Oh Canada!

Issue 16;

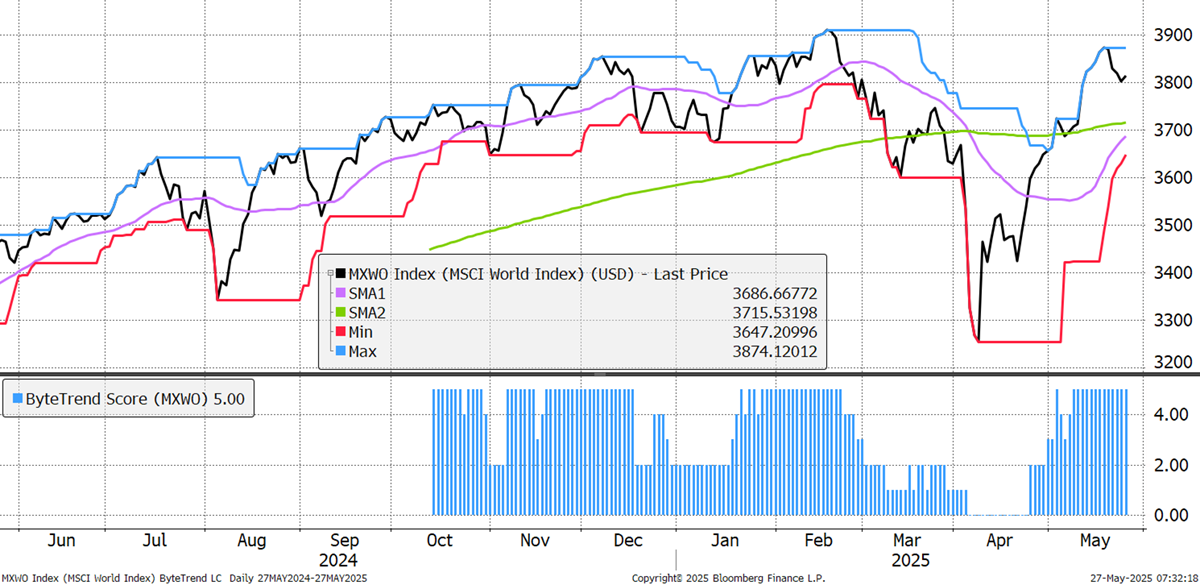

The World Index has maintained a ByteTrend Score of 5 for most of May. The index is yet to make an all-time high, but the state of the market is welcome compared to what we saw in April.

World Index – Developed Markets - Daily

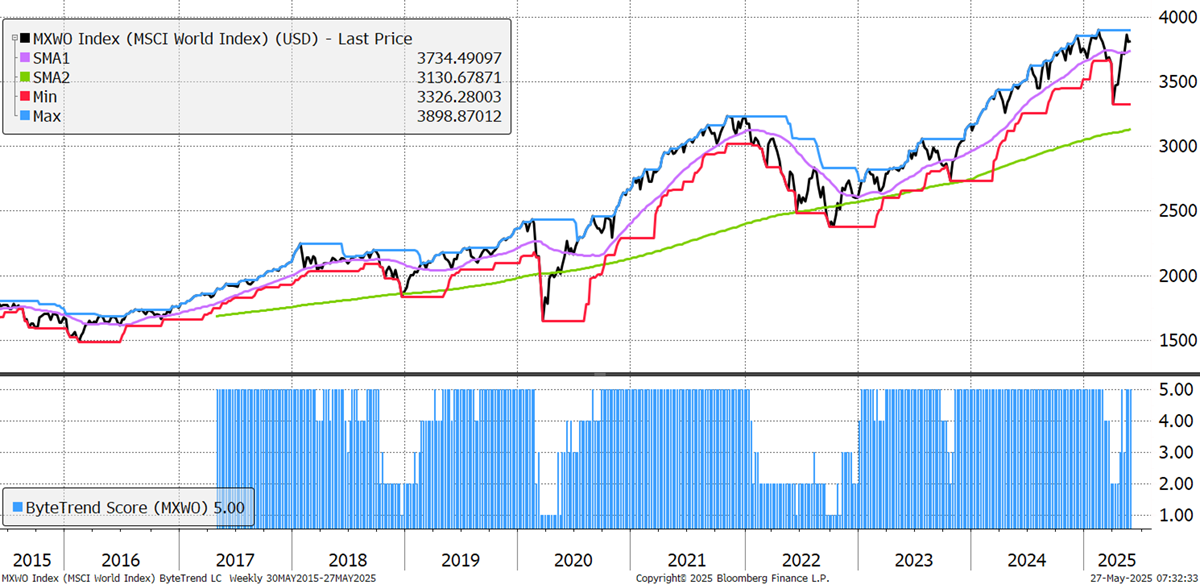

The 10-year weekly chart also has a ByteTrend Score of 5. A 5 score on the weekly and daily is as good as it gets.

World Index – Developed Markets - Weekly

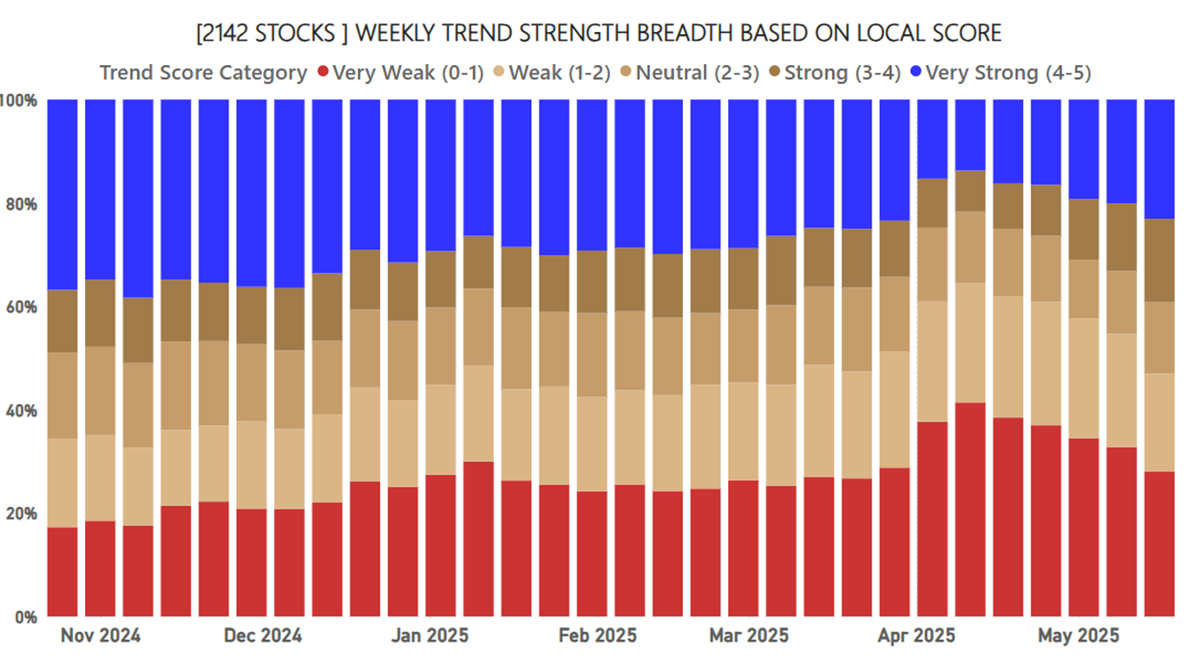

The number of stocks rising or falling is known as market breadth. This has been steadily improving, with more blue bars and fewer red, which is as expected in a market recovery.

ByteTrend: Weekly Breadth Signal

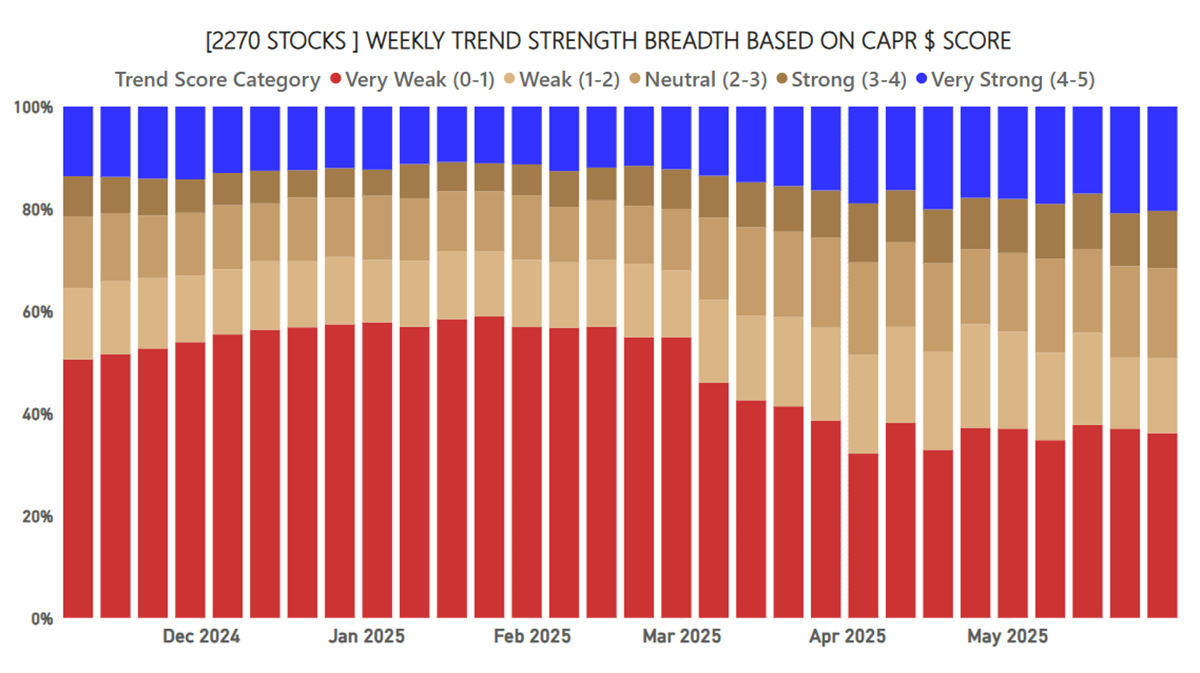

I show the same data in CAPR as opposed to local currency. There are fewer strong trends, but the number is growing. This demonstrates that the ultra-large stocks are no longer driving the market, but rather a larger number of other large stocks.

ByteTrend: Weekly Breadth Signal – CAPR

Look back to January or February, when over 50% of stocks were in bear trends, and just 10% were in bull trends. It is normal to have many more bear trends than bull trends because the bulls tend to have larger market valuations than the bears (because they are going up). Therefore, a bull market can be supported by fewer bulls and more bears, most of the time.

Oh Canada!

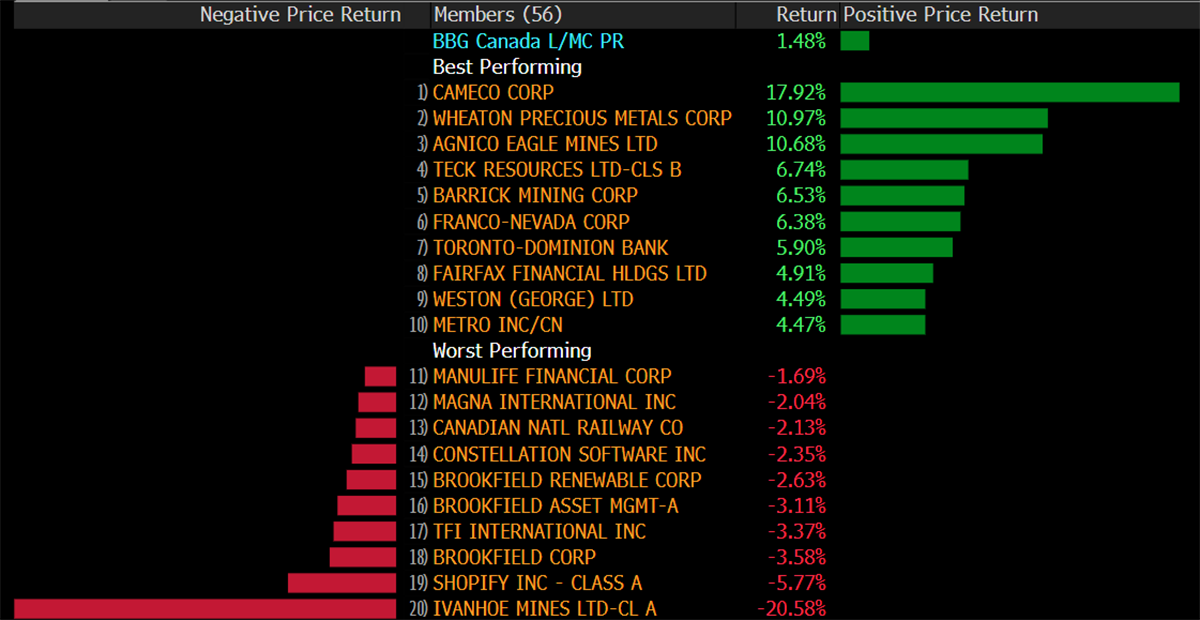

One country that stands out this week is Canada. It has several emerging trends, and I show the leaders and laggards over the past week. There’s some gold mining, but also large banks on the move alongside uranium and other great businesses. The laggards resemble US-facing companies. Canada probably deserves more credit.

Canada Leaders and Laggards

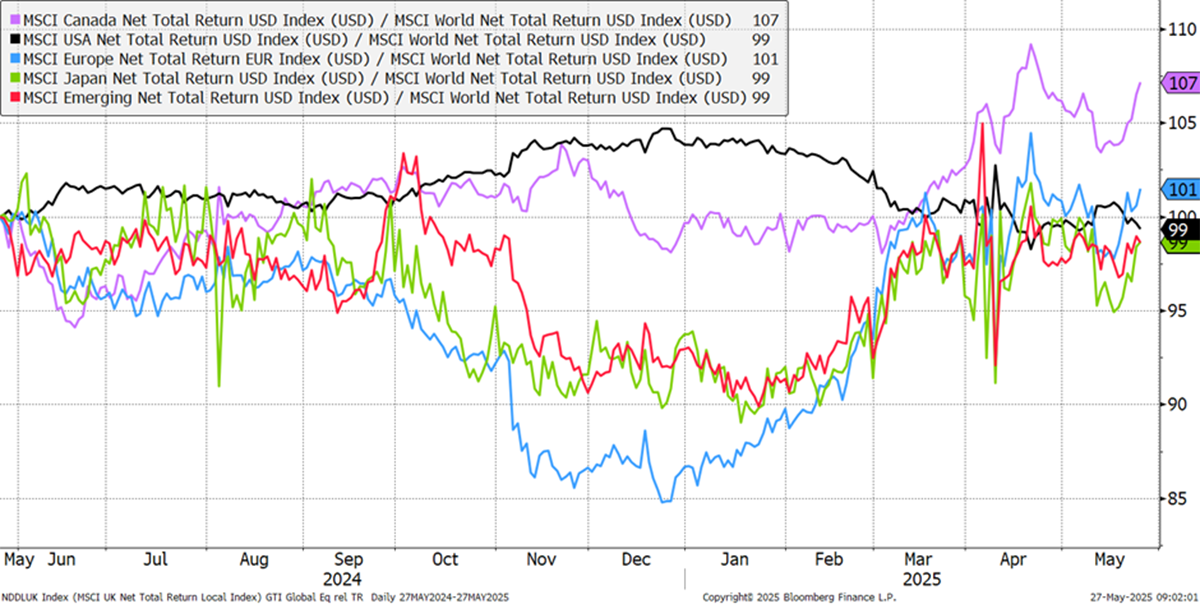

The regional CAPR chart sees the US market (black) turn down again. Japan (green) and Europe (blue) perform best. This demonstrates that the rotation into the rest of the world is back. Canada is doing well there too.

Europe, USA, Emerging Markets, Japan, and Canada CAPR - Past Year

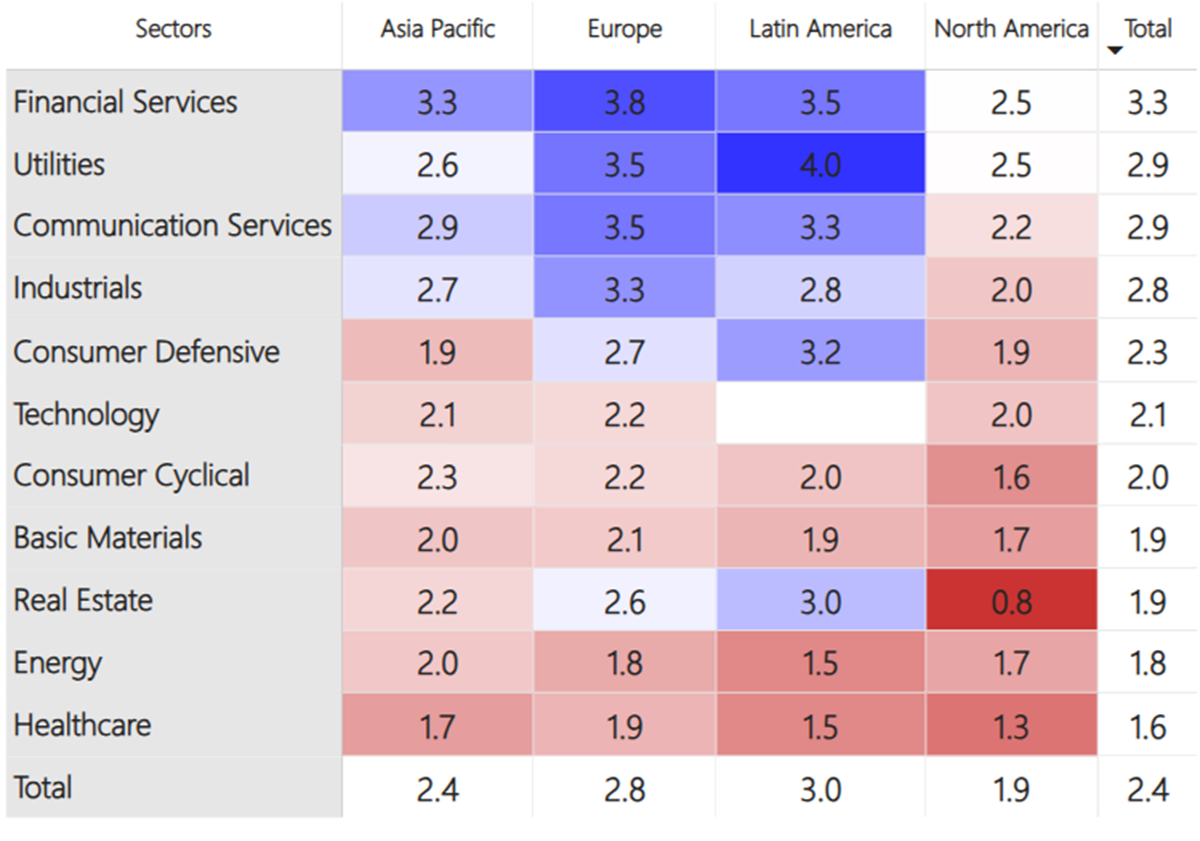

The world matrix still sees strength in financial services, mainly banks, utilities and communications (internet). The improving group is industrials. Yet this doesn’t hold true in North America in any category, and that’s with Canada in the mix. Healthcare has become a toxic sector.

Average ByteTrend Score by Region and Sector Heatmap - CAPR

Leading Trends

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of 5. All charts shown are CAPR rebased to 100.

| Ticker | FX | Name | Score CAPR | Dev High | Low | Cap | Sector | Industry | |

|---|---|---|---|---|---|---|---|---|---|

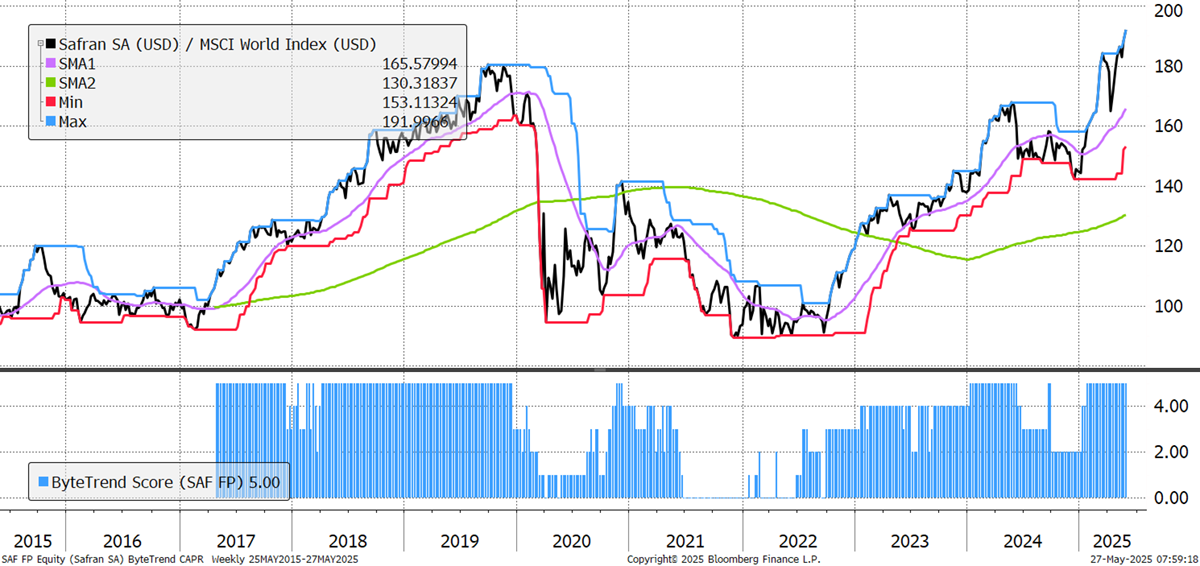

| SAF | EUR | Safran | 5 | 0 | 35 | 26 | 123 | Indust | Aerospace |

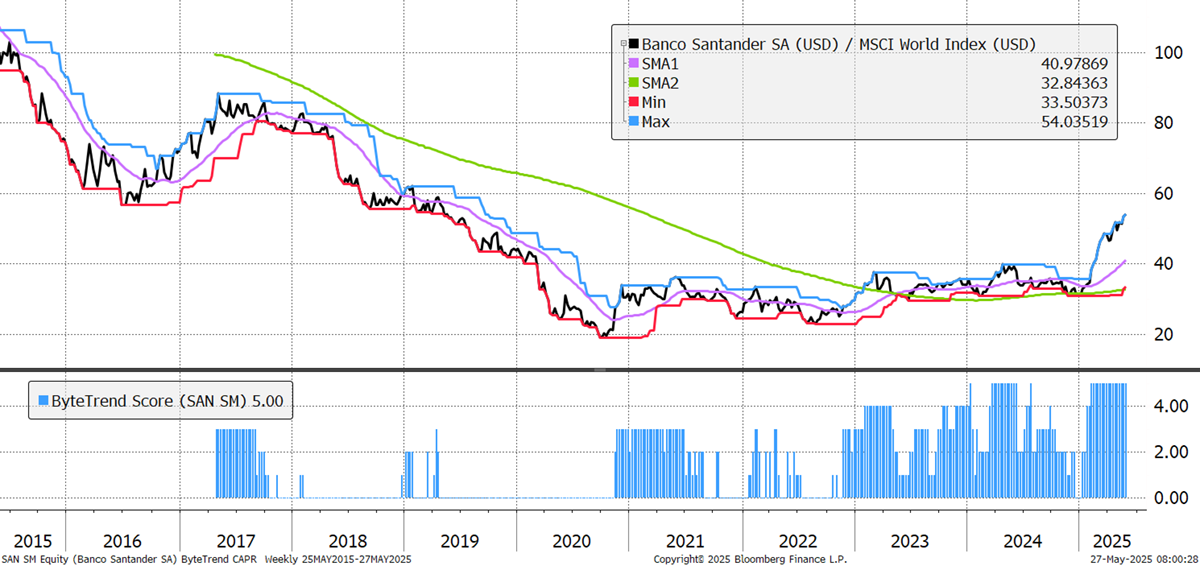

| SAN | EUR | Santander | 5 | 0 | 74 | 34 | 122 | Finance | Banks |

| PRX | EUR | Prosus | 5 | 0 | 44 | 39 | 113 | Comms | Internet |

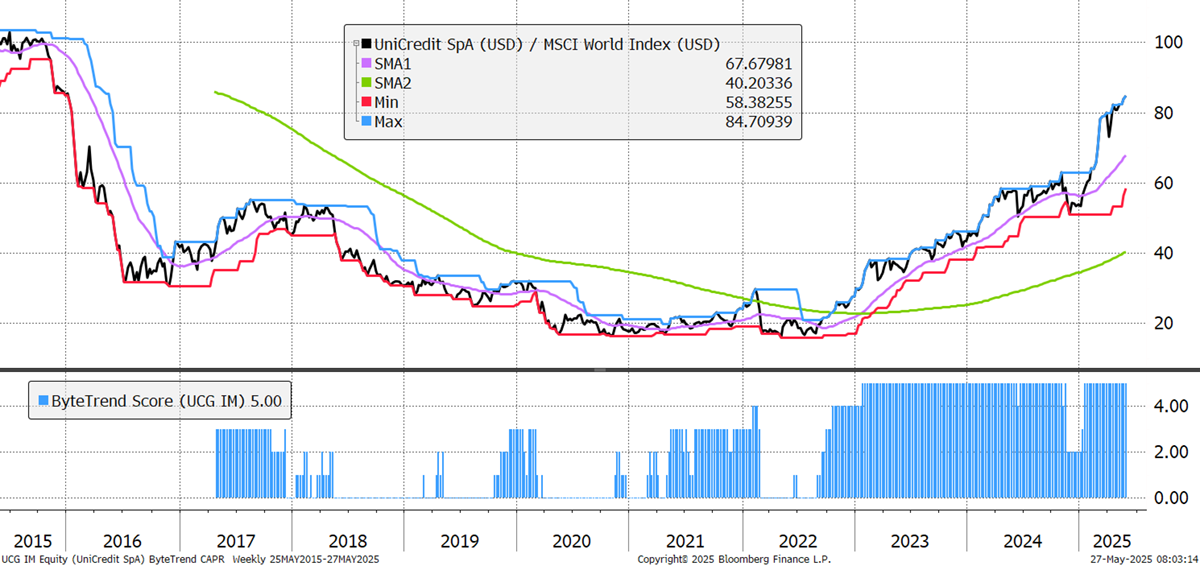

| UCG | EUR | UniCredit | 5 | 0 | 66 | 37 | 100 | Finance | Reg Banks |

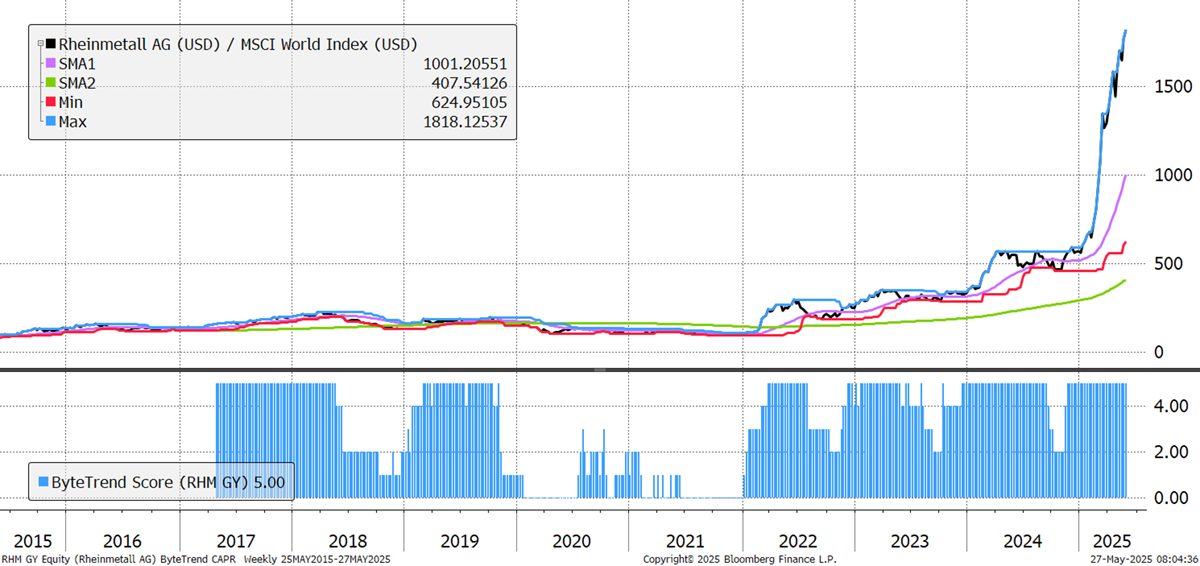

| RHM | EUR | Rheinmetall AG | 5 | 0 | 256 | 48 | 95 | Indust | Aerospace |

| BBVA | EUR | BBVA | 5 | 0 | 62 | 28 | 88 | Finance | Banks |

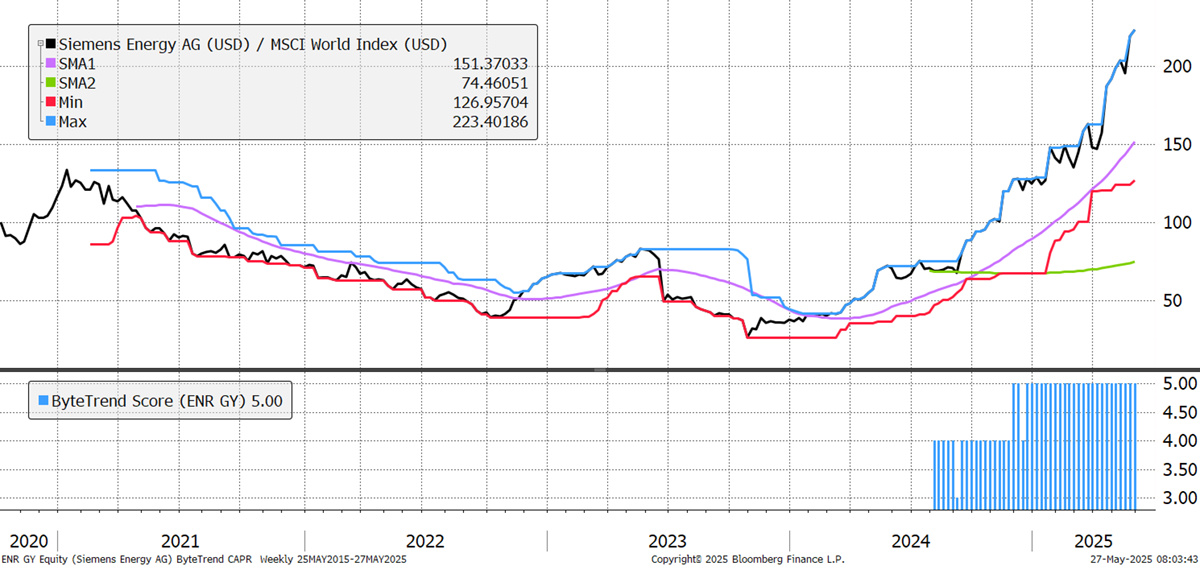

| ENR | EUR | Siemens Energy | 5 | 0 | 122 | 53 | 75 | Indust | Ind Mach |

| sINGA | EUR | ING Groep | 5 | 0 | 39 | 29 | 65 | Finance | Banks |

| CABK | EUR | CaixaBank | 5 | 0 | 58 | 31 | 61 | Finance | Reg Banks |

| UMG | EUR | Universal Music | 5 | 0 | 35 | 29 | 59 | Comms | Entertain |

The French defence giant Safran is performing well as Europe’s defence sector heats up. There was also growth in their civil aerospace division, with further gains in aftermarket and services. Full-year 2025 guidance targets around 10% revenue growth, which is a welcome pick-up. Management has also taken steps to mitigate tariff and supply chain risks. The company has also made regulatory progress towards acquiring Collins Aerospace from RTX Corp.

Safran

Spanish bank Santander enters 2025 with strong geographical diversification and stable profitability targets. Remarkably, the shares still trade at just 1.1x book, when pre-2008, 2x was the norm. Plenty to go for.

Santander

Italian bank UniCredit delivered a record net profit and its best-ever quarterly results in Q1 2025, with strong growth in fee and trading income, offsetting a decline in net interest income. It has been a remarkable turnaround and still trades at 1.5x book. It is no surprise that capital flows back into Europe are finding their way to the banks.

UniCredit

German defence company Rheinmetall has a great chart. JD Vance’s speech in Europe feels like it took place in a different world, and the stock is up threefold in just a few months since then. It is receiving a huge number of new orders for military equipment, as European nations are spending more on defence due to recent conflicts, and the US is looking to step back from global protection. There is so much catching up to do in Europe, but the optimism now baked into Rheinmetall’s share price is extreme. A PE of 65x is rich.

Rheinmetall

German alternative energy company Siemens Energy raised its 2025 outlook, driven by robust demand in Gas Services and Grid Technologies. Challenges remain in their wind operations, Siemens Gamesa, which continues to lose money. There is a good growth pipeline, and the company looks forward to a major gain from the Indian Energy business transfer, which is expected in the second half.

Siemens Energy

There are 81 additional leading trends with new highs in the GTI universe, including Greek banks.

Emerging Trends

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of less than 5. They don’t have to be in an uptrend, just emerging. All charts shown are CAPR rebased to 100.

| Ticker | FX | Name | Score CAPR | Dev High | Low | Cap | Sector | Industry | |

|---|---|---|---|---|---|---|---|---|---|

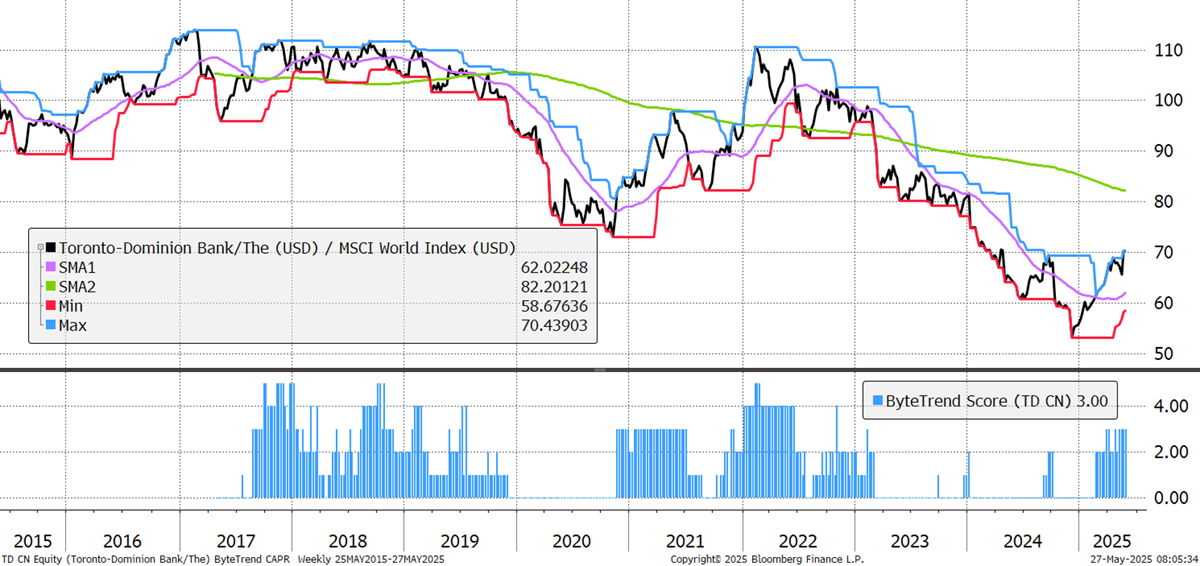

| TD | CAD | Toronto-Dmn Bank | 3 | 0 | 32 | 19 | 119 | Finance | Banks |

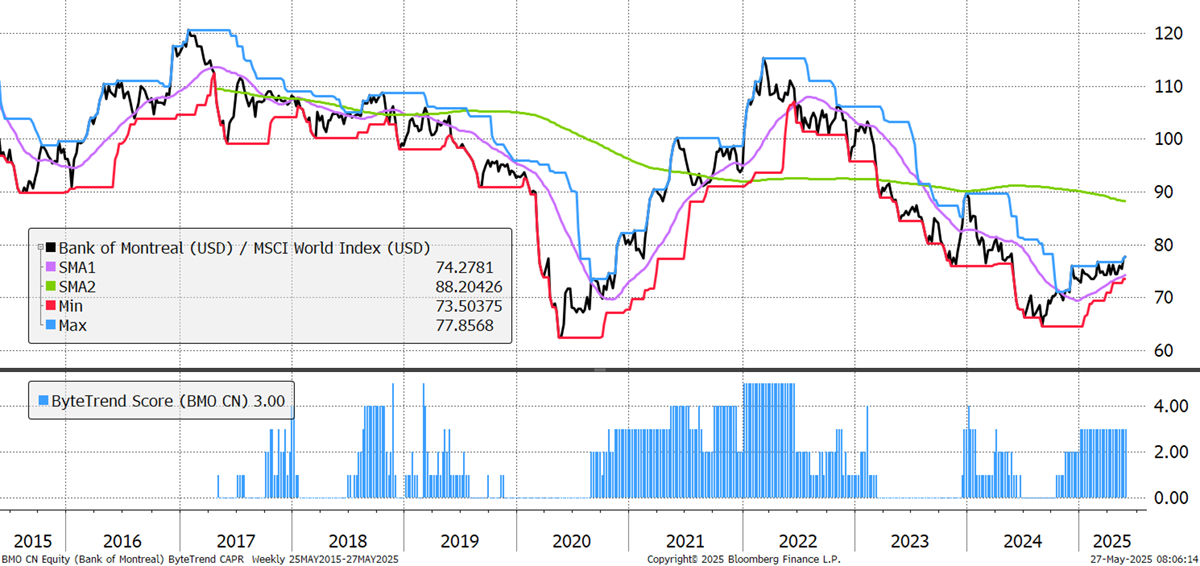

| BMO | CAD | Montreal | 3 | 0 | 12 | 21 | 76 | Finance | Banks |

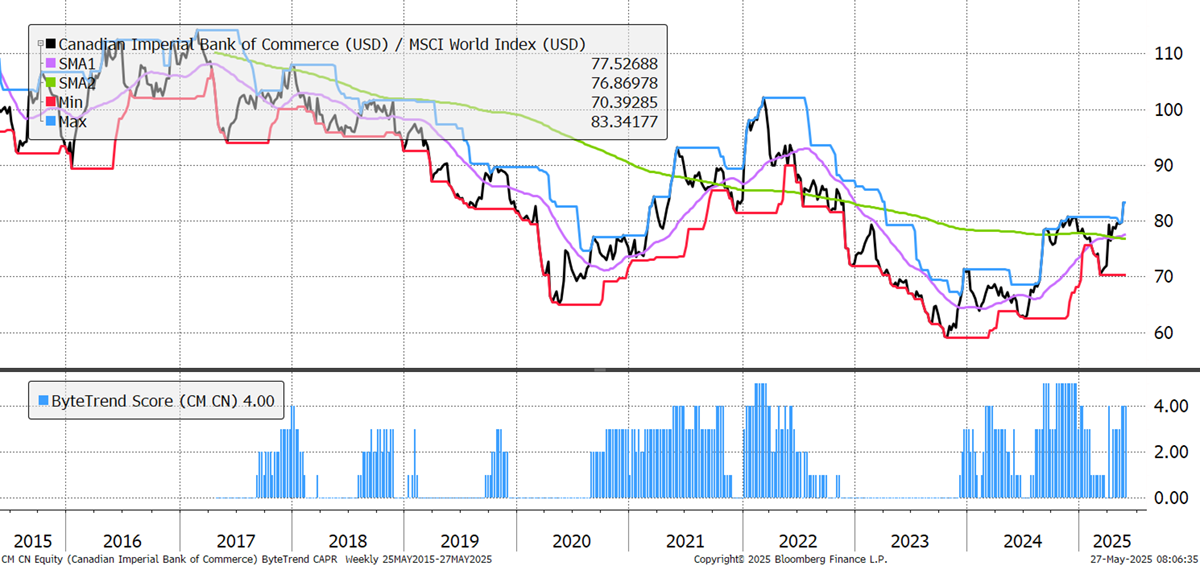

| CM | CAD | CIBC | 4 | 0 | 18 | 17 | 64 | Finance | Banks |

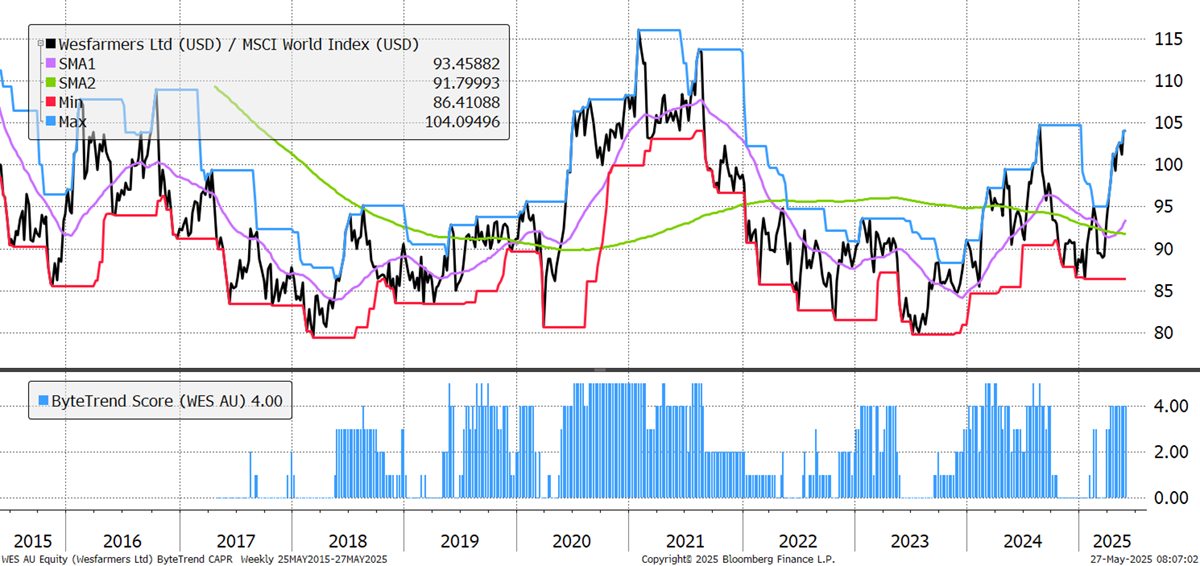

| WES | AUD | Wesfarmers | 4 | 0 | 21 | 19 | 61 | Con Cycl | Home Impr |

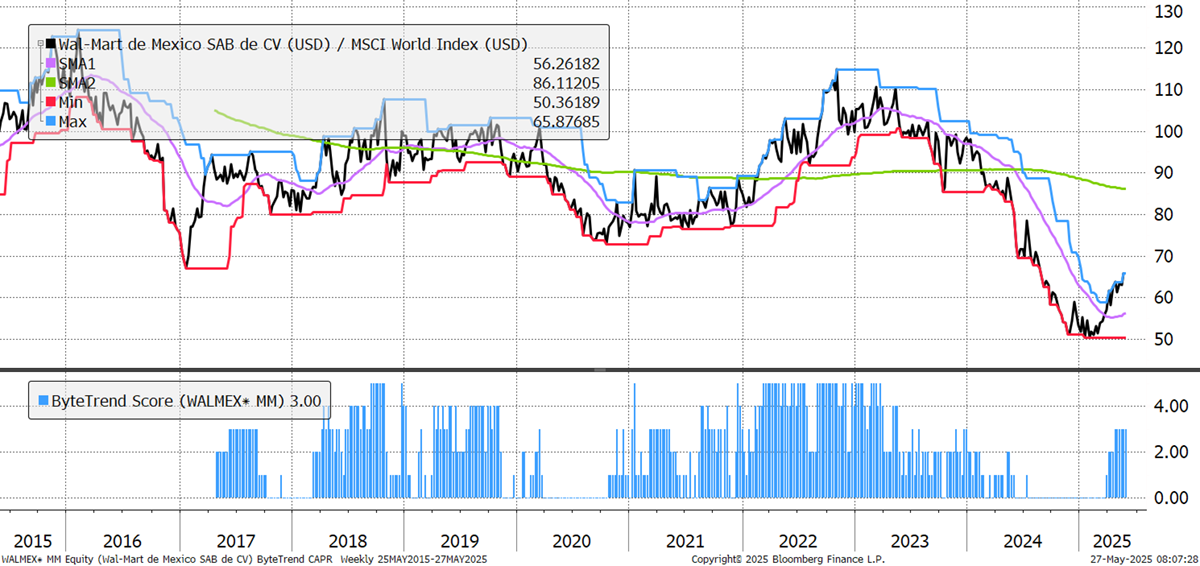

| WALMEX | MXN | Walmart de México | 3 | 0 | 32 | 29 | 60 | Con Disc | Discounters |

Canada’s Toronto Dominion (TD) Bank is a leader in digital banking, offering extensive cross-border services, and is also the leader in Canadian retail banking. Net income surged due to a one-time gain from the sale of its large stake in Charles Schwab, while adjusted earnings declined modestly YoY due to higher credit provisions and expenses. Canadian and US retail banking segments saw pressure from credit and restructuring costs, but Wealth Management, Insurance, and Wholesale Banking delivered strong growth. The bank remains well-capitalised.

Toronto Dominion Bank

Canada’s Bank of Montreal (BMO) presents a very different chart to TD. Notice how it has made a higher low in CAPR since the pandemic, suggesting BMO has faced fewer pressures in recent years compared to its rivals.

BMO

Another Canadian bank shows up, CIBC, which has a larger global footprint than its domestic competitors. It has a significant portion of its business tied to the domestic housing market, making it more exposed to Canadian economic cycles and real estate risks than the others. It will report results this Thursday, following a strong set last time.

Canadian Imperial Bank of Commerce (CIBC)

Australian conglomerate Wesfarmers saw profits rise with strong retail performance offsetting cost pressures and underperformance elsewhere. Conglomerates haven’t been in vogue in most countries, and so Wesfarmers stands out. The company is boosting efficiency, and the market likes what it sees.

Wesfarmers

Mexico’s Walmart, Walmex, continues aggressive store expansion and maintains industry-leading returns on invested capital, but faces macroeconomic uncertainty in Mexico and only modest capital returns. If you were ever planning to own this company, this may prove to be an attractive entry point.

Wal-Mart de Mexico

There are 51 additional emerging trends in the GTI universe. Germany’s Bayer is an interesting turnaround, as is the tyre maker Continental. Those agricultural suppliers keep on coming up as well.

Weakening

These stocks are trading at the 30-week CAPR lows with a ByteTrend Score above 0. They are weakening trends but not yet downtrends. All charts shown are CAPR rebased to 100.

| Ticker | FX | Name | Score CAPR | Dev High | Low | Cap | Sector | Industry | |

|---|---|---|---|---|---|---|---|---|---|

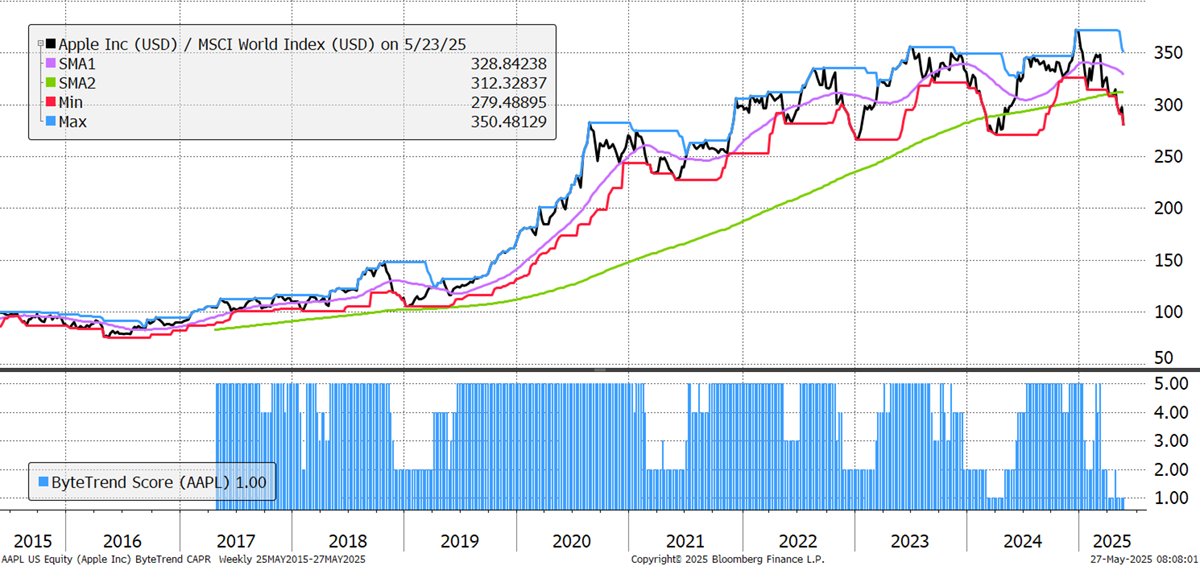

| AAPL | USD | Apple | 1 | -25 | 0 | 35 | 2917 | Tech | Cons Elec |

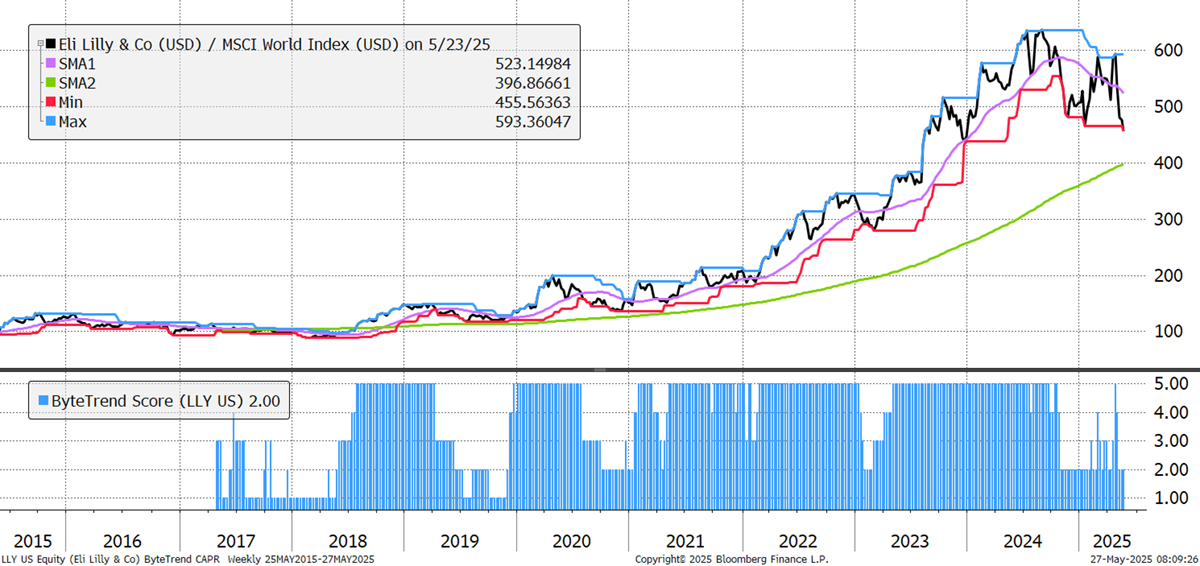

| LLY | USD | Eli Lilly | 2 | -23 | 0 | 45 | 676 | Health | Drug Makers |

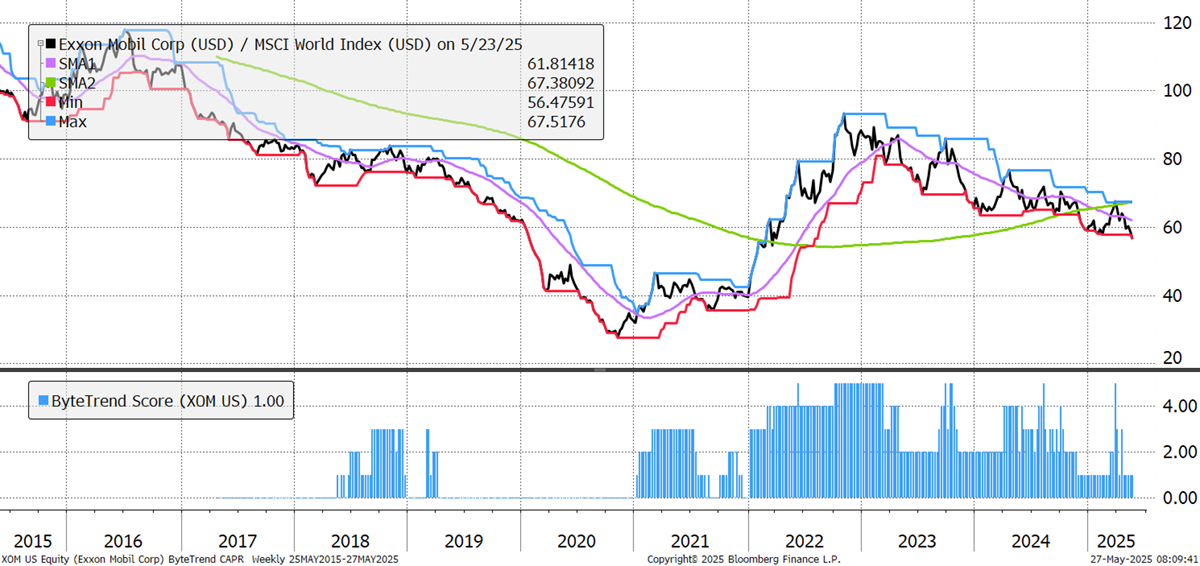

| XOM | USD | Exxon Mobil | 1 | -17 | 0 | 25 | 444 | Energy | O&G Int |

| CVX | USD | Chevron | 1 | -22 | 0 | 28 | 238 | Energy | O&G Int |

| COP | USD | ConocoPhillips | 1 | -26 | 0 | 34 | 108 | Energy | O&G Exp |

| FI | USD | Fiserv | 1 | -33 | 0 | 34 | 88 | Tech | IT |

| EOG | USD | EOG Resources | 1 | -20 | 0 | 31 | 60 | Energy | O&G Exp |

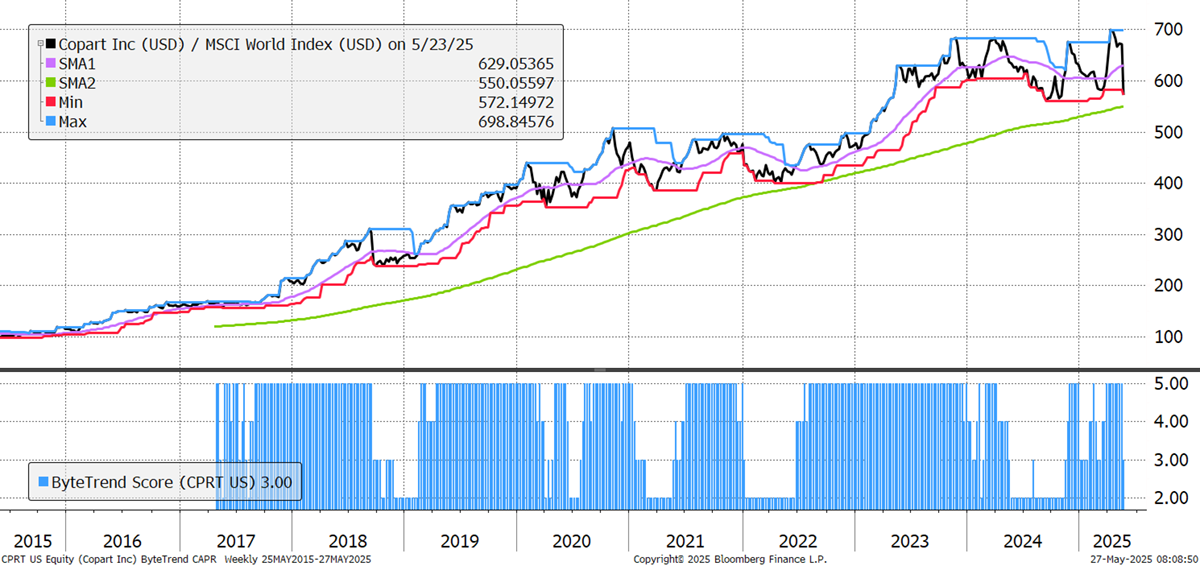

| CPRT | USD | Copart | 3 | -18 | 0 | 35 | 52 | Con Cycl | Auto Dealers |

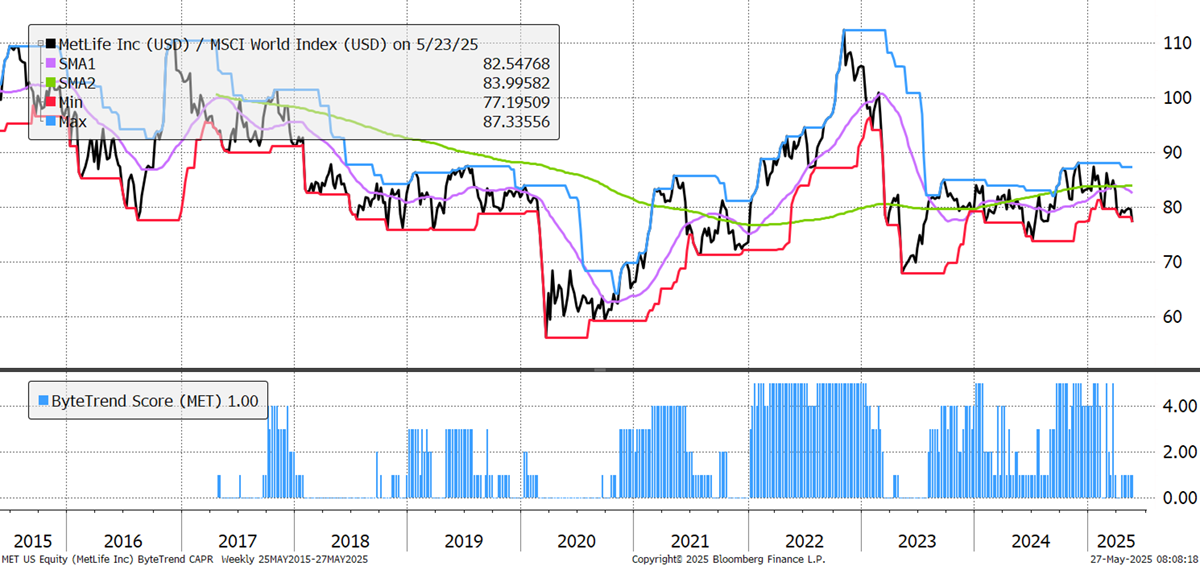

| MET | USD | MetLife | 1 | -13 | 0 | 29 | 52 | Finance | Life Ins |

Apple is still one of the largest companies in the world. However, heavy exposure to US-China trade tensions, with potential tariffs threatening up to a 25% downside to earnings if exemptions are lost (costs that could reach $900 million in a single quarter). Its supply chain remains highly concentrated in China and Taiwan, and Trump has criticised its suggested expansion into India too. Delays in key innovations, such as generative AI, further cloud its growth prospects and raise uncertainty about maintaining its historical pace of outperformance.

Apple

Eli Lilly’s impressive revenue growth continues to be driven by its diabetes and obesity drugs, but its 2025 earnings guidance was cut due to higher R&D charges and a one-time acquisition cost, leading to an 11% stock drop and raising concerns about execution risks, high product pricing, and intense competition in the weight-loss drug market. While the long-term outlook remains positive, the company’s premium valuation leaves little room for disappointment.

Eli Lilly

Once one of the world’s most valuable companies, Exxon reported that persistent oil price weakness, legal risks, and potential tariff impacts weigh heavily on it, along with the sector. Q1 2025 earnings were $7.7 billion, with strong cash flow and industry-leading shareholder returns, despite lower profits due to weaker refining and chemical margins. This does not bode well for the oil sector.

Exxon

US auto company Copart remains a leader in online vehicle auctions, benefitting from structural trends in used vehicle markets and digitalisation. Its scalable platform and international expansion have driven consistent revenue and margin growth, but recent statements have been cautious about substantial risks and uncertainties.

Copart

US insurance giant MetLife delivered good results, but it suffers from having a high valuation. It trades at 2.2x book since 2022. In the 25 years before that, the average was 1x book. Maybe this is a simple case of a high valuation.

MetLife

There are 27 additional weakening trends in the GTI universe. The list includes many energy stocks.

Bear Trends

These stocks are trading at the 30-week CAPR lows with a ByteTrend Score of 0. They are in a downtrend. All charts shown are CAPR rebased to 100.

| Ticker | FX | Name | Score CAPR | Dev High | Low | Cap | Sector | Industry | |

|---|---|---|---|---|---|---|---|---|---|

| 2222 | SAR | Saudi Arabian Oil | 0 | -16 | 0 | 16 | 1625 | Energy | O&G Int |

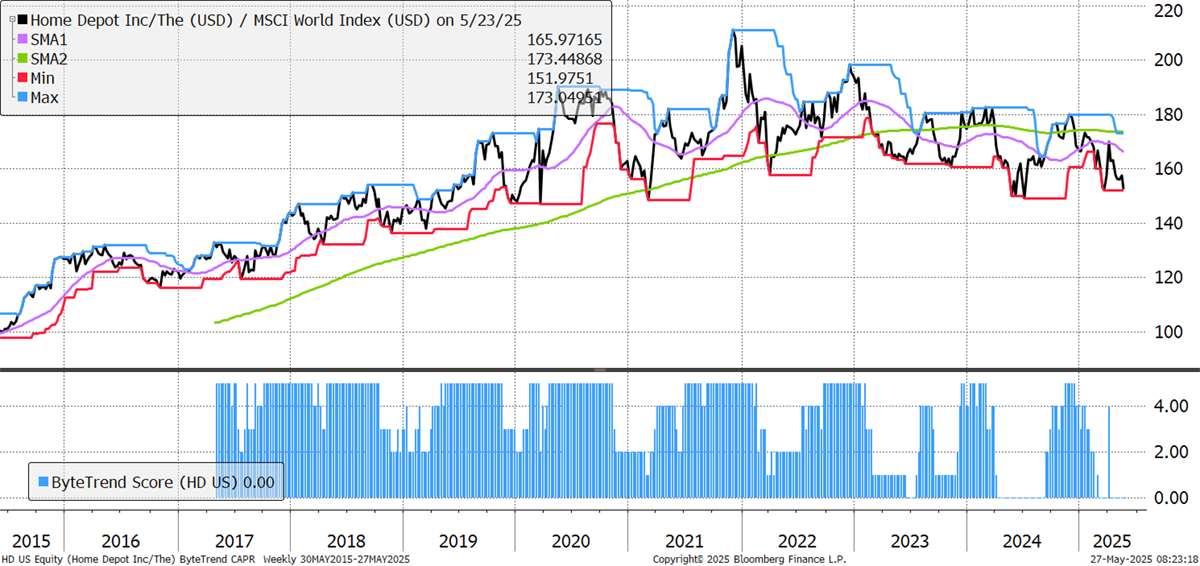

| HD | USD | Home Depot | 0 | -16 | 0 | 22 | 361 | Con Cycl | Home Impr |

| PEP | USD | PepsiCo | 0 | -23 | 0 | 20 | 177 | Con Disc | Soft Drinks |

| BX | USD | Blackstone | 0 | -32 | 0 | 38 | 161 | Finance | Asset Man |

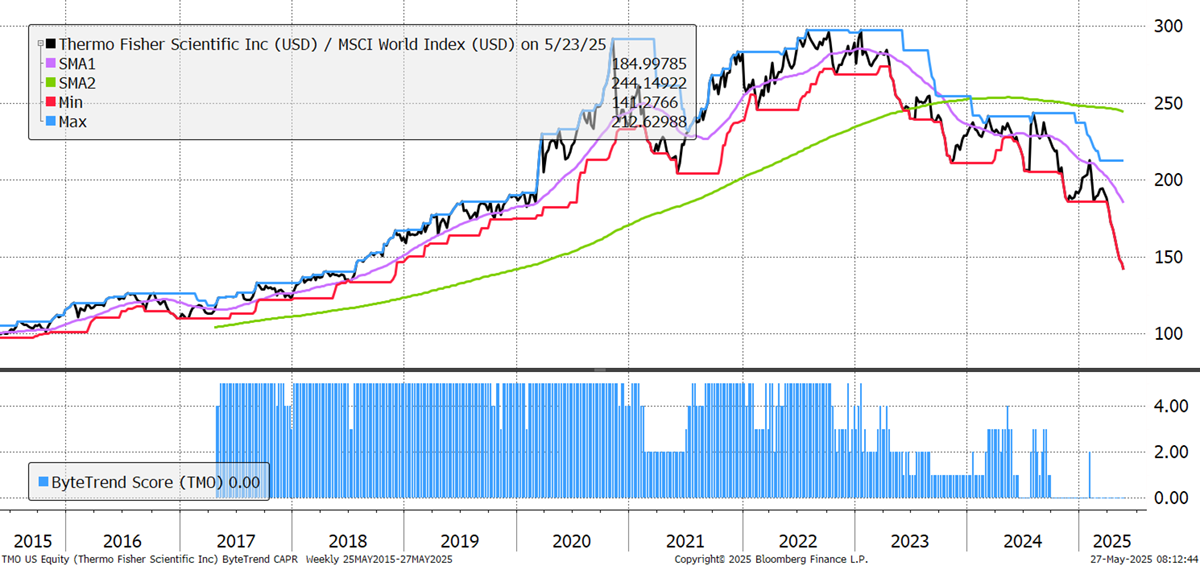

| TMO | USD | Thermo Fisher | 0 | -34 | 0 | 25 | 149 | Health | Med Diag |

| UNP | USD | Union Pacific | 0 | -13 | 0 | 24 | 133 | Indust | Rail |

| DHR | USD | Danaher | 0 | -25 | 0 | 29 | 132 | Health | Med Diag |

| LOW | USD | Lowe's | 0 | -20 | 0 | 23 | 124 | Con Cycl | Home Impr |

| 3690 | HKD | Meituan | 0 | -33 | 0 | 41 | 107 | Con Cycl | Spec Retail |

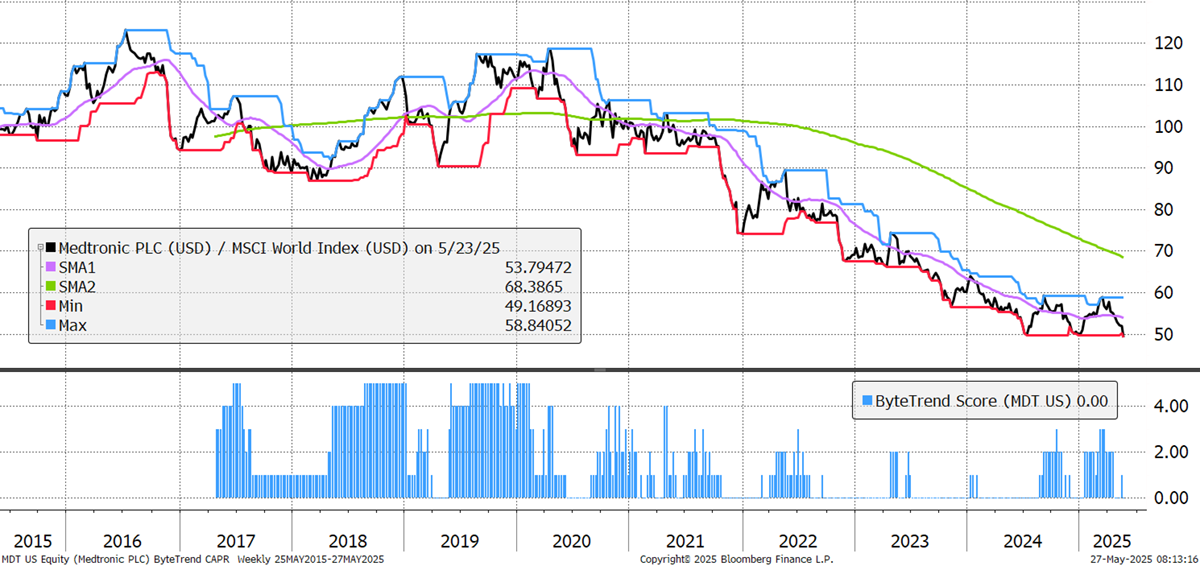

| MDT | USD | Medtronic plc | 0 | -17 | 0 | 22 | 103 | Health | Med Devices |

| PLD | USD | Prologis, | 0 | -16 | 0 | 30 | 97 | Real Est | Ind REITs |

| ELV | USD | Elevance Health | 0 | -24 | 0 | 20 | 84 | Health | Med Plans |

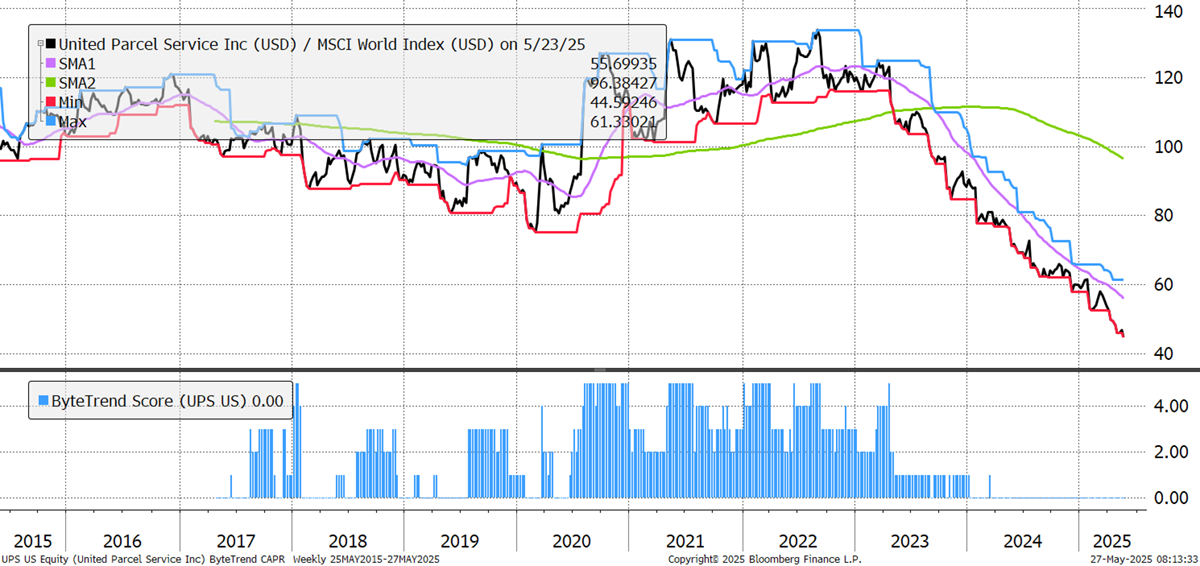

| UPS | USD | UPS | 0 | -31 | 0 | 31 | 81 | Indust | Logistics |

| ITW | USD | Illinois Tool Works | 0 | -14 | 0 | 23 | 71 | Indust | Ind Mach |

| WDAY | USD | Workday | 0 | -15 | 0 | 36 | 64 | Tech | Software |

| APD | USD | Air Products | 0 | -20 | 0 | 29 | 60 | Materials | Special Chem |

Home Depot faces persistent headwinds from high interest rates, sluggish home sales, and consumer reluctance to undertake large renovation projects, resulting in flat or declining comparable sales and falling short of Wall Street’s earnings expectations in early 2025. Although management is taking steps to preserve margins and diversify supply chains, ongoing macroeconomic uncertainty and tariff risks could further pressure sales and profitability. This company remains at a high valuation compared to the past.

Home Depot

Thermo Fisher keeps appearing on the bear list. Its products range from lab instruments and chemicals to advanced genetic testing tools, and it supports everything from basic research to large-scale drug manufacturing. Revenue and earnings showed only modest growth in Q1 2025. Free cash flow declined significantly, while capital deployment included a major acquisition. It cut its profit forecast due to higher costs from tariffs and weaker research funding, especially in China and Europe. This won’t do for another overvalued company.

Thermo Fisher

US medical device company Medtronic is focusing on innovation to drive growth, but faces persistent margin pressures and regulatory challenges in key markets. While its diversified medical device portfolio supports resilience, execution risks and slower-than-expected growth in some segments temper the long-term outlook.

Medtronic

UPS generates 75% of its revenues in the US, and half of it from ground transport deliveries. In Q1, revenues declined again, and its transformation initiatives and cost-saving programs are adding significant one-time charges, which impact GAAP results. Higher labour costs and slowing deliveries following the Covid-boom have mounted a dual challenge to its financials, exacerbated by Amazon’s continued development of its own logistics. The costs of investment needed to keep up look like a heavy weight on the next few years too, hence the persistent underperformance.

UPS

There are 116 additional bear trends in the GTI universe, including energy companies, US real estate, and REITs, as well as home builders.

Outlook

The dynamics have stabilised. Europe’s banks and industrials remain well-positioned while Canada shines through. There was also a taste of Mexico, which may indicate the neighbours are in a surprisingly strong position.

Energy and healthcare remain weak, alongside natural resources. Yet Canada’s strength challenges that view somewhat, as it is a country full of good banks, combined with high exposure to commodities.

Thanks for reading GTI.