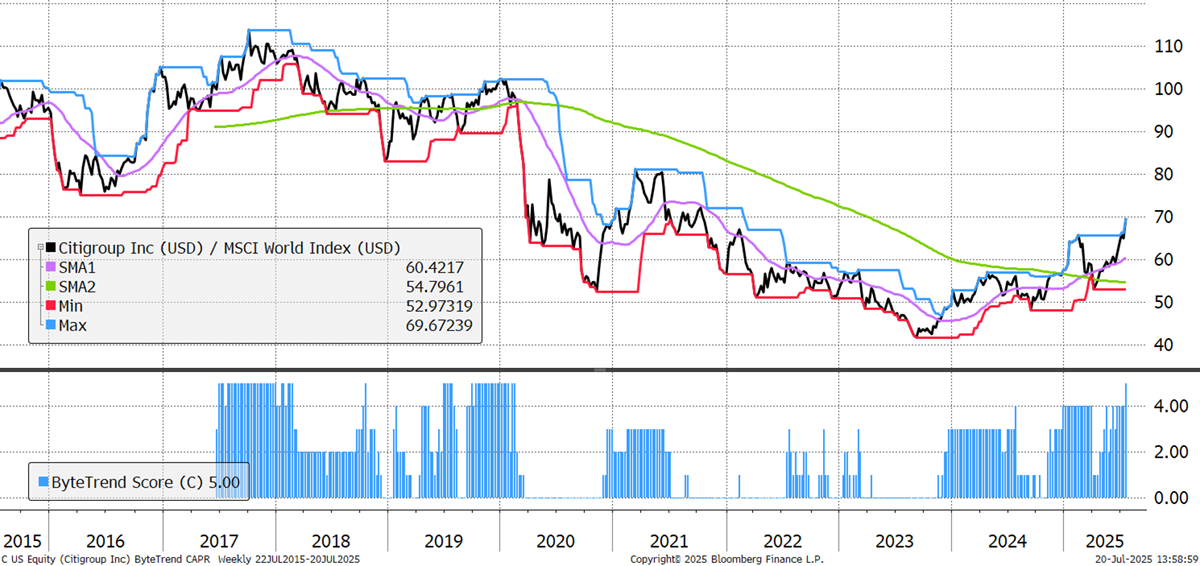

Citigroup’s share price never recovered from the 2008 financial crisis, when it fell 95%. It has just broken out to its highest level in price terms since then, but remains a long way below its former peak, naturally, much less so in terms of market capitalisation due to capital raising. It is simplifying its global banking operations while embracing digital, including stablecoins and tokenised assets. Recent results have been strong.

Citigroup

ABB is a Swiss-Swedish multinational industrial conglomerate focused on electrification and industrial automation, and the market leader in collaborative robotics. It is seeing revenue growth and rising profitability of late, leading it to reach all-time highs in stock price terms, and in its valuation multiples too (EV/Sales 3.7x). Recent results were good again, and guidance was positive despite the tariff.

ABB

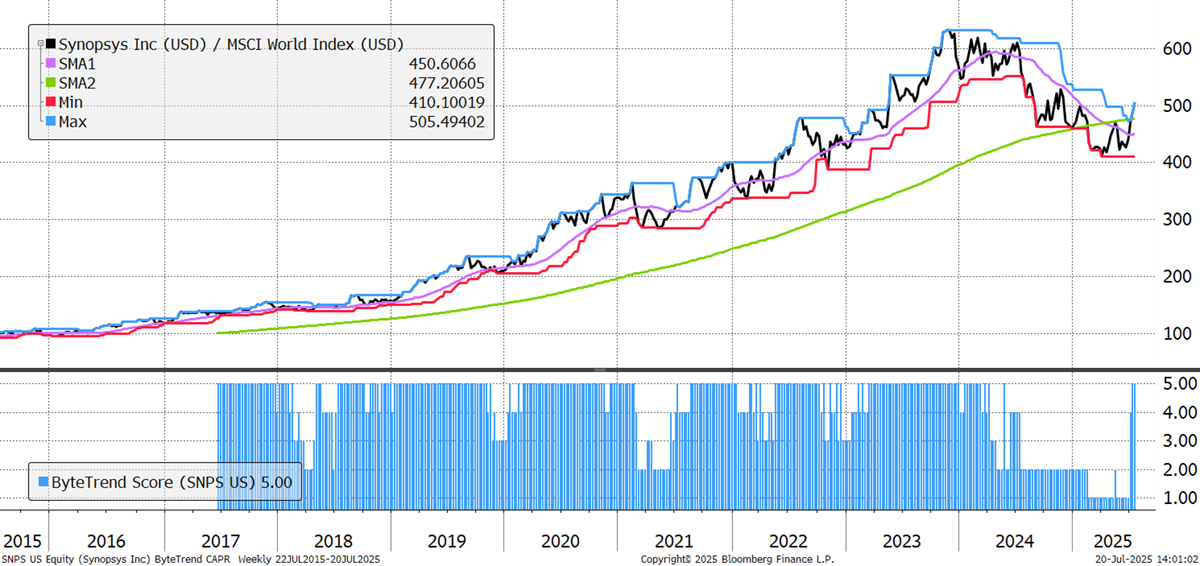

Synopsys is the global leader in Electronic Design Automation (EDA) software and semiconductor IP. It recently acquired a company called Ansys to strengthen its semiconductor offering, making it a key beneficiary of the AI boom that is back underway. It spends an incredible 35% of revenues on R&D, and commands gross margins above 80%, on revenues which have grown steadily for two decades. A recent dip in FCF/share seems to be under control, and the company is leading once again.

Synopsys

There are 74 additional leading trends with new highs in the GTI universe. A new theme comes from capital markets and exchanges in Asia, including the Singapore Exchange. Additionally, AI and aerospace remain key themes.

Emerging Trends

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of less than 5. They don’t have to be in an uptrend, just emerging. All charts shown are CAPR rebased to 100.

Full details are in the GTI: 200 Spreadsheet, at the end of this issue.

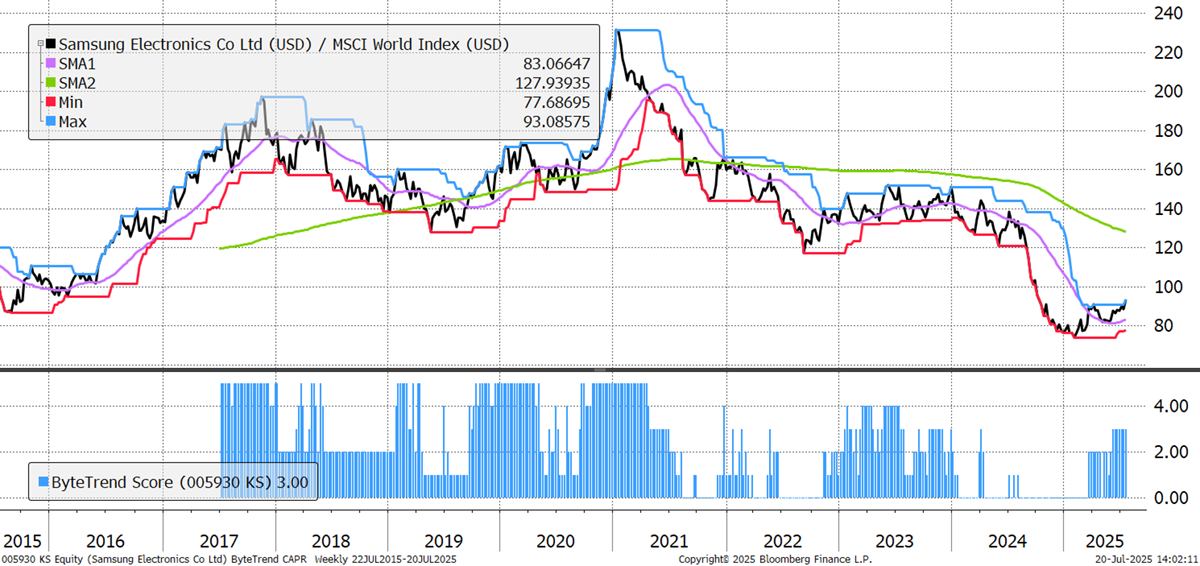

Samsung has market-leading smartphone sales (20% global market share), and cutting-edge semiconductor manufacturing too, including advanced 3-nanometre and memory chips. In theory, its diverse portfolio makes it more resilient. However, this hasn’t played out in reality, as it has underperformed significantly since the pandemic, with the semi division in particular being particularly weak. Q1 saw record group revenues, driven by strong smartphone sales, on top of a healthy operating profit, and the stock is starting to pick up again.

Samsung

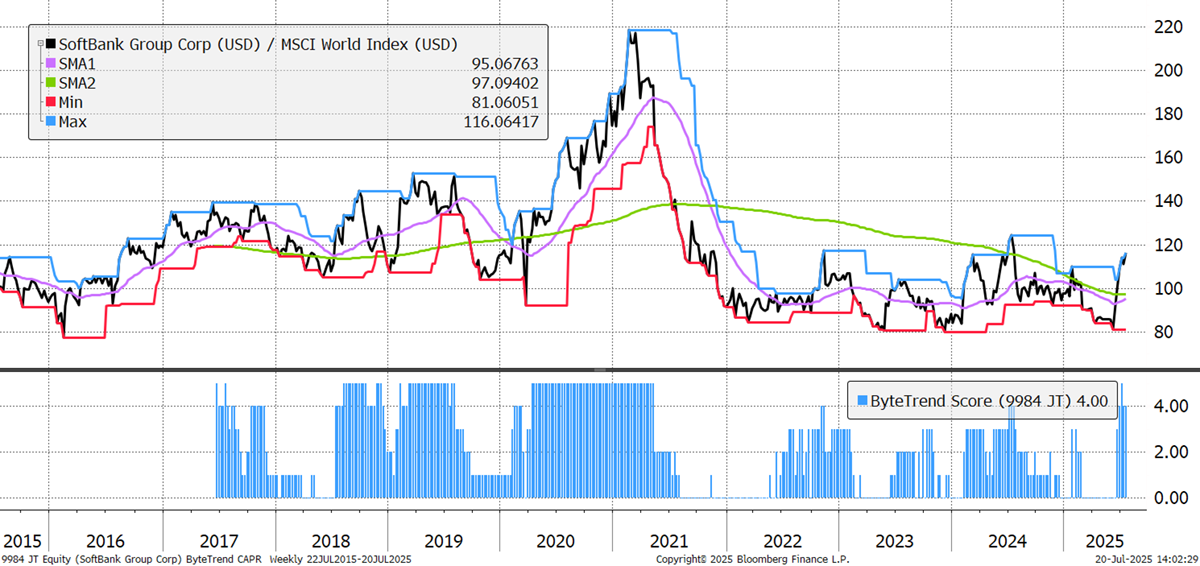

SoftBank, led by the unique Masayoshi Son, is Japan’s one-man answer to Silicon Valley. It invests heavily in whatever the current megatrend is, which is currently AI. It was part of Project Stargate, Trump’s $500bn investment in domestic AI, and has continued to invest in OpenAI, even launching a Joint Venture in Japan. The CEO bets the house on a glittering future, anything less than perfect spells trouble, but for now, AI keeps delivering.

SoftBank