NVIDIA All-Time High While Apple Slumps

Issue 21;

“Embedded in today’s relative strength are tomorrow’s narratives.”

- Jeff DeGraff

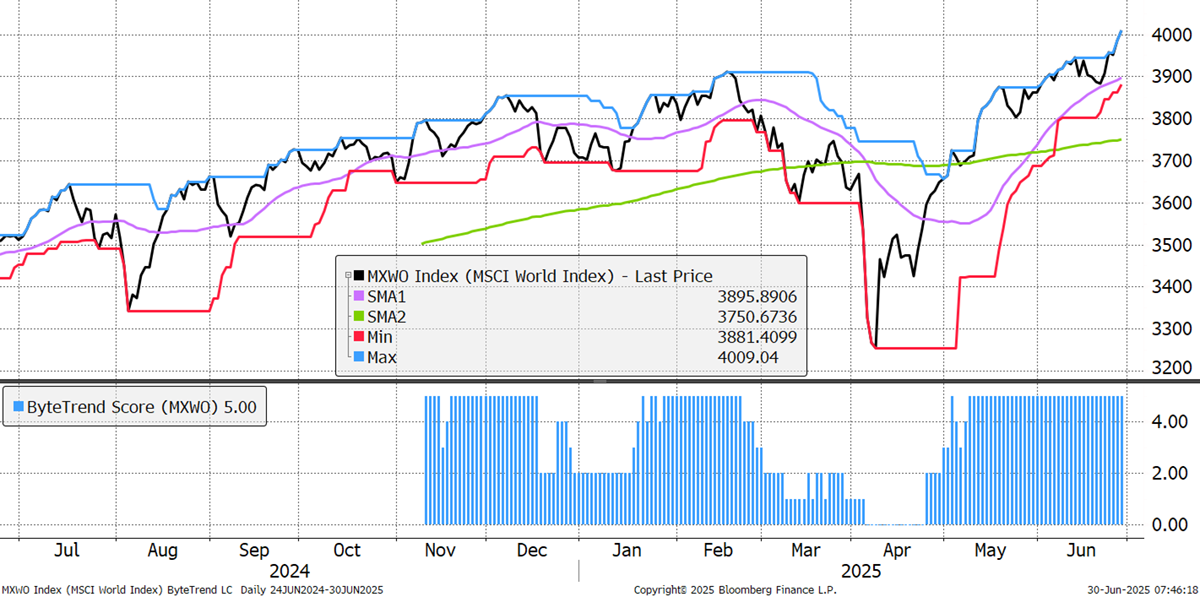

The World Index makes a new all-time high, and the ByteTrend Score is a 5. Simply put, this is bullish.

World Index – Developed Markets - Daily

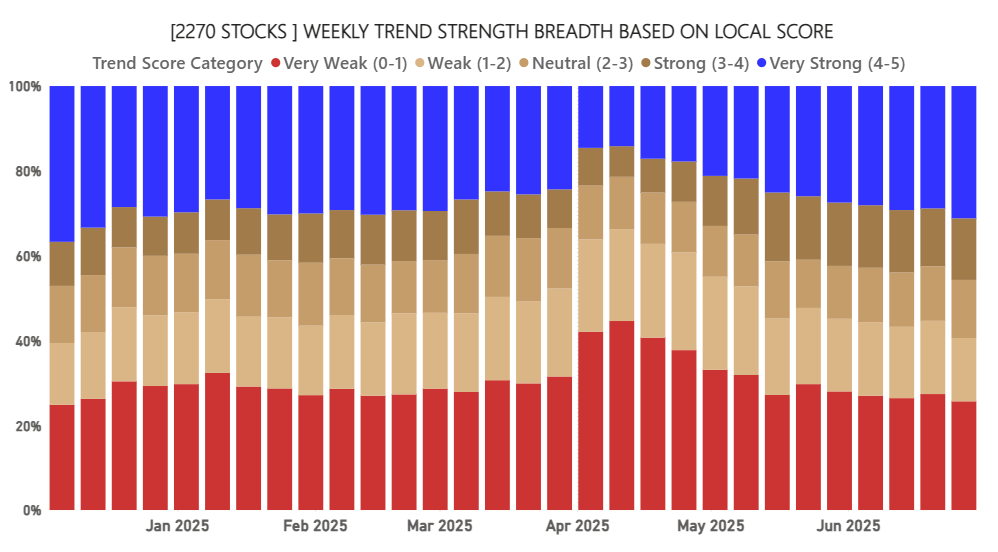

Market breadth improved again last week, with a few more stocks registering bullish trends (blue) and slightly fewer registering bearish trends (red). Again, this is bullish.

ByteTrend: Weekly Breadth Signal

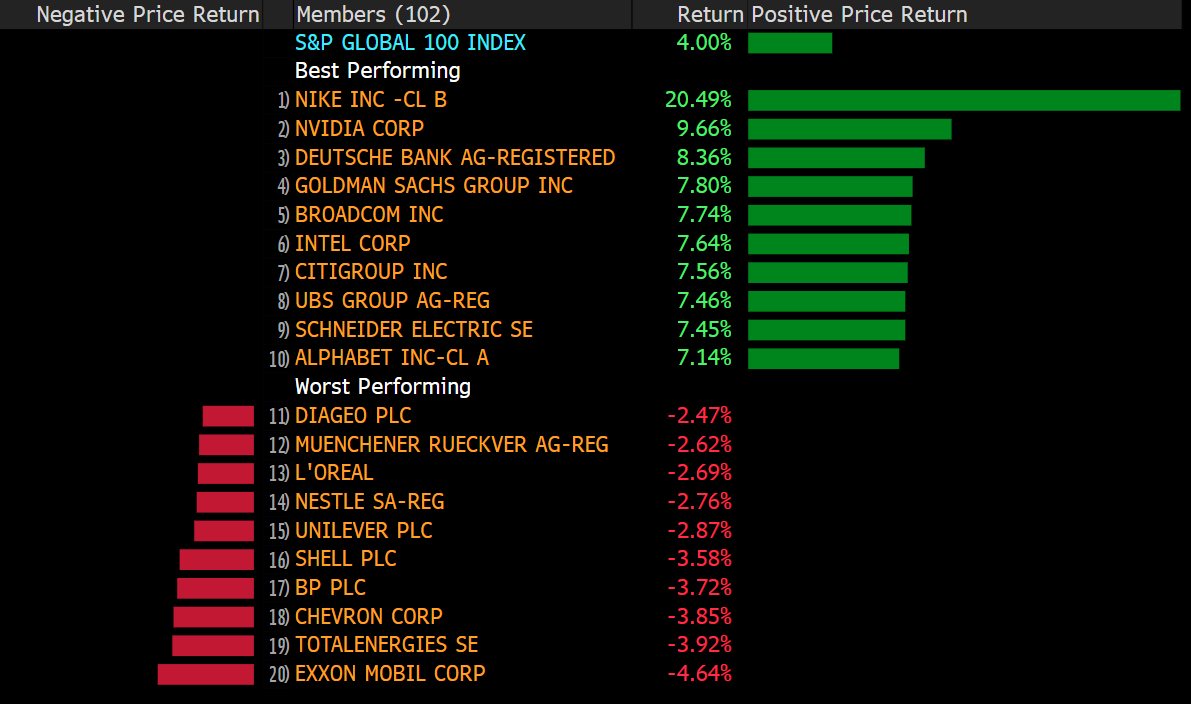

Last Week’s Leaders and Laggards

Nike, a regular attendee on GTI’s bear list since 2022, rallied 20.5% last week as the CEO said its troubles were behind it. Beyond that, the leaderboard was once again dominated by microchips and banks.

The laggards were dominated by energy stocks following oil’s short-lived rally after the bombing of Iran. Yet we also see high-quality companies that continue to disappoint in this bull market.

Developed Markets Leaders and Laggards

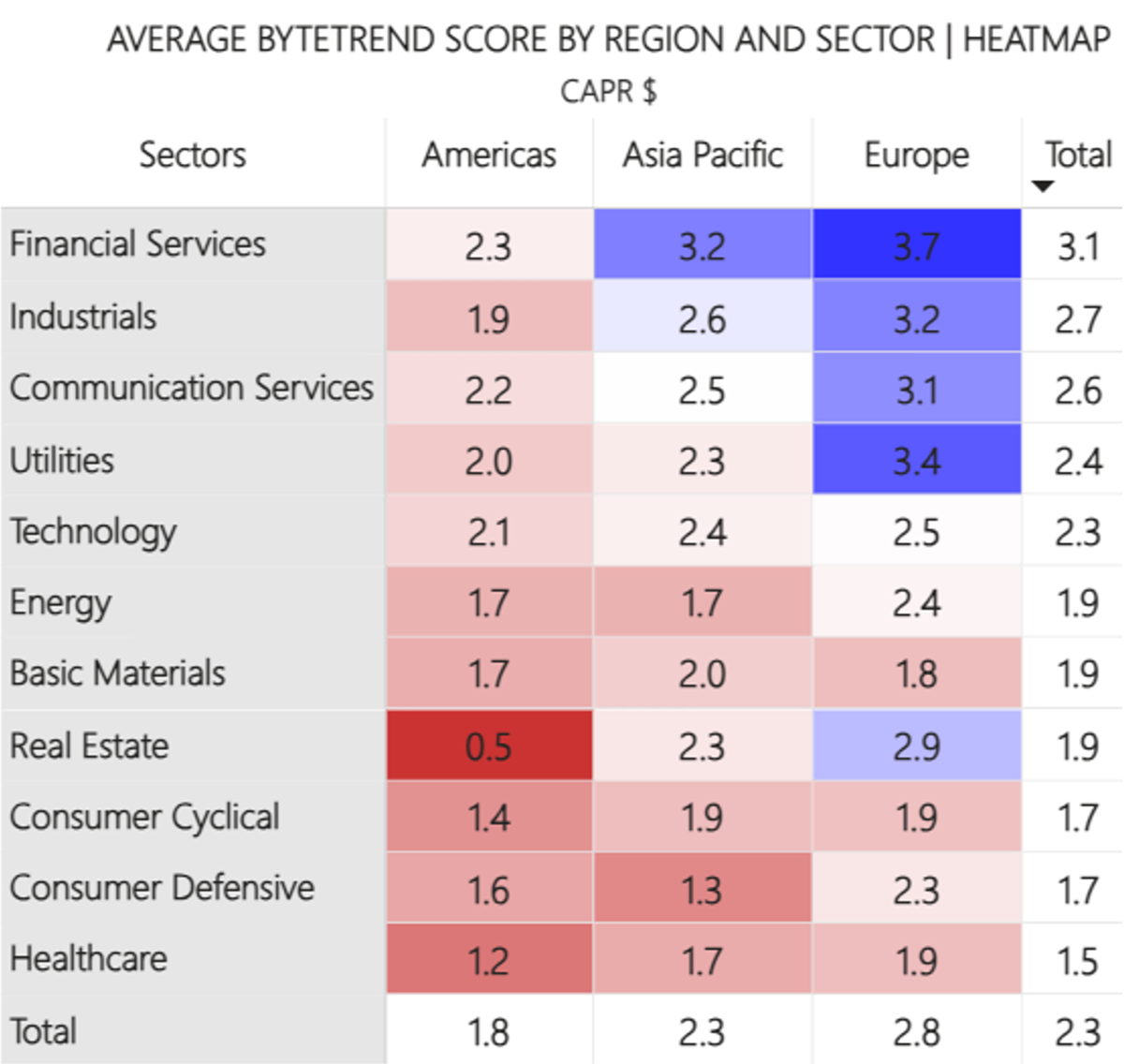

The world matrix puts Europe firmly in the lead, with financial services and utilities being the strongest groups. The US lags, and the divergence between US real estate and European real estate is significant. The bull case in Europe is firmly intact, but in the US, it keeps on weakening. The average ByteTrend Score of a US real estate stock is 0.5, which is lower than last week. Consumer and quality defensives are struggling in this bull market.

Average ByteTrend Score by Region and Sector Heatmap - CAPR

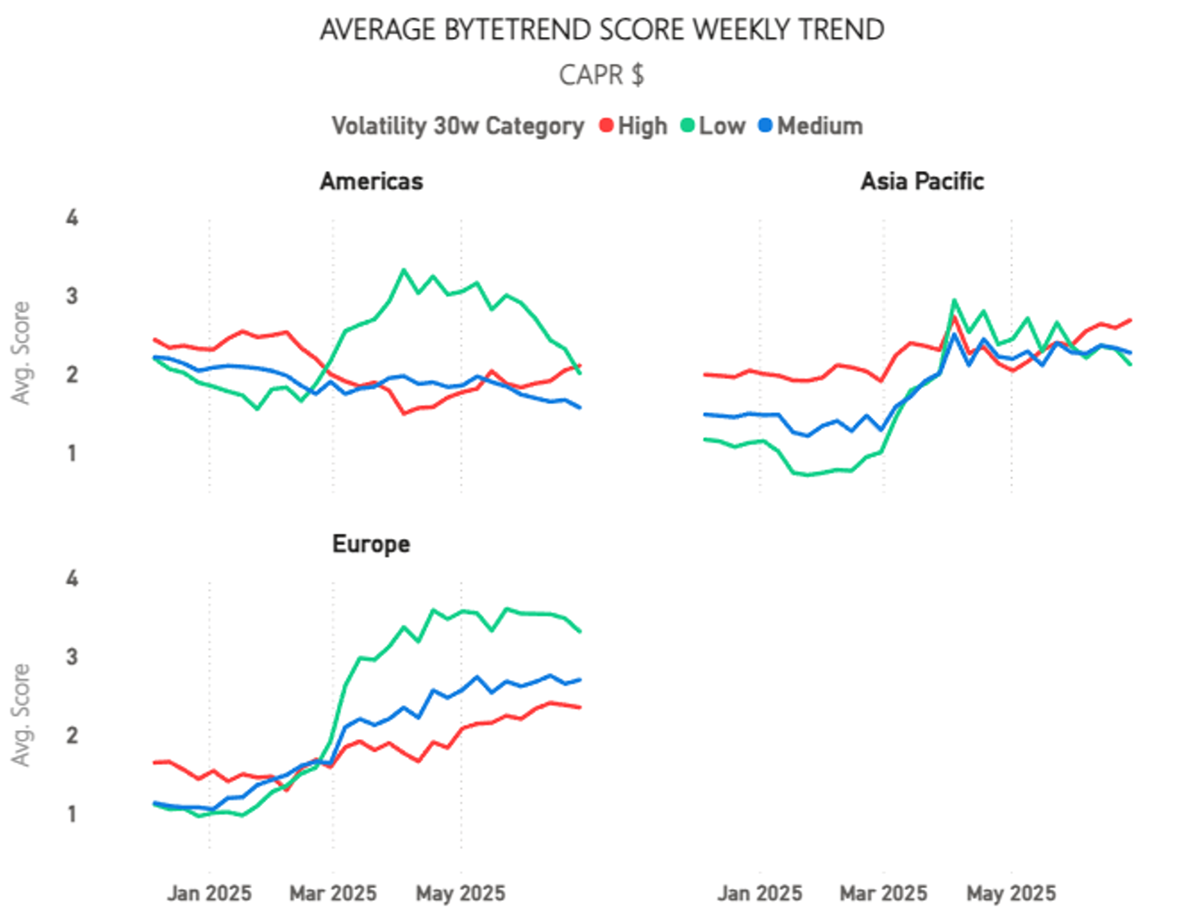

It is important to note that many of the stronger stocks have high volatility, which can be considered riskier and more speculative. Low-volatility stocks are lagging behind and are normally safer and more cautious investments. Bull markets don’t always look like this, as we saw before the pandemic, but today, the high vol stocks are in charge.

High Volatility Stocks Lead Low Volatility Stocks in the USA

The chart above shows data for the US market, where high vol stocks are in the lead. This is also true in Asia, where the chips sector is driving performance. In Europe, however, medium vol stocks are leading, demonstrating that the nature of the European bull is less speculative. Low vol stocks tend to be steady businesses with modest growth, and are sensitive to interest rates. In all regions, low vol stocks are lagging. That is likely due to high valuations for defensive stocks in general and stubbornly high interest rates. Quality stocks remain under pressure, and this is likely to continue until the market turns down, when they will become resilient once again.

This week, we continue to see the prevailing themes play out with little high-level market rotation.

- Leaders are dominated by financial and industrials outside the USA. AI-related tech is rebounding but on a selective basis, principally hardware. Rare earth metals and the Chinese-led EV and battery companies stand out.

- Emerging has a huge showing from asset managers, but none are large enough to feature in the top 200. Real estate in the UK and Hong Kong features. There are a few mining companies as well, which haven’t featured for a while. The UK has a strong showing.

- Weakening is a mixed bag with no clear theme. A notable new entrant is the London Stock Exchange, which sits alongside Apple. There’s also the US online real estate company Zillow, which follows recent weak signals in US housing.

- Bear is dominated by consumer stocks and healthcare. Auto and retailers are struggling. McDonald's is a notable new entry. US real estate has a strong showing. Indonesia, Thailand, and Malaysia also feature.

Leading Trends with New Highs

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of 5. All charts shown are CAPR rebased to 100.

| Ticker | FX | Name | Sector | Industry | |||||

|---|---|---|---|---|---|---|---|---|---|

| NVDA | USD | NVIDIA Corporation | 5 | 0 | 39 | 57 | 3849 | Tech | Semis |

| MSFT | USD | Microsoft Corporation | 5 | 0 | 19 | 28 | 3686 | Tech | Software Infra |

| AVGO | USD | Broadcom Inc. | 5 | 0 | 53 | 65 | 1267 | Tech | Semis |

| 2330 | TWD | Taiwan Semiconductor Manufacturing Company Limited | 5 | 0 | 23 | 26 | 962 | Tech | Semis |

| NFLX | USD | Netflix, Inc. | 5 | 0 | 45 | 39 | 563 | Comms | Entertain |

| GS | USD | The Goldman Sachs Group, Inc. | 5 | 0 | 22 | 38 | 212 | Finance | Cap Mkts |

| AIR | EUR | Airbus SE | 5 | 0 | 22 | 30 | 164 | Indust | Aerospace |

| SPOT | USD | Spotify Technology S.A. | 5 | 0 | 59 | 42 | 155 | Comms | Internet |

| 660 | KRW | SK hynix Inc. | 5 | 0 | 71 | 42 | 144 | Tech | Semis |

| GEV | USD | GE Vernova Inc. | 5 | 0 | 68 | 55 | 142 | Utility | Renew |

| 6501 | JPY | Hitachi, Ltd. | 5 | 0 | 18 | 42 | 136 | Indust | Conglom |

| SAF | EUR | Safran S.A. | 5 | 0 | 38 | 27 | 133 | Indust | Aerospace |

| CRWD | USD | CrowdStrike Holdings, Inc. | 5 | 0 | 40 | 47 | 124 | Tech | Software Infra |

| LRCX | USD | Lam Research Corporation | 5 | 0 | 36 | 48 | 124 | Tech | Semis |

| PRX | EUR | Prosus N.V. | 5 | 0 | 48 | 39 | 122 | Comms | Internet |

| APH | USD | Amphenol Corporation | 5 | 0 | 45 | 41 | 118 | Tech | Hardware |

| 7974 | JPY | Nintendo Co., Ltd. | 5 | 0 | 51 | 31 | 110 | Tech | Gaming |

| RR | GBp | Rolls-Royce Holdings plc | 5 | 0 | 73 | 40 | 109 | Indust | Aerospace |

| DASH | USD | DoorDash, Inc. | 5 | 0 | 34 | 42 | 103 | Comms | Internet |

| ENR | EUR | Siemens Energy AG | 5 | 0 | 108 | 50 | 89 | Indust | Ind Mach |

| 7011 | JPY | Mitsubishi Heavy Industries, Ltd. | 5 | 0 | 81 | 51 | 85 | Indust | Ind Mach |

| RCL | USD | Royal Caribbean Cruises Ltd. | 5 | 0 | 44 | 53 | 84 | Con Cycl | Trav Serv |

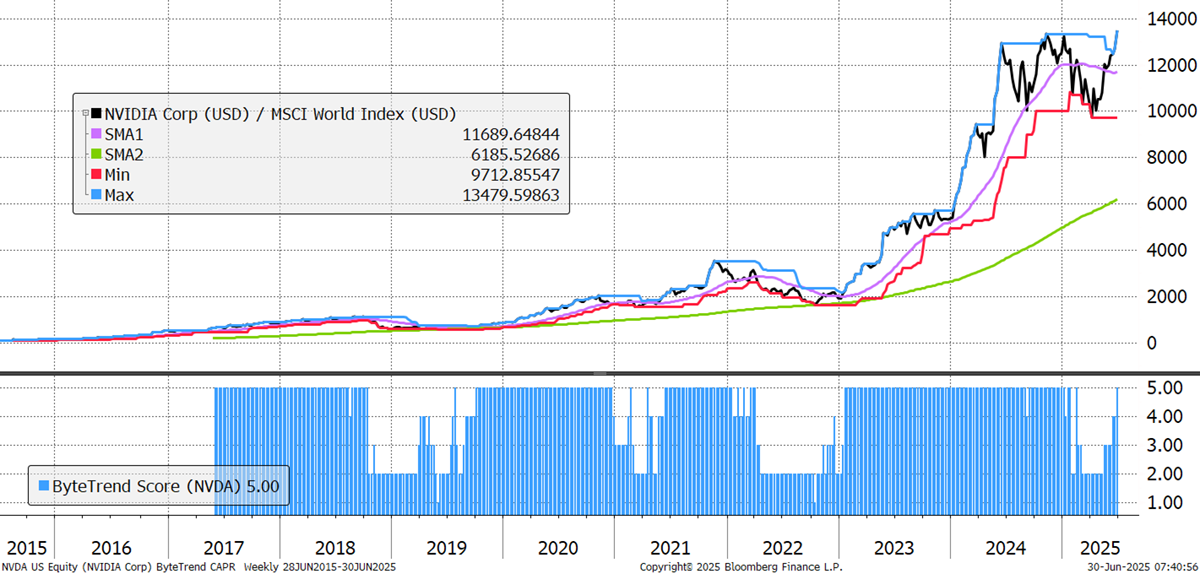

For some time, GTI has highlighted that of the Magnificent 7, Microsoft alone has been in the leading category, beating the market. However, as of this week, it is joined by Nvidia, which is making new all-time highs in price terms and now in CAPR too. Insiders have sold $1bn worth of stock in the last year, half of which was in the last month. It looked set for a rough patch ahead of tariffs, but the company’s results just keep knocking the lights out quarter after quarter. Its growth, at scale, is truly remarkable.

Nvidia

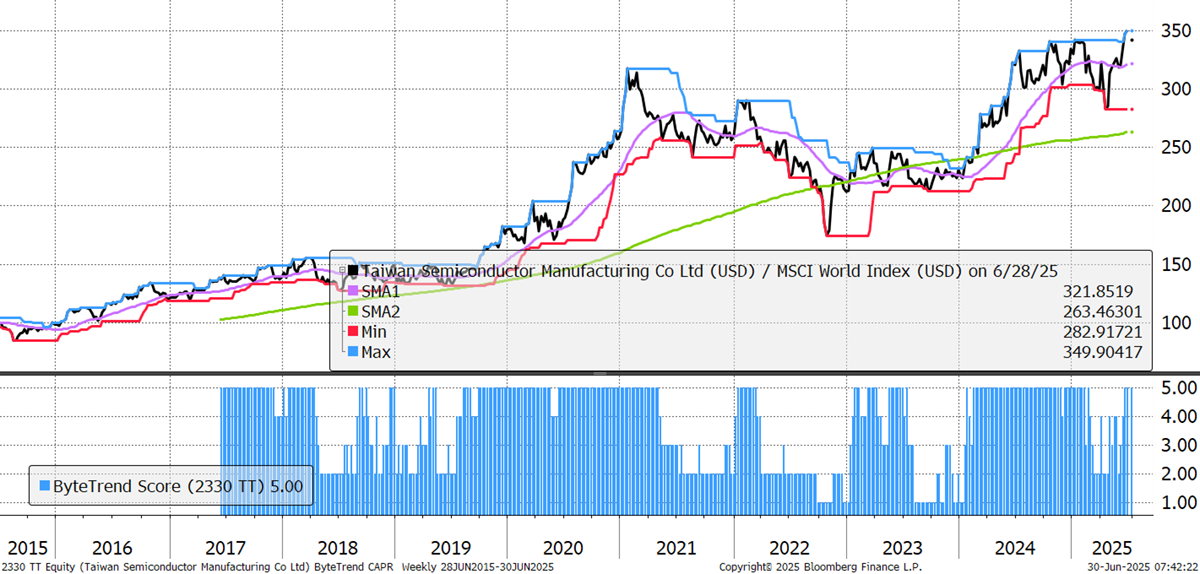

A main concern for Taiwan’s TSMC was geopolitics, but with greater troubles elsewhere, there seems to be a reprieve. It is investing in American production and reporting strong YoY demand growth (39.6% in May).

TSMC