The Greatest Rotation

Issue 11;

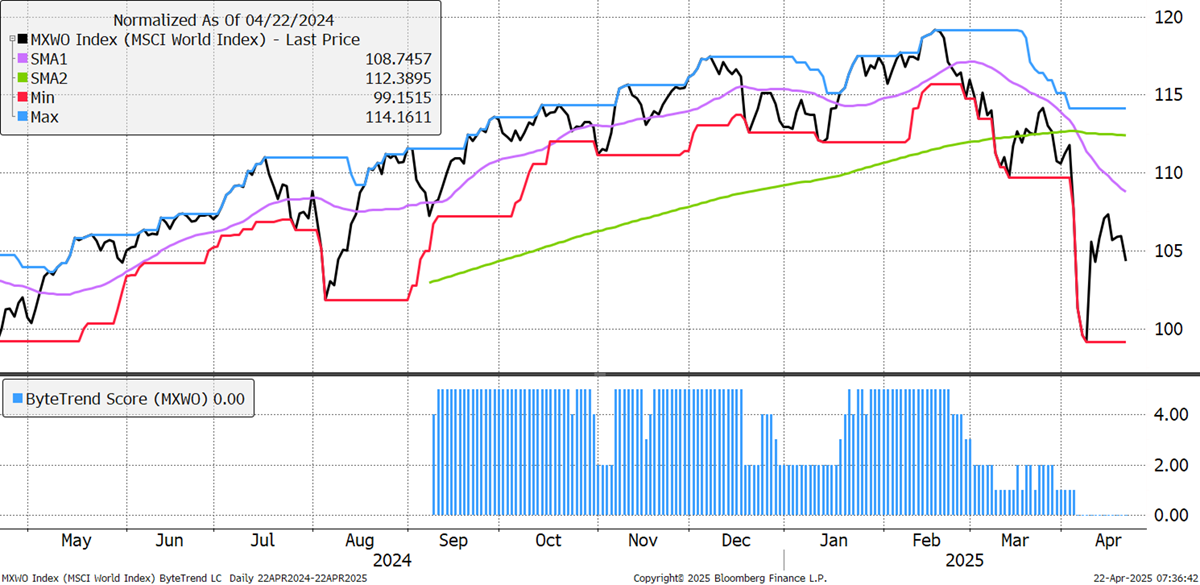

The World drops back from a ByteTrend Score of 5 in February to a 0 on the daily chart. The index is being pulled down by weaker US stocks, yet supported by a weak dollar.

World Index in USD – Developed Markets - Daily

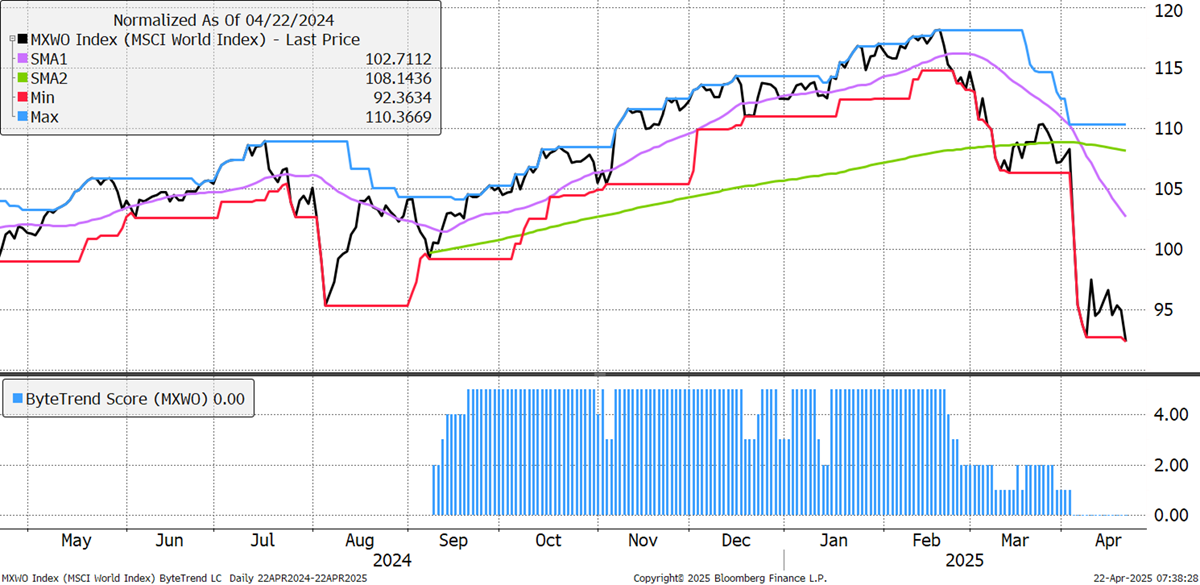

The currency effect is illustrated by plotting the same chart in Swiss Francs, which has been a stronger currency. The fall is much more severe.

World Index in Swiss Francs – Developed Markets - Daily

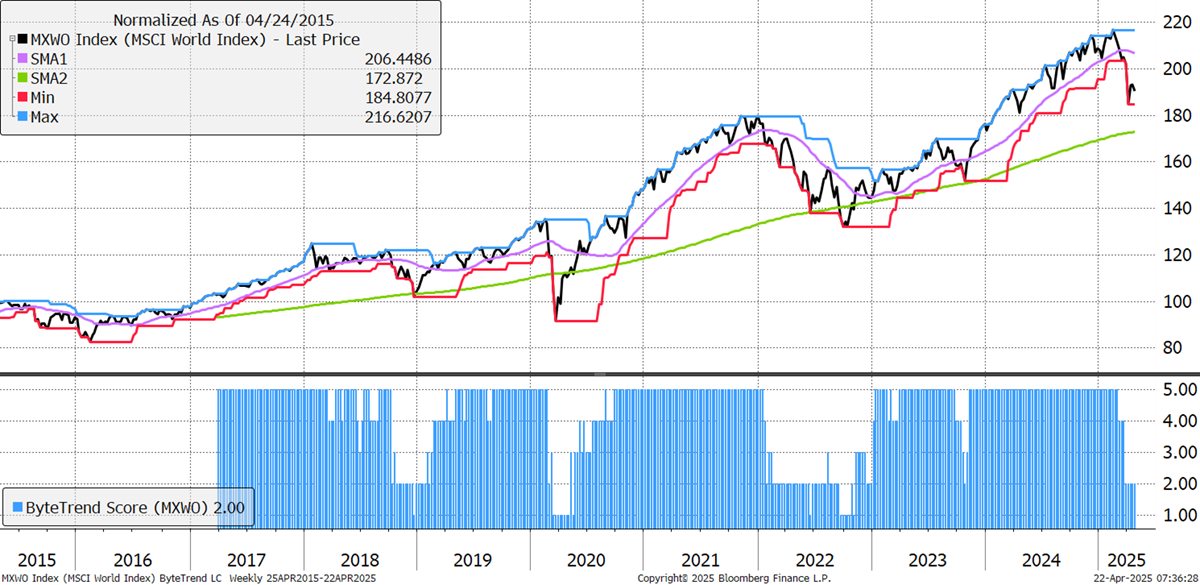

On the weekly chart in USD, the ByteTrend Score has fallen to 2 as the 30-week moving average has turned down, but the 200-week MA is still upward-sloping, with the price above.

World Index in USD – Developed Markets - Weekly

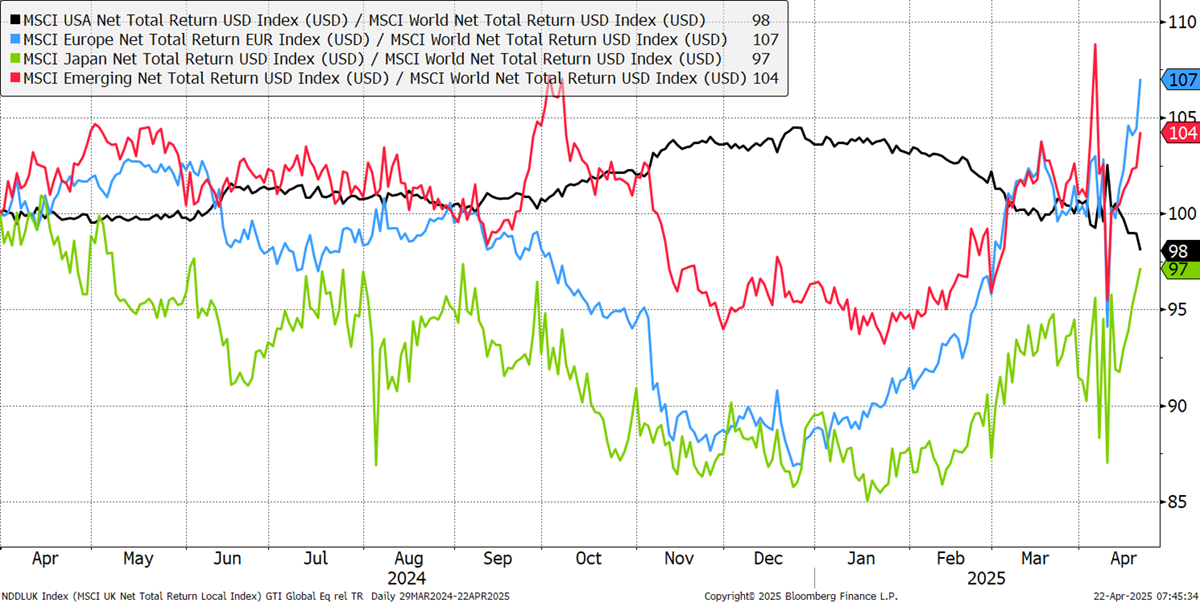

The daily charts for the world index are alarming, but the weekly in USD looks remarkably normal. Yet, behind the scenes, we are witnessing one of the greatest stock rotations on record. The regional CAPR sees the US market, which is twice as large as the others put together, continue its downtrend. As a result, Japan, Emerging Markets and Europe lead, with Europe in front.

CAPR: Europe, USA, Emerging Markets, and Japan

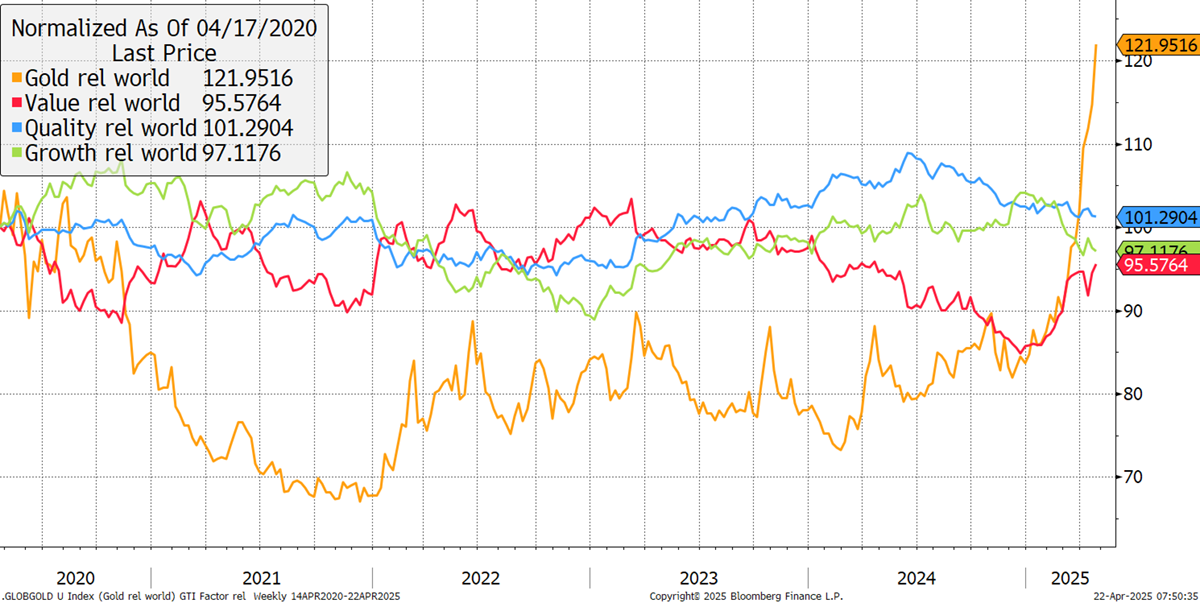

It should be noted that European currencies are currently stronger, especially the Swiss Franc and the Swedish Krona. But the currency (or monetary asset) that is most in demand is gold. The recent excess return has been stunning. Quality and Growth are lagging, while Value is rising.

Major Factors CAPR - Past Five Years

Regions and Sectors

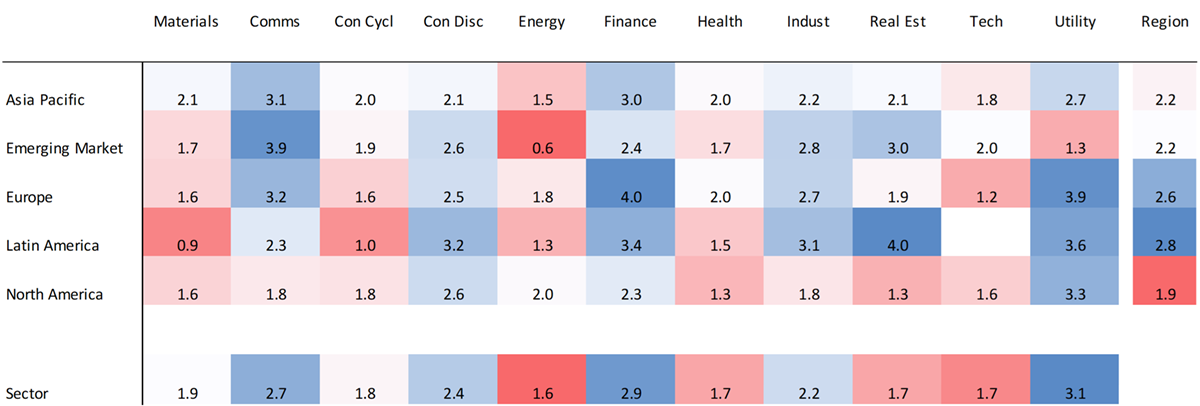

The table below highlights the average CAPR scores for regions and sectors. Europe and Latin America show up as the safe havens with the highest average CAPR scores (right column). The USA is the weakest, but there will be some bias for the major markets that didn’t trade on Easter Monday, of which only China, Japan, the US and Canada did.

On the sector side, utilities, financials, and communications held up (bottom row). Strength in financials suggests rates may stay higher for longer. It also suggests this is not a financial crisis but a trade crisis. Energy, healthcare, real estate and technology are the weakest. That said, real estate held up well in the emerging markets.

Global Regional and Sector ByteTrend CAPR Scores (Averages)

EM tech was a bright spot, which is essentially Chinese. European financials and utilities were also strong. Utilities and consumer discretionary are normally strong when the stockmarket is falling. Consumer cyclicals are weak, as consumer spending is expected to come under pressure.

Energy and materials remain in a slump, which is likely forecasting a recession. Real estate is weak overall, but is further dragged down by the US, which has many more stocks. It’s a brighter spot elsewhere. Healthcare is the standout because it is weak across the board and is normally a defensive area during times of market uncertainty.

In this issue of The Global Trend Investor, we cover the top 200 global stocks from a universe of over 2,000 stocks from both developed and emerging markets. We have analysed the trends, reported the results, and will discuss the highlights.

Please refer to our GTI: User Guide for an overview of the key concepts and terminology used in this report.

Glossary

| CAPR | Currency Adjusted Price Relative |

| Dev | Deviation from the 200-week Moving Average |

| Vol | 360-day Volatility |

| Cap | Market Cap in USD Billions |

Leading Trends with New Highs

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of 5. All charts shown are CAPR rebased to 100.

| Ticker | FX | Name | CAPR | Dev | Vol | Cap | Sector | Industry |

|---|---|---|---|---|---|---|---|---|

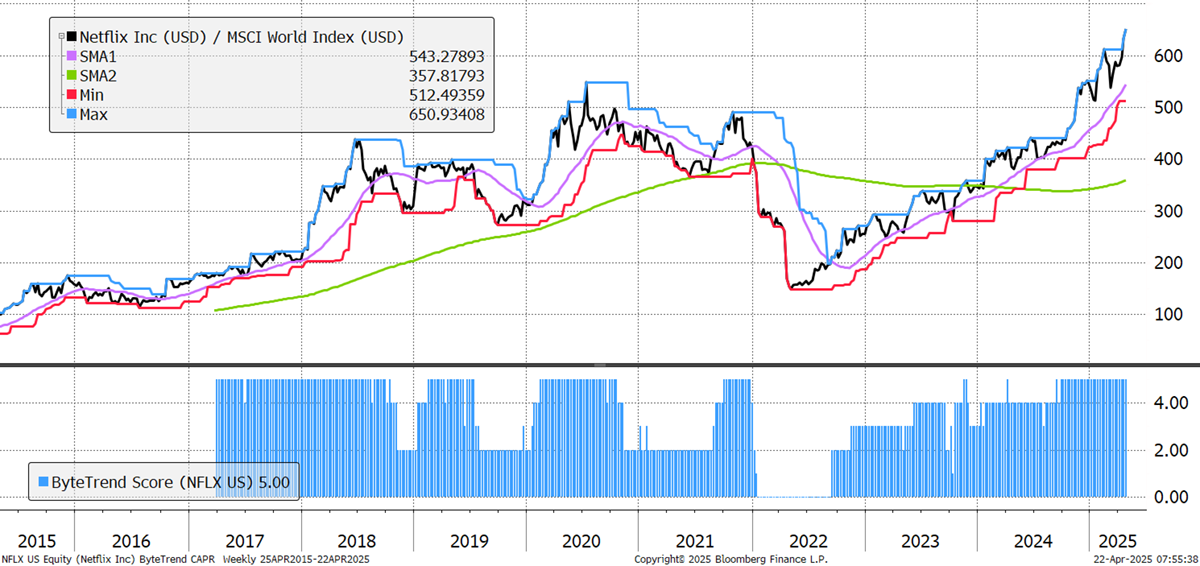

| NFLX | USD | Netflix | 5 | 94 | 36 | 422.6 | Comms | Entertain |

| KO | USD | Coca-Cola | 5 | 18 | 19 | 313.2 | Con Disc | Soft Drinks |

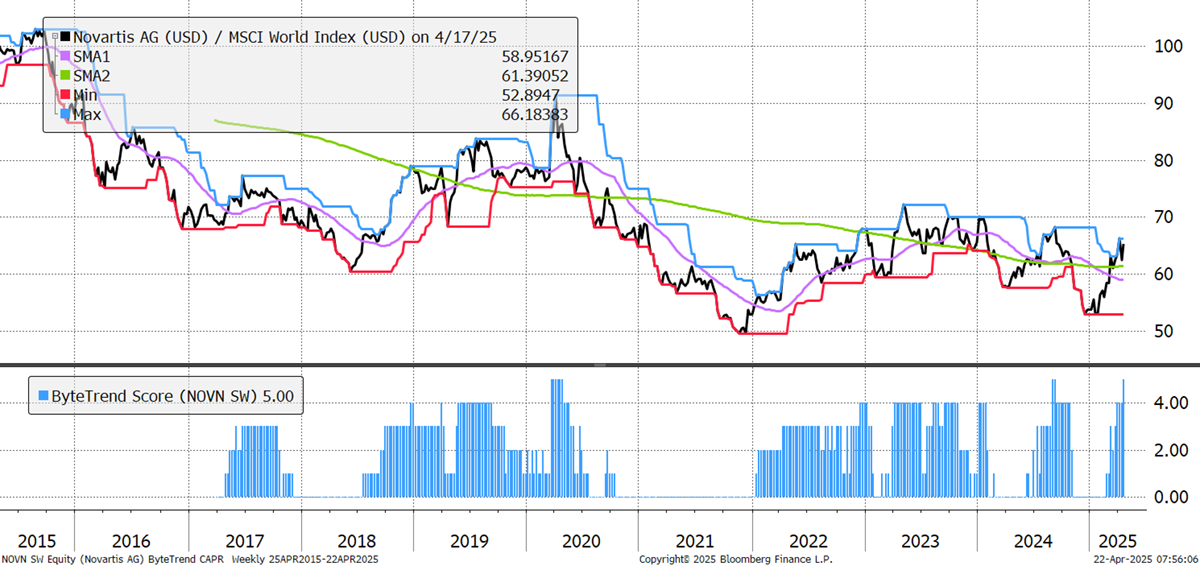

| NOVN.SW | CHF | Novartis AG | 5 | 5 | 22 | 212.6 | Health | Drug Makers |

| CBA.AX | AUD | Commonwealth | 5 | 42 | 23 | 173.0 | Finance | Banks |

| ALV.DE | EUR | Allianz | 5 | 49 | 17 | 154.7 | Finance | Insurance |

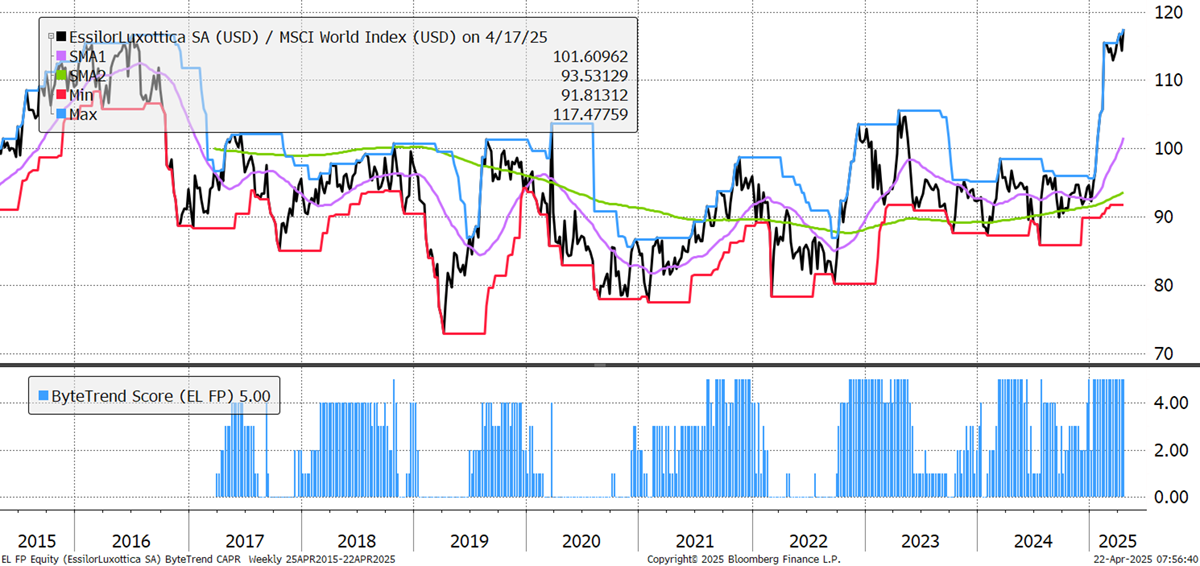

| EL.PA | EUR | EssilorLuxottica | 5 | 33 | 24 | 130.0 | Health | Med Supplies |

| BHARTIARTL.NS | INR | Bharti Airtel | 5 | 86 | 24 | 126.0 | Comms | Telecoms |

| ICICIBANK.NS | INR | ICICI Bank | 5 | 47 | 21 | 117.9 | Finance | Reg Banks |

| AI.PA | EUR | Air Liquide | 5 | 21 | 16 | 114.9 | Materials | Special Chem |

| IBE.MC | EUR | Iberdrola | 5 | 37 | 18 | 111.3 | Utility | Utilities |

| SAN.MC | EUR | Santander | 5 | 63 | 33 | 103.5 | Finance | Banks |

| CS.PA | EUR | AXA | 5 | 37 | 19 | 98.9 | Finance | Insurance |

| ZURN.SW | CHF | Zurich ins | 5 | 24 | 21 | 98.4 | Finance | Insurance |

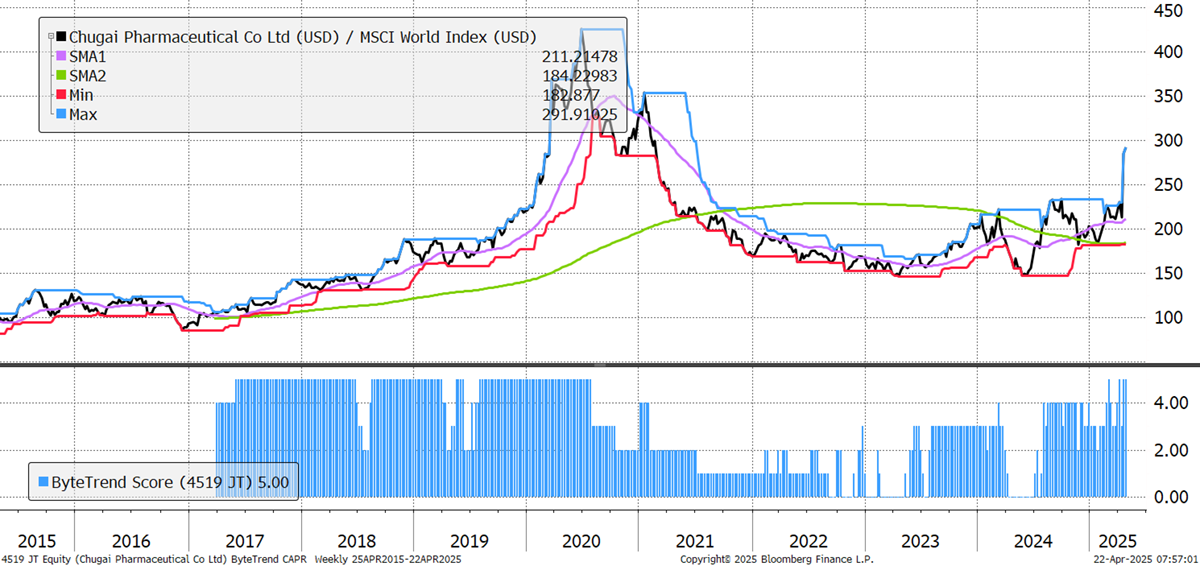

| 4519.T | JPY | Chugai Pharma | 5 | 77 | 53 | 98.3 | Health | Drug Makers |

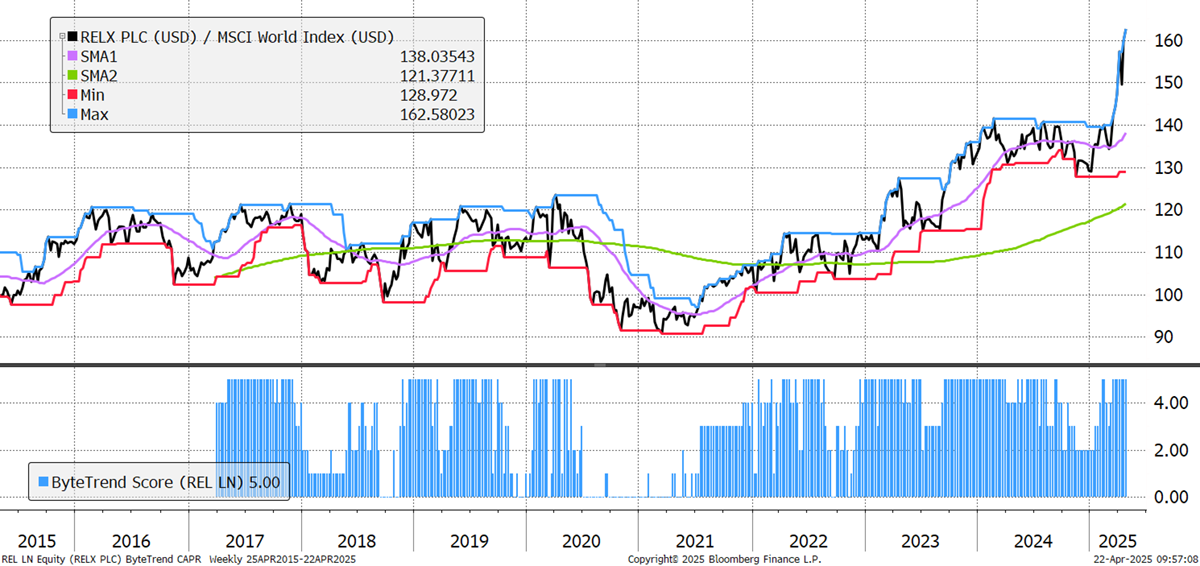

| REL.L | GBp | RELX | 5 | 39 | 19 | 97.1 | Comms | Publishing |

| BNP.PA | EUR | BNP Paribas | 5 | 22 | 31 | 92.0 | Finance | Reg Banks |

| MUV2.DE | EUR | Munich Re | 5 | 70 | 22 | 91.9 | Finance | Reinsurance |

| UCG.MI | EUR | UniCredit | 5 | 118 | 37 | 89.4 | Finance | Reg Banks |

| INVE-B.ST | SEK | Investor AB | 5 | 20 | 19 | 89.3 | Finance | Asset Man |

| INVE-A.ST | SEK | Investor AB | 5 | 19 | 18 | 89.3 | Finance | Asset Man |

| ISP.MI | EUR | Intesa Sanpaolo | 5 | 58 | 30 | 89.2 | Finance | Reg Banks |

| SBIN.NS | INR | State Bank Ind | 5 | 32 | 25 | 85.6 | Finance | Reg Banks |

| LSEG.L | GBp | LSE | 5 | 31 | 17 | 80.2 | Finance | Exchanges |

Netflix crashed when subscriber growth disappointed in early 2022, but the rebound has been astonishing. EBIT margins have been growing steadily (from sub-10% pre-2018 to nearly 30% now), as its fixed-cost original content creates powerful economies of scale. Their ambition is to “entertain the world”, and their continued capex suggests they still see a large opportunity ahead on top of their existing dominance. It’s the only large US tech stock still in an uptrend.

Netflix

Switzerland’s safe-haven status is helping Novartis here because pharma more broadly has not been immune to the tariff shock. Chugai, featured later, is the only other strong trend from pharma. For Novartis, 2024 was a strong year financially. This added to the rotation of capital from the US into Europe in Q1 and has presumably given it added resilience to the tariff shock. Sales grew 12%, and operating profits 22%. Moreover, it’s already investing heavily in US production capacity, which offers protection from the tariffs currently being proposed.

Novartis

Luxury is a very mixed bag at the moment, with exposure to China a key factor for many. EssilorLuxottica sees China as a key growth market, but it only makes up 15% of sales, while some luxury companies are at 30% or higher. Its near-monopoly position in eyewear gives it pricing power, and its vertical integration gives it better supply chain control, making it more resilient to inflation and tariff shocks. Once again, the rotation into Europe was boosted by good results reported in early February.

EssilorLuxottica

RELX’s results on 13 February precipitated an 11% fall in the share price over the following weeks. Investors had high expectations, and currency headwinds and guidance not being upgraded may have disappointed them, given its rich valuation. However, it was handily beating the world index before that and has rebounded sharply from the tariff news, thanks to its digital/service-based business model.

RELX

As mentioned, pharma has been broadly weak. United Health, which showed up last week, got smashed on bad results soon after. Japanese Chugai stands out, alongside Novartis, for its relative strength. Like Novartis, in 2024, Chugai reported strong results with record revenues, core operating profit, and core net income. Net income rose 19.0% YoY, driven by especially strong overseas sales. A special dividend for its 100th anniversary helped too.

Chugai Pharmaceutical

There are 160 additional leading trends with new highs in the GTI universe.

Emerging Trends

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of less than 5. They don’t have to be in an uptrend, just emerging. All charts shown are CAPR rebased to 100.

| Ticker | FX | Name | CAPR | Dev | Vol | Cap | Sector | Industry |

|---|---|---|---|---|---|---|---|---|

| NESN.SW | CHF | Nestle | 3 | -15 | 17 | 279.6 | Con Disc | Pkg Food |

| FEMSAUBD.MX | MXN | Fomento Economico | 4 | 17 | 19 | 179.3 | Con Disc | Alcohol |

| HDFCBANK.NS | INR | HDFC Bank | 4 | 23 | 21 | 173.2 | Finance | Reg Banks |

| ULVR.L | GBp | Unilever | 4 | 17 | 15 | 160.8 | Con Disc | Home prod |

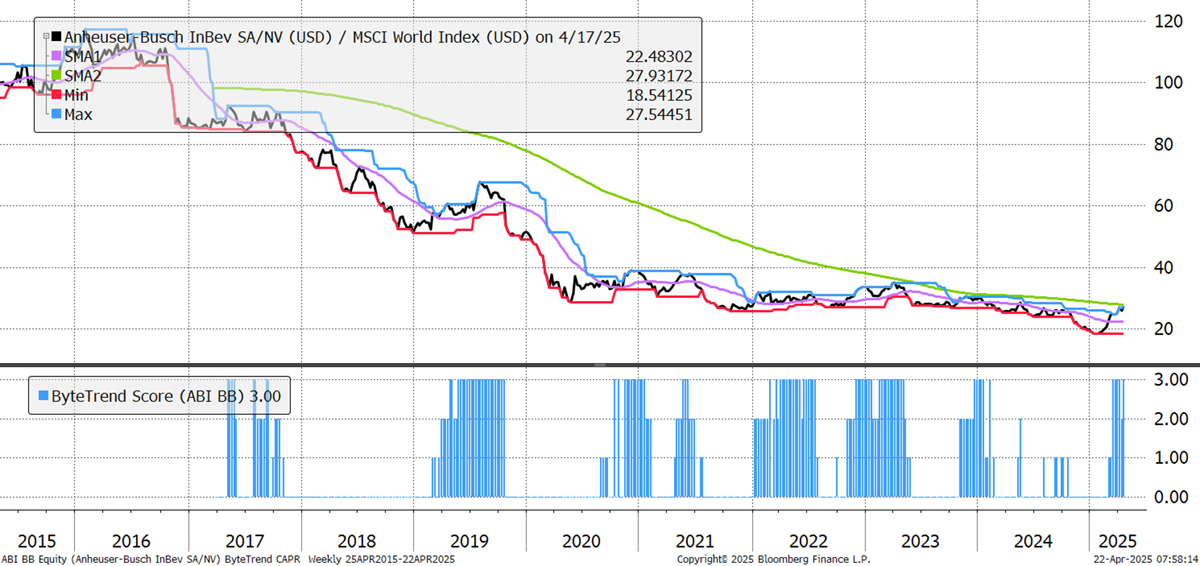

| ABI.BR | EUR | AB InBev | 4 | 7 | 26 | 131.9 | Con Disc | Alcohol |

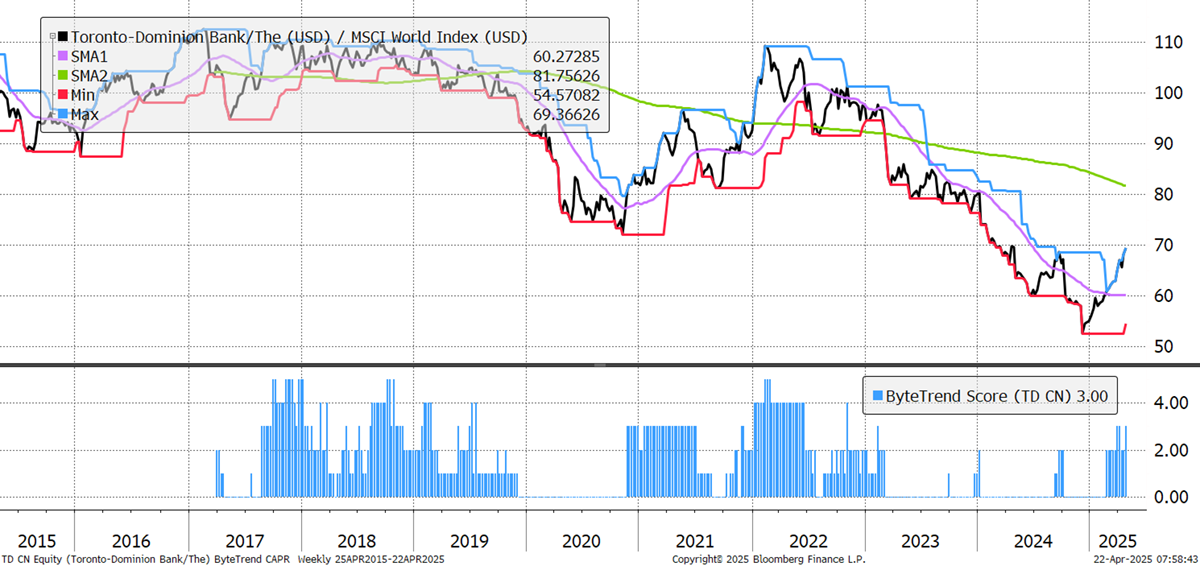

| TD.TO | CAD | Toronto-Dmn Bank | 3 | -1 | 22 | 106.6 | Finance | Banks |

| BATS.L | GBp | British American | 4 | 10 | 21 | 92.9 | Con Disc | Tobacco |

| ENEL.MI | EUR | Enel SpA | 4 | 18 | 22 | 86.2 | Utility | Utilities |

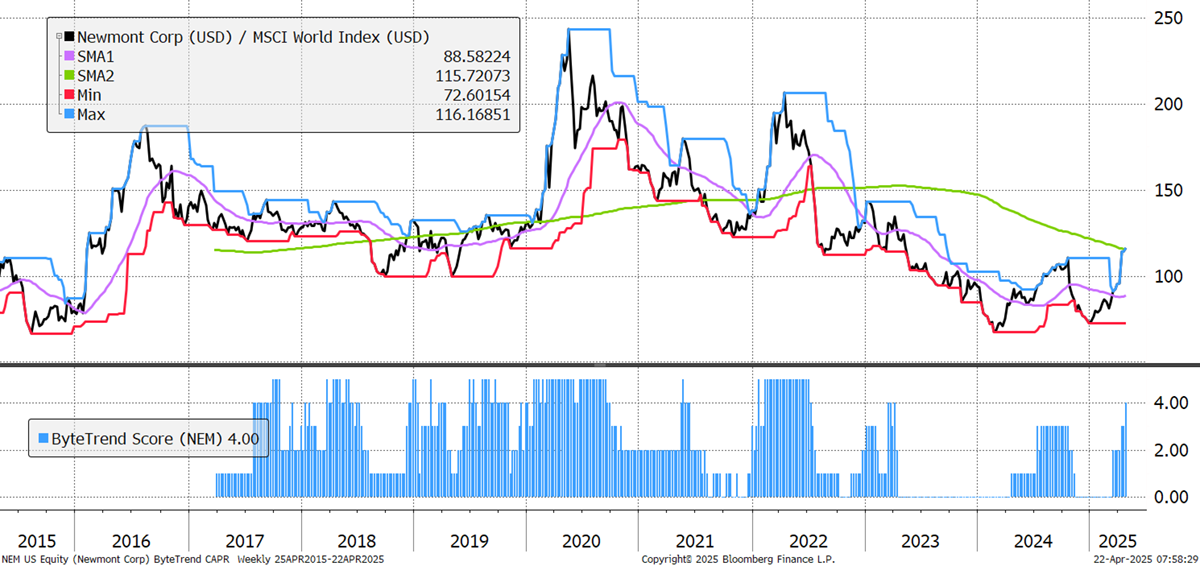

| NEM | USD | Newmont | 3 | 13 | 49 | 62.2 | Materials | Gold |

AB InBev has been losing for a decade. People are drinking less, especially younger people, and they are also shifting from beer towards spirits or away from mainstream brands to craft beers. The low alcohol trend is a growth opportunity, but from such low levels, it cannot compensate for losses in the main business. Margins have suffered, and the revenue rebound after covid has faded. However, it’s showing signs of life in 2025 as its 2024 results showed promise. Key debt ratios fell to their lowest level since 2015, EPS grew 15%, and free cash flow was strong. It has good brands and dominant market shares in interesting markets, which could support a turnaround.

Anheuser Busch InBev

Financials are the strongest sector at the moment and are well-represented in the leading category. Canada is under pressure, but “Liberation Day” wasn’t as bad as feared, given Trump’s earlier moves. Toronto Dominion Bank’s strong revenue growth and impressive cost-efficiency in 2024 have helped drive a turnaround. Regulatory failures in 2024 led to a $500m investment program in Anti-Money Laundering controls. Q1 2025 also saw it sell its entire 10% stake in Charles Schwab for $1.5bn because they saw great opportunities to invest in their own business instead.

Toronto Dominion Bank

Gold miners are finally seeing relative strength as the metal itself rockets higher. Newmont shows up rather than Barrick, presumably because of Barrick’s troubles in West Africa. Newmont has beaten it by 16% YTD. Its integration of the large acquisition, Newcrest, slowed it down in 2024, but the combined entity is starting to shape up now, with more scale and copper exposure. It has begun divesting non-core assets and hopes to generate $4.3 billion in total proceeds. The average realised gold price in 2024 was $2,408, up 23% YoY, and the current price is above $3400.

Newmont Corp

There are 135 additional emerging trends in the GTI universe.

Weakening

These stocks are trading at the 30-week CAPR lows with a ByteTrend Score above 0. They are weakening trends but not yet downtrends. All charts shown are CAPR rebased to 100.

| Ticker | FX | Name | CAPR | Dev | Vol | Cap | Sector | Industry |

|---|---|---|---|---|---|---|---|---|

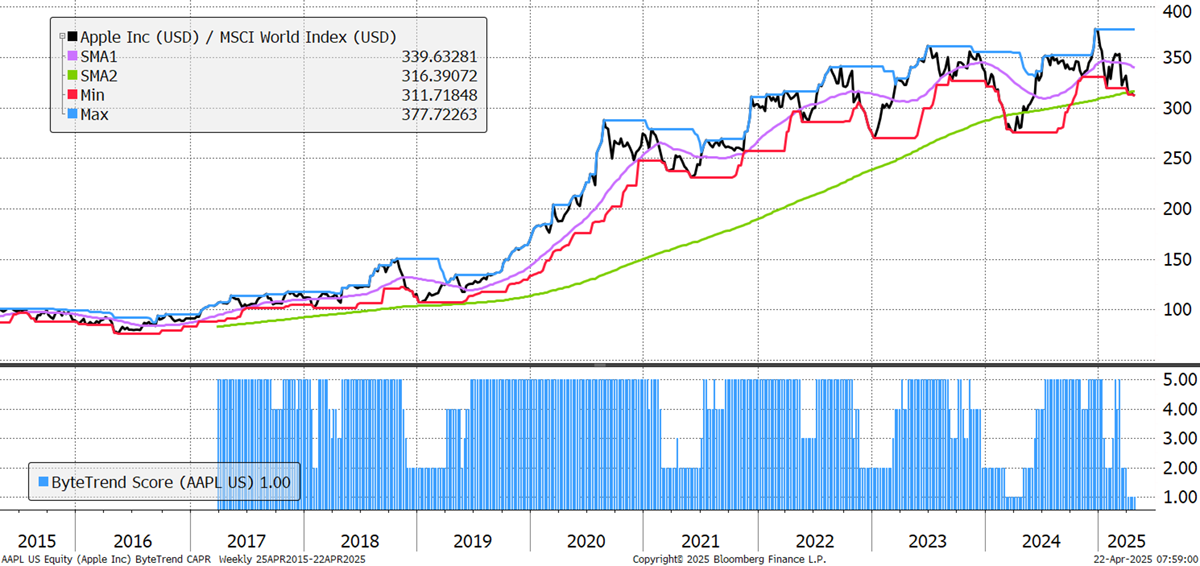

| AAPL | USD | Apple | 1 | 8 | 31 | 2901.7 | Tech | Cons Elec |

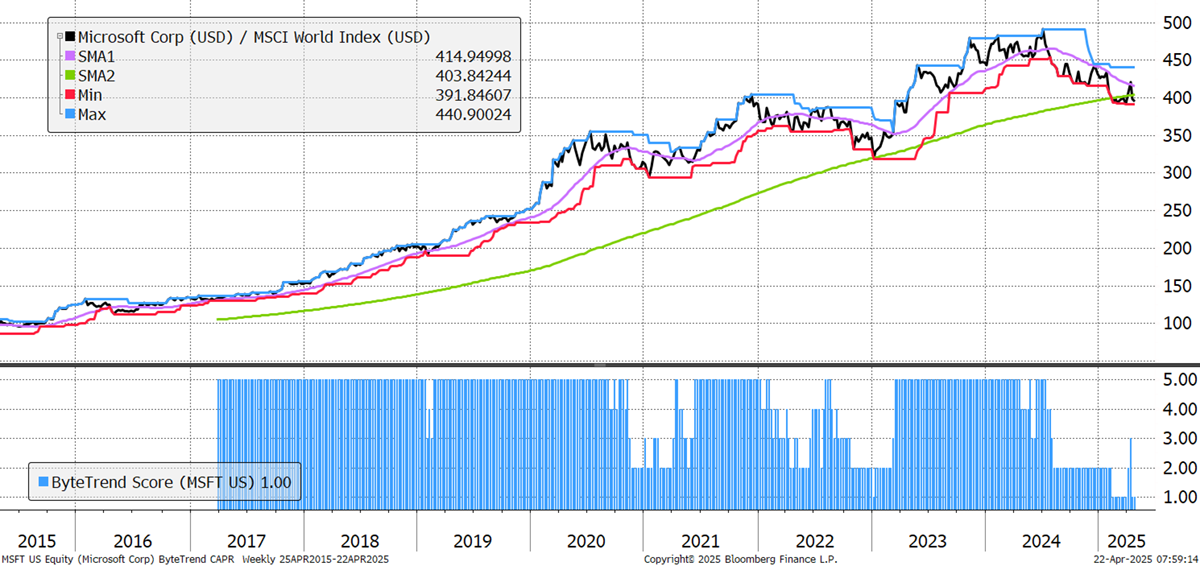

| MSFT | USD | Microsoft | 1 | 7 | 22 | 2669.7 | Tech | Software Infra |

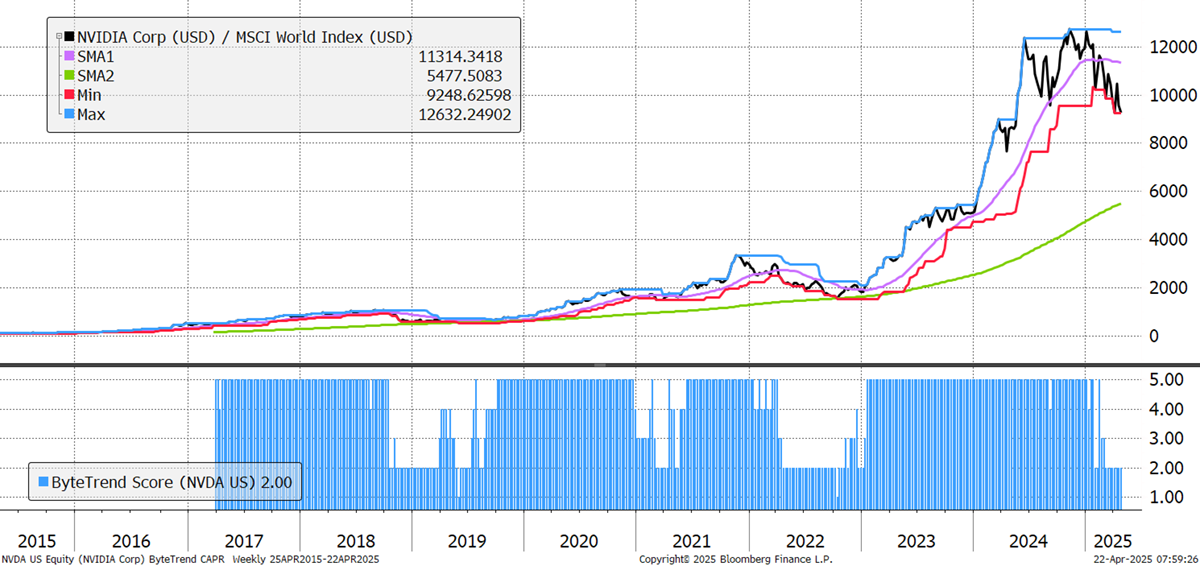

| NVDA | USD | NVIDIA | 2 | 73 | 53 | 2364.6 | Tech | Semis |

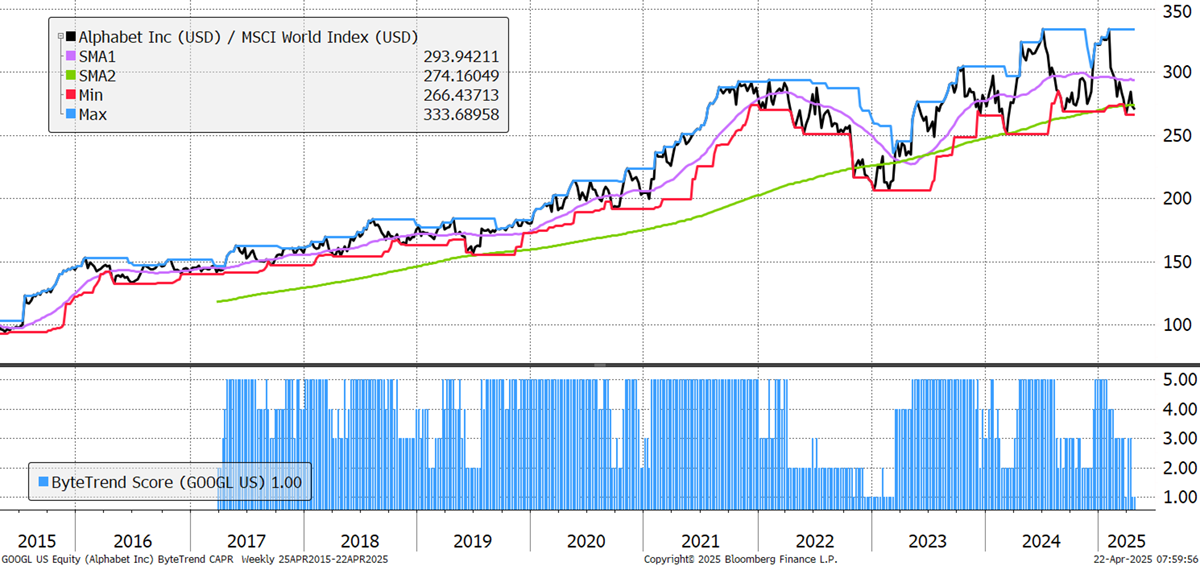

| GOOGL | USD | Alphabet | 1 | 8 | 29 | 1811.9 | Comms | Internet |

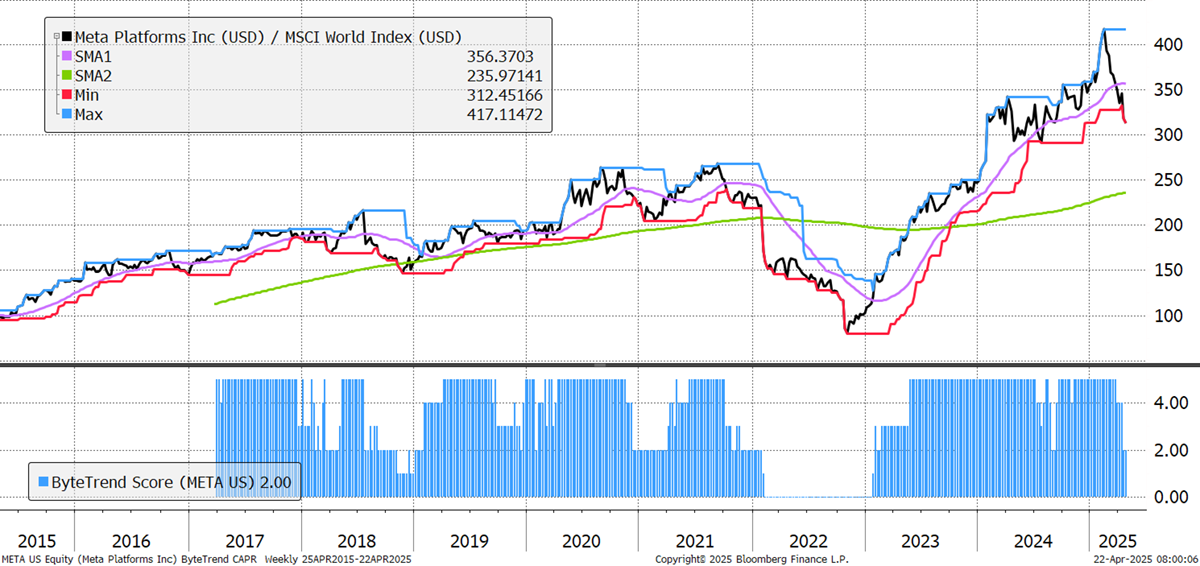

| META | USD | Meta Platforms | 2 | 40 | 36 | 1227.3 | Comms | Internet |

| 2330.TW | TWD | TSMC | 2 | 24 | 27 | 667.0 | Tech | Semis |

| ORCL | USD | Oracle | 2 | 13 | 39 | 344.4 | Tech | Software Infra |

| CVX | USD | Chevron | 2 | -11 | 28 | 233.6 | Energy | O&G Int |

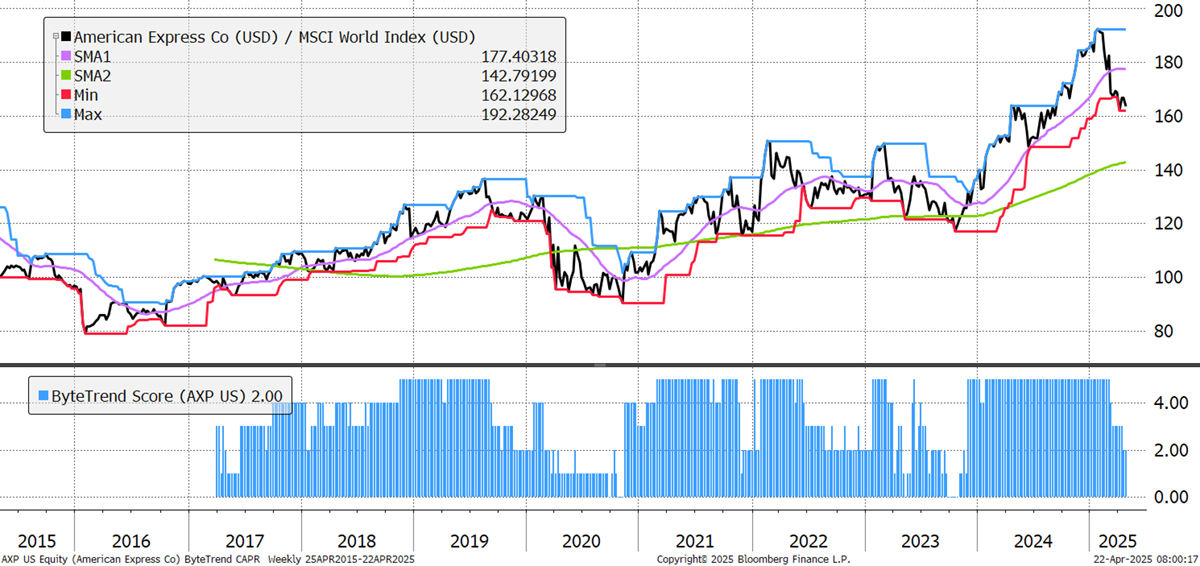

| AXP | USD | American Express | 2 | 24 | 29 | 170.0 | Finance | Credit |

| BX | USD | Blackstone | 1 | 1 | 41 | 156.8 | Finance | Asset Man |

| NOW | USD | ServiceNow | 2 | 18 | 33 | 156.6 | Tech | Software |

| CAT | USD | Caterpillar | 1 | 7 | 30 | 136.1 | Indust | Ag Mach |

| PANW | USD | Palo Alto Networks | 3 | 33 | 34 | 106.0 | Tech | Software Infra |

The Magnificent Seven all appear for the first time.

Apple was the victim of many headlines predicting horror prices for its iPhones if the full tariffs took effect. It has benefitted from globalisation and cheap foreign labour, which are Trump’s two main targets. Rich valuations, question marks over the supply chain, and a rotation out of US assets exacerbate the threat.

Apple

Microsoft has been flagging as weak for some time, having fallen to a ByteTrend Score of 2 in mid-2024. Its underperformance is nothing new. It is quietly cancelling planned data centre capex, undermining the AI bull narrative. Capex as a % of revenue jumped from single-digits pre-2016 to 15% in 2023 and 30% in 2025. Recent results beat analyst estimates, but guidance disappointed. Its EV/Sales ratio grew from 3x to 15x from 2015 to 2024, and is still above 10x.

Microsoft

It's hard to say anything of value about Nvidia. It’s a brilliant company, but the hype was clearly extreme. Expectations were for decades of monopoly power in the fastest-growing industry. Its rapid ascent had already plateaued by the time DeepSeek came along in January 2025, and the shares are down over 30% since. EV/Sales reached 45x, and is back to “only” 18x.

Nvidia

Google’s dominance of search is in question, as Chat GPT, Perplexity and the rest offer a faster, more natural search function. Its monopoly power is under real threat for the first time, and the stock was not priced for it.

Alphabet

Mark Zuckerberg is desperately trying to convince US lawmakers and regulators that ByteDance (TikTok) is a real and growing threat in many of its markets so that it is not treated as a monopoly and forced to spin out Instagram and WhatsApp. However, pushing the strength of a competitor in public is also bad for investor sentiment. The Metaverse, after which it rebranded, was a misstep and a large waste of capex. It has now plunged another huge sum into AI, but the market is no longer convinced of this either. It was priced for perfection, but guidance in the recent results disappointed, even though the results exceeded expectations.

Meta

American Express’ revenues were below estimates, exacerbating the flight of capital from the US stock market. Credit card rates are very high in America, and credit card defaults have hit their highest levels since the GFC, following record levels of debt. Its Q1 results were solid, with high single-digit performance and guidance for the top and bottom line. However, the lack of positive surprises led to further declines. When negative sentiment hits rich valuations, it doesn’t take much to disappoint.

American Express

There are 48 additional weakening trends in the GTI universe.

Bear Trends

These stocks are trading at the 30-week CAPR lows with a ByteTrend Score of 0. They are in a downtrend. All charts shown are CAPR rebased to 100.

| Ticker | FX | Name | CAPR | Dev | Vol | Cap | Sector | Industry |

|---|---|---|---|---|---|---|---|---|

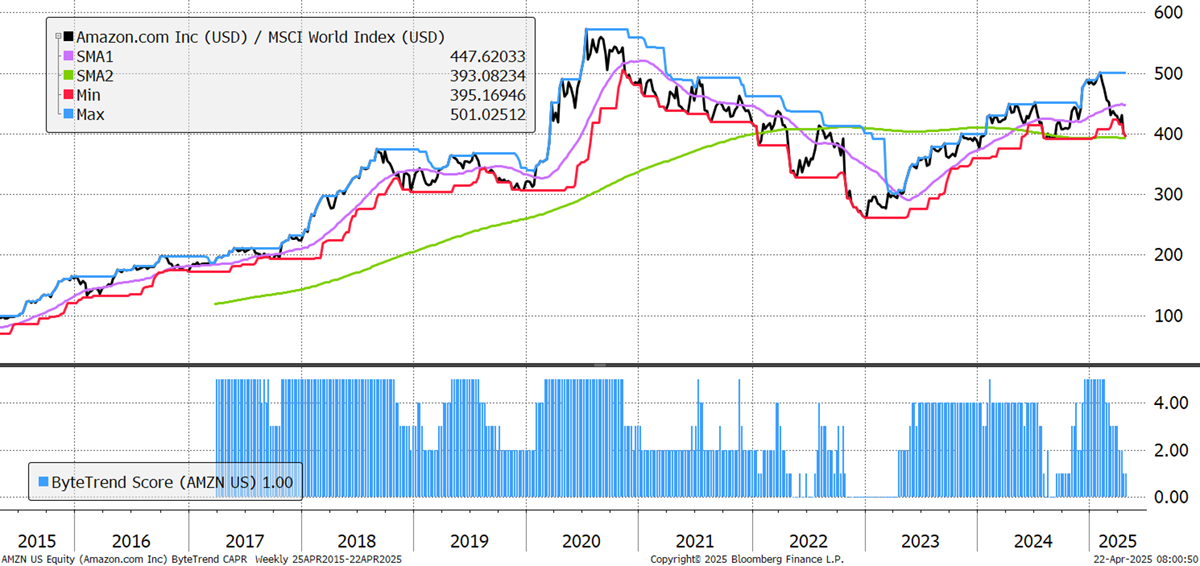

| AMZN | USD | Amazon | 0 | 9 | 31 | 1775.7 | Con Cycl | Spec Retail |

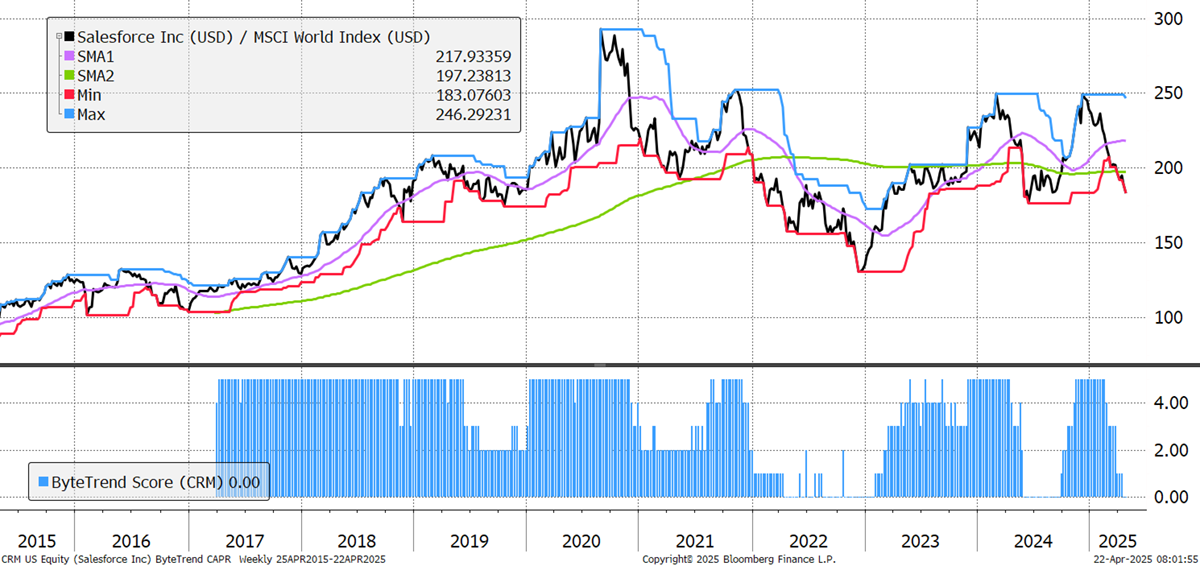

| CRM | USD | Salesforce | 0 | 1 | 32 | 227.0 | Tech | Software |

| ACN | USD | Accenture plc | 0 | -13 | 23 | 174.8 | Tech | IT |

| TMO | USD | Thermo Fisher | 0 | -24 | 26 | 159.2 | Health | Med Diag |

| DIS | USD | Disney | 0 | -25 | 35 | 151.9 | Comms | Entertain |

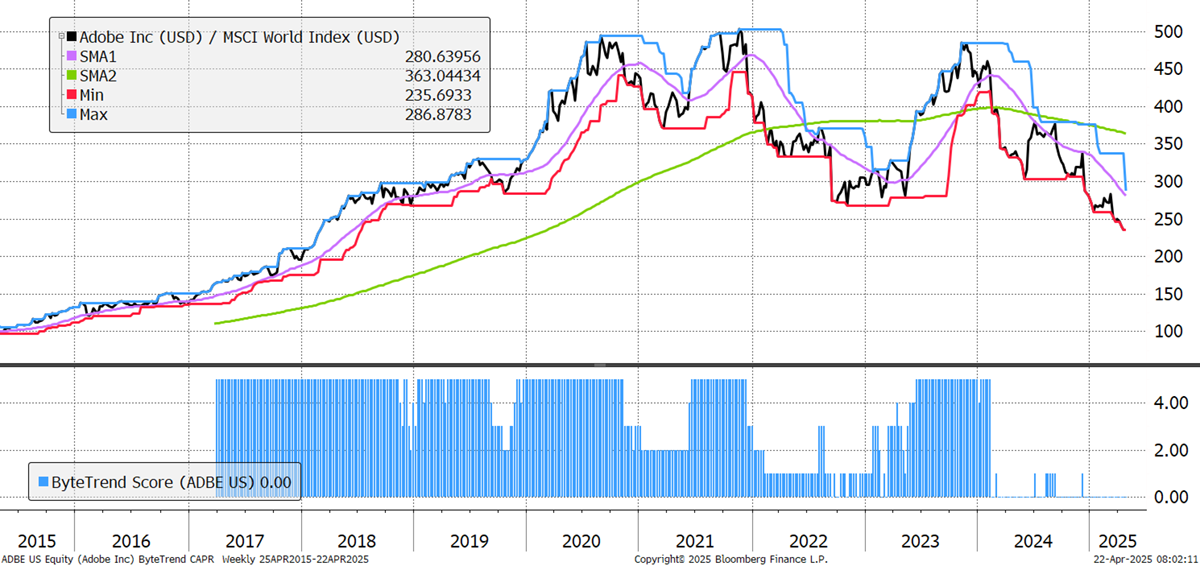

| ADBE | USD | Adobe | 0 | -28 | 35 | 146.3 | Tech | Software Infra |

| SPGI | USD | S&P Global | 0 | 8 | 24 | 140.9 | Finance | Exchanges |

| AMD | USD | AMD | 0 | -26 | 43 | 139.0 | Tech | Semis |

| TXN | USD | Texas Instruments | 0 | -18 | 32 | 132.5 | Tech | Semis |

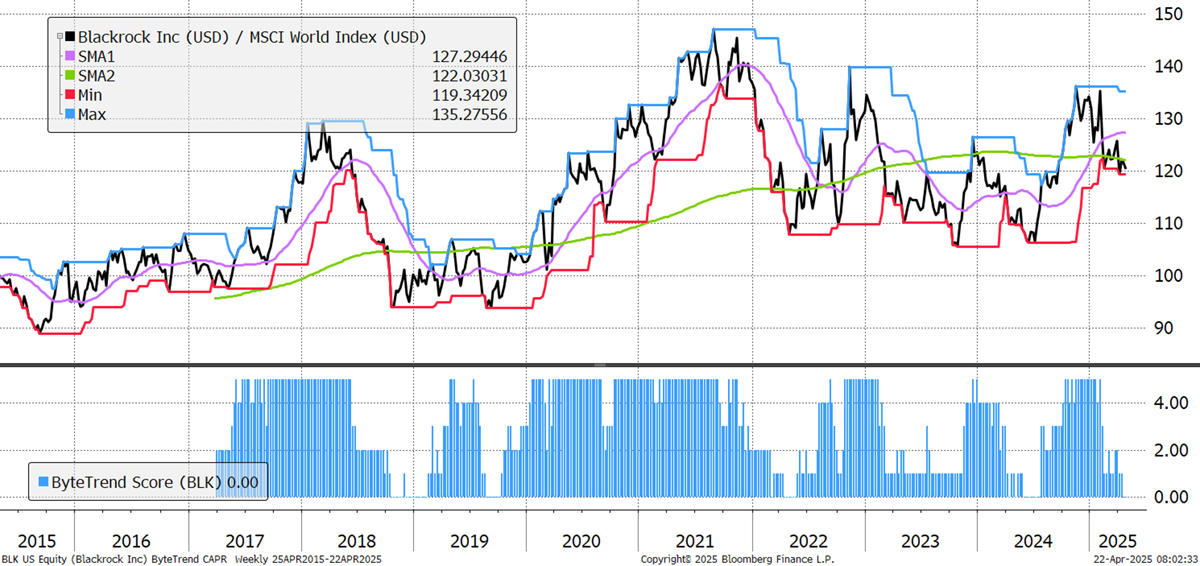

| BLK | USD | BlackRock | 0 | 8 | 30 | 132.4 | Finance | Asset Man |

| PFE | USD | Pfizer | 0 | -42 | 22 | 125.0 | Health | Drug Makers |

| LOW | USD | Lowe's | 0 | -3 | 22 | 119.1 | Con Cycl | Home Impr |

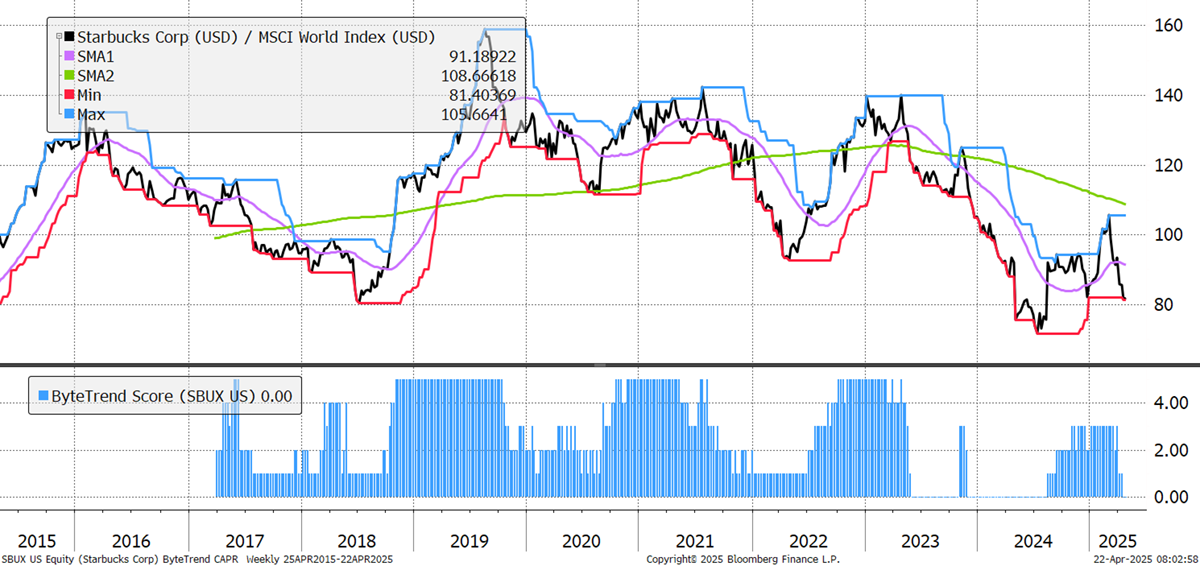

| SBUX | USD | Starbucks | 0 | -16 | 36 | 91.6 | Con Cycl | Restaurants |

| UPS | USD | UPS | 0 | -42 | 29 | 81.6 | Indust | Logistics |

| EQIX | USD | Equinix, | 0 | -0 | 21 | 75.6 | Real Est | Spec REITs |

| MU | USD | Micron Tech | 0 | -17 | 59 | 74.6 | Tech | Semis |

| ABNB | USD | Airbnb | 0 | -17 | 42 | 70.4 | Con Cycl | Trav Serv |

| 9984.T | JPY | SoftBank | 0 | -3 | 43 | 68.0 | Comms | Telecoms |

| ITW | USD | Illinois Tool Works | 0 | -3 | 22 | 66.8 | Indust | Ind Mach |

| PYPL | USD | PayPal | 0 | -40 | 35 | 59.6 | Finance | Credit |

Amazon is faring the worst of the Magnificent 7. Its real-world connection gives it extra challenges from the tariff and trade shock. When your advantage is speed and low cost, the realigning of supply chains and the reshoring of production are bad for both. It is the first member of the MAG 7 to make the bear list.

Amazon

The very high switching costs for enterprise software give Salesforce high margins and lots of recurring revenues, which investors have loved. However, it has been flat against the world index since 2019, which is a surprise, and well down from its post-covid relative peak. Margin and free cash flow growth have accelerated during that time, but slowing revenue growth has outweighed those positives. The tariffs impact its cloud business, which is used by customers to run their international trade and supply chains.

Salesforce

Adobe was ahead of the game and has been flagged as a bear stock for over a year. The story is familiar. Solid growth and impressive margins continue, but rich valuations and high expectations mean just “good” isn’t enough. The fading AI narrative also reduces a key growth driver for it.

Adobe

BlackRock is a geared play on financial markets, a so-called high beta stock. It has still beaten the world by 20% over the past decade, in a bull market, but if this bear carries on, it will remain on the bear list.

BlackRock

Starbucks’s new CEO came from a hugely successful time at Chipotle. Star-CEOs rarely live up to their reputations in new roles, as the competitive forces driving company performance count for more. Starbucks has lost its edge and reputation, and it will take a lot to turn it around. Coffee prices are soaring, and the tariff shock just makes things harder, but it was already a struggle.

Starbucks

There are 138 additional bear trends in the GTI universe.

Outlook

This is turning into one of history’s great market rotations. In 2025, US equities are down 18%, while Europe is up 4%. It is a remarkable situation, largely driven by tariff wars. However, high US valuations, combined with a highly valued dollar, make the moves all the more significant.

Thanks for reading GTI.