Weather Warning

Issue 26;

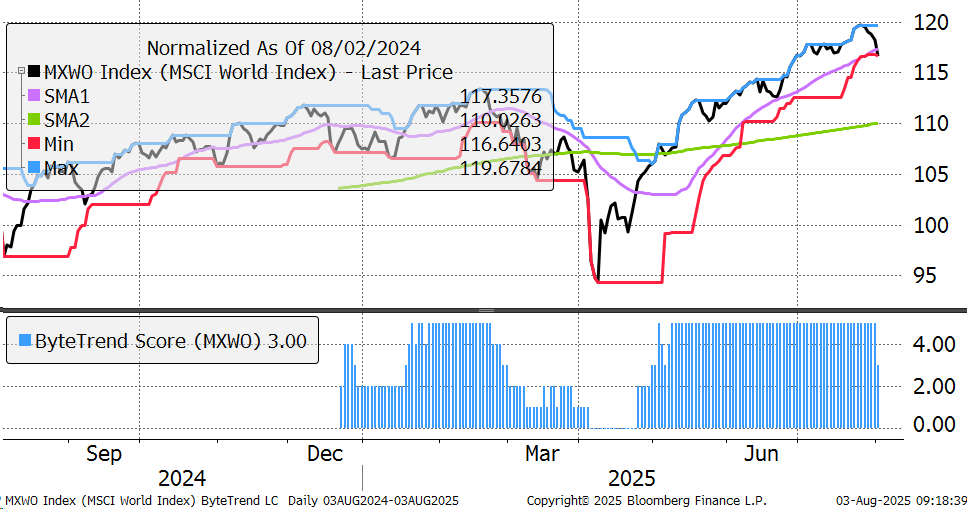

For the first time since April, the ByteTrend score has fallen to a 3. The World Index has dropped below its 30-day moving average (pink) and touched the 20-day min line (red). This is not yet a disaster, but we should certainly acknowledge the pullback in markets may continue.

World Index – Developed Markets – Daily

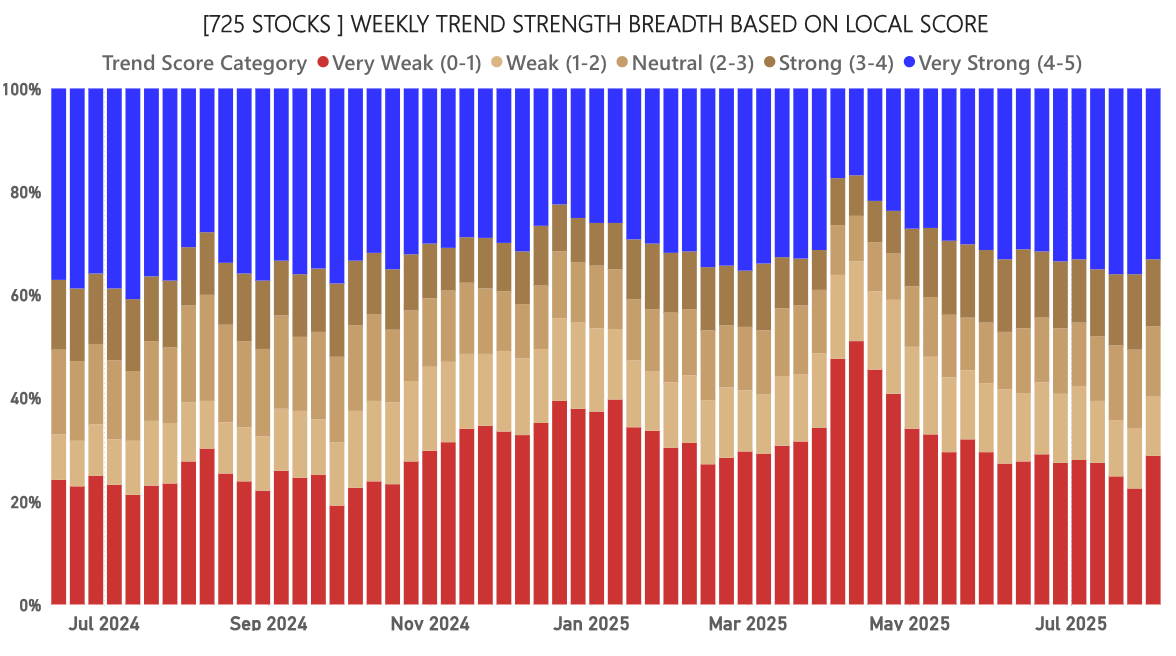

That has been accompanied by weaker market breadth. The number of bear trends (red) have increased, while the bull trends have contracted (blue).

ByteTrend: Weekly Breadth Signal – Local Currency

Macro Events

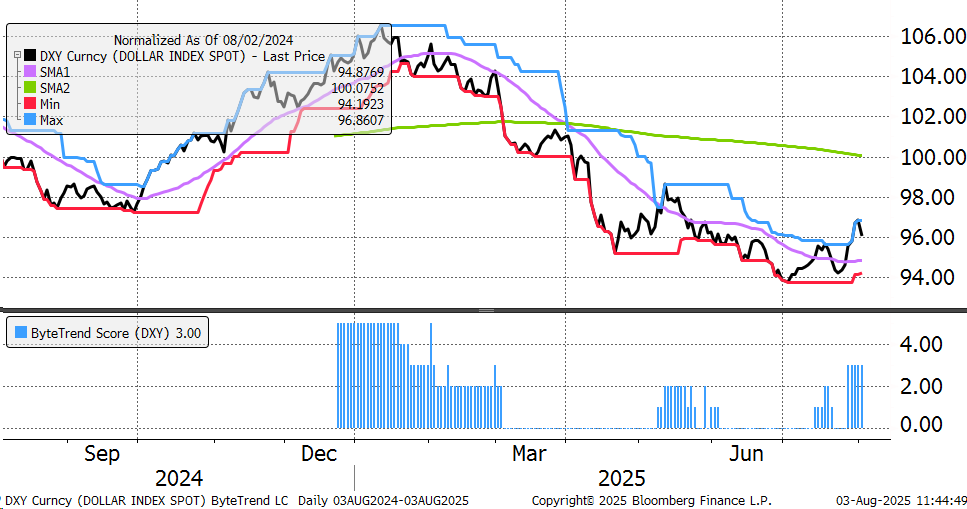

The dollar rallied to a ByteTrend score of 3. A bigger story perhaps was the rally in the yen on the hope of US rate cuts, and a new high for the defensive Swiss Franc. This macro reawakening was negative for markets, but a bigger concern was the weak jobs report which saw the 10-year treasury yield fall from 4.5% to 4.2%. Time for bonds?

Dollar Index

Leaders and Laggards

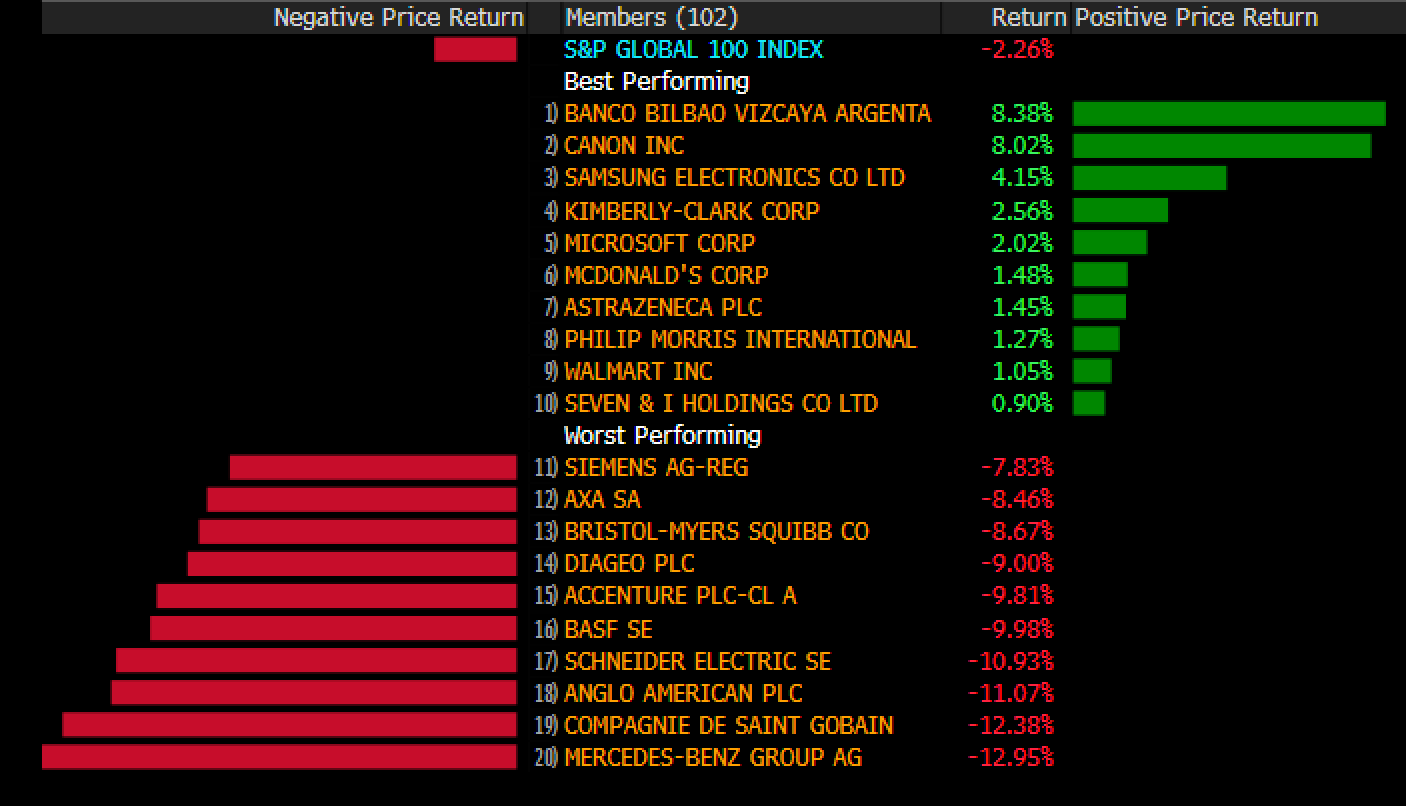

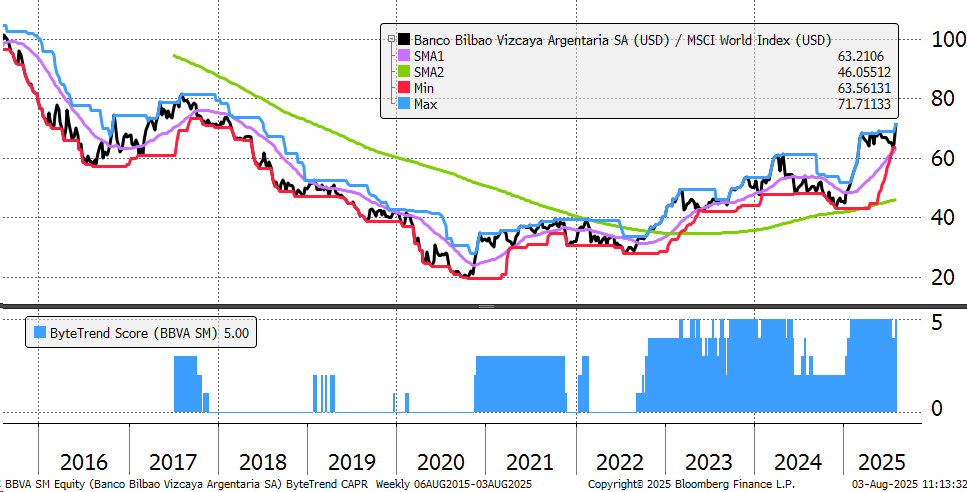

The laggards had notable moves in contrast to the leaders. BBVA (featured below) is in a healthy uptrend, with strong results, especially from Mexico. Canon also released good results and announced a buy back. The laggards were well represented on the Global Trends bear list.

Developed Markets Leaders and Laggards

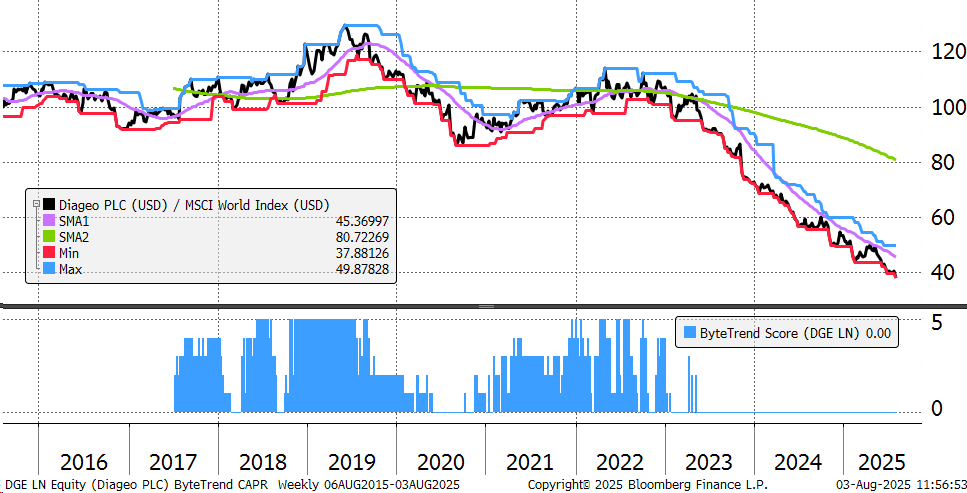

Just when you thought Diageo was close to buy territory. Sales are down, and tariffs haven’t helped. They also blame Gen Z and the Millennials for not boozing enough. They also blame the weight loss drugs. There is a new CEO and the valuation is no longer demanding.

Diageo

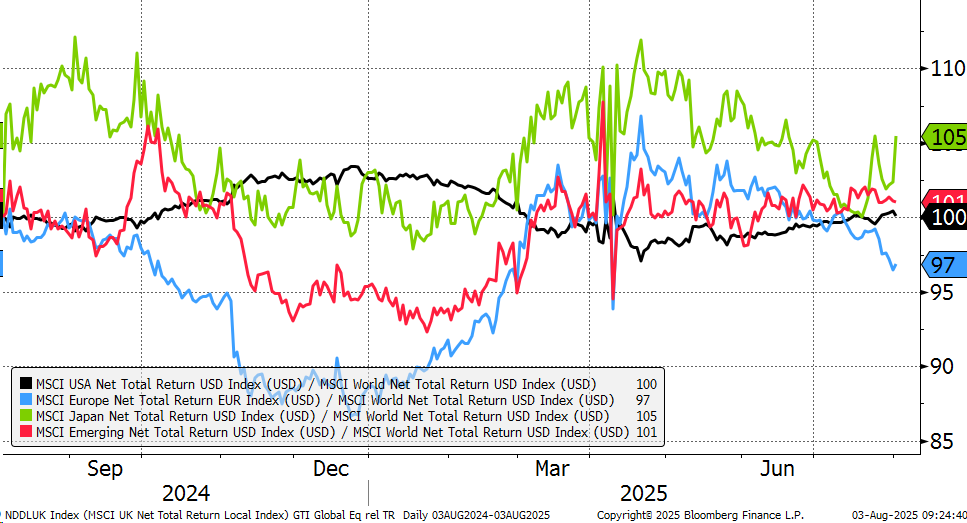

The regional CAPR chart sees a surge in the Japanese as the yen rallies. Europe is showing weakness. Note the start a year ago was at the time of the yen carry trade unwind. That distorts the chart this week, but Japan is showing strength regardless. Expect a catch down on Monday, as the Japanese stocks respond to US weakness on Friday.

CAPR: Europe, USA, Emerging Markets and Japan - Past Year

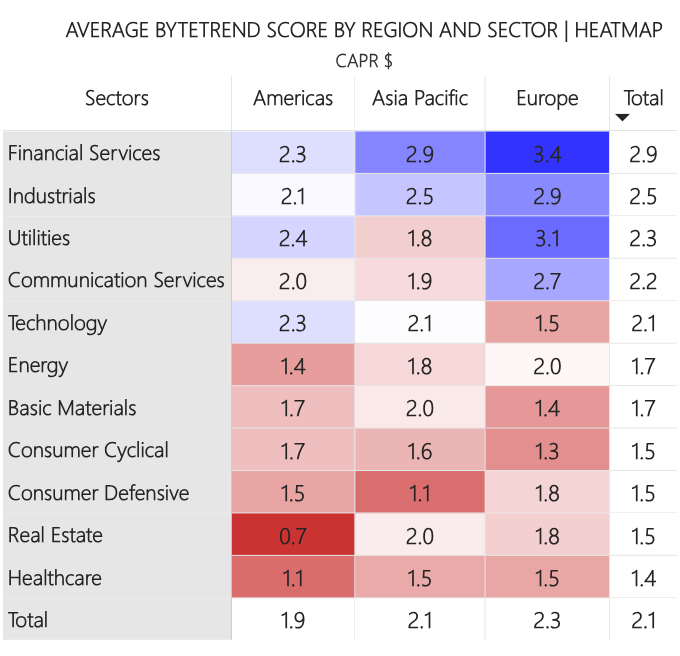

The world matrix still favours Europe in terms of the number of strong stocks, but the strength in fewer super-strong, mega cap US stocks has more impact on market indices. Financials and industrials still dominate the list. The risk to financials is rate cuts which seem to be a step closer. Consumer stocks, real estate and healthcare continue to weigh on the market.

Average ByteTrend Score by Region and Sector Heatmap - CAPR

Leading Trends with New Highs

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of 5. All charts shown are CAPR rebased to 100.

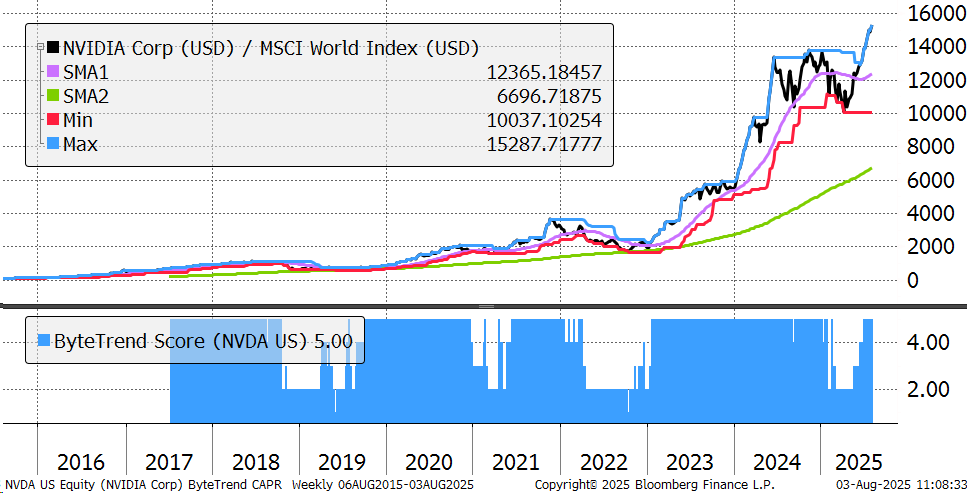

| NVDA | USD | NVIDIA Corporation |

| MSFT | USD | Microsoft Corporation |

| AVGO | USD | Broadcom Inc. |

| ORCL | USD | Oracle Corporation |

| GE | USD | GE Aerospace |

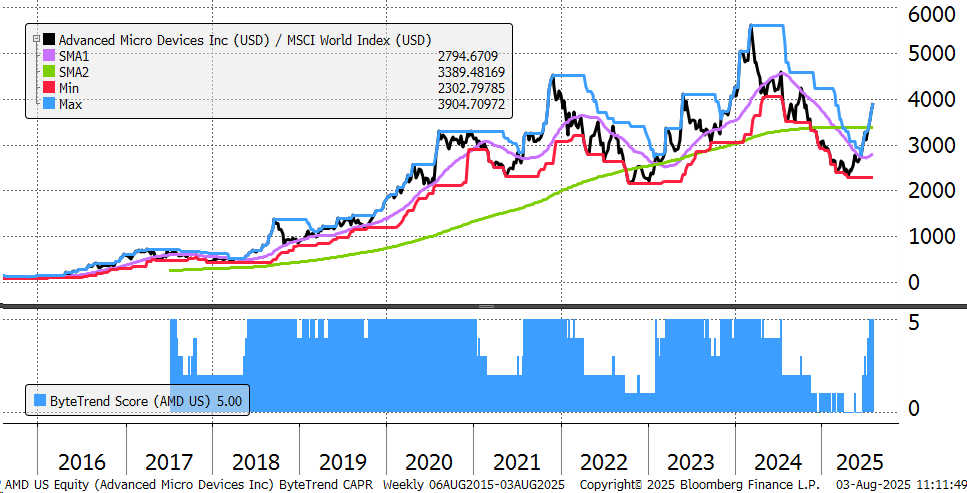

| AMD | USD | Advanced Micro Devices, Inc. |

| RTX | USD | RTX Corporation |

| CAT | USD | Caterpillar Inc. |

| GEV | USD | GE Vernova Inc. |

| APH | USD | Amphenol Corporation |

| ABBN | CHF | ABB Ltd |

| UBSG | CHF | UBS Group AG |

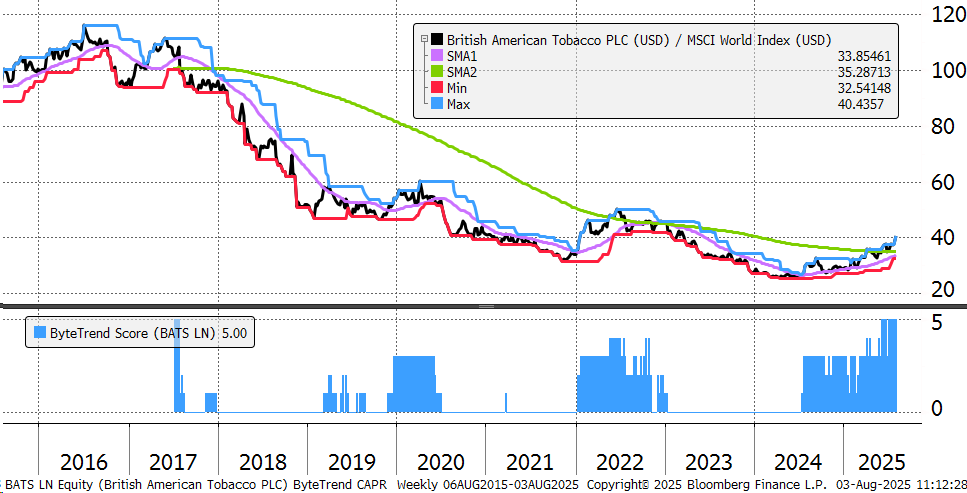

| BATS | GBp | British American Tobacco p.l.c. |

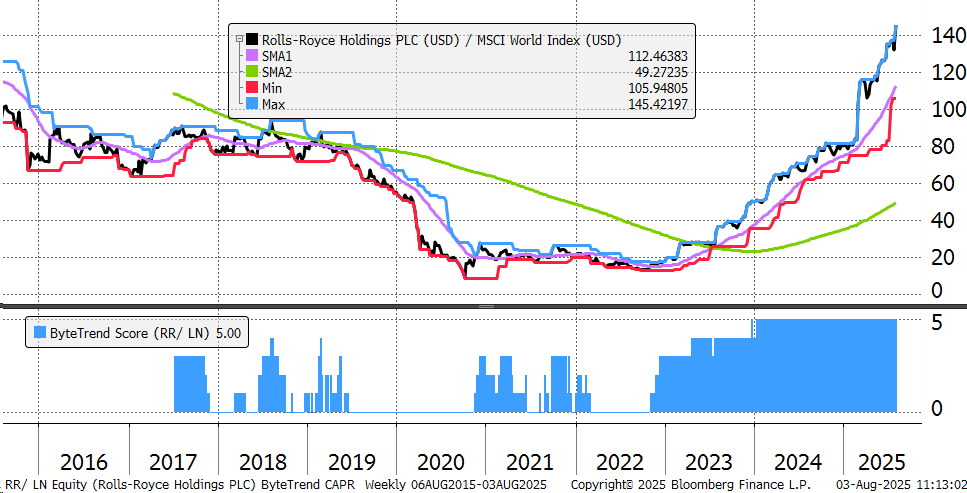

| RR | GBp | Rolls-Royce Holdings plc |

| SNPS | USD | Synopsys, Inc. |

| UCG | EUR | UniCredit S.p.A. |

| CDNS | USD | Cadence Design Systems, Inc. |

| BBVA | EUR | Banco Bilbao Vizcaya Argentaria, S.A. |

These CAPR charts are rebased to 100 a decade ago. NVDA has beaten the market by 150 times and it breaks higher again. The forward PE is 35, which isn’t that bad for a growth stock, but the 28x sales however, is very high indeed. That assumes high margins into eternity.

NVIDIA

Advanced Micro Devices fights off weakness and is back in an uptrend. Expectations for AMD to increase market share in AI are high.

Advanced Micro Devices

Tobacco company BATS is a classic unpopular defensive that has turned up following a decade of underperformance. The company generates strong cashflow and there is optimism around its smoke free products.

BATS

An impressive performance from Rolls Royce as profits grew by 50% over last year. Revenue, margins and cashflow were strong with firmer guidance. The strength came from aerospace which remains strong globally. This recovery was so obvious in hindsight. Shame I missed it.

Rolls Royce

As stated earlier, BBVA is doing well, especially in Mexico. It’s Spain’s answer to HSBC or Citigroup. The valuation is undemanding, and the analysts love it.

BBVA

There are 96 additional leading trends with new highs in the GTI universe. The world’s leading trends, in terms of quantity, are dominated by European financials. The second strongest group are European and Asian Industrials. Tech comes third, but the stocks are big, and mainly from the USA and Taiwan. AI continues to move markets.

Emerging Trends

These stocks are trading at the 30-week CAPR highs with a ByteTrend Score of less than 5. They don’t have to be in an uptrend, just emerging. All charts shown are CAPR rebased to 100.

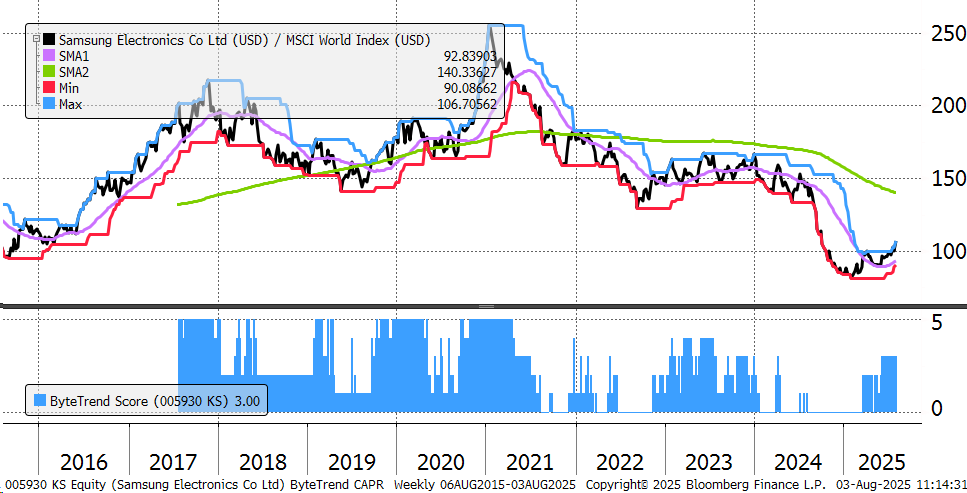

| 5930 | KRW | Samsung Electronics Co., Ltd. |

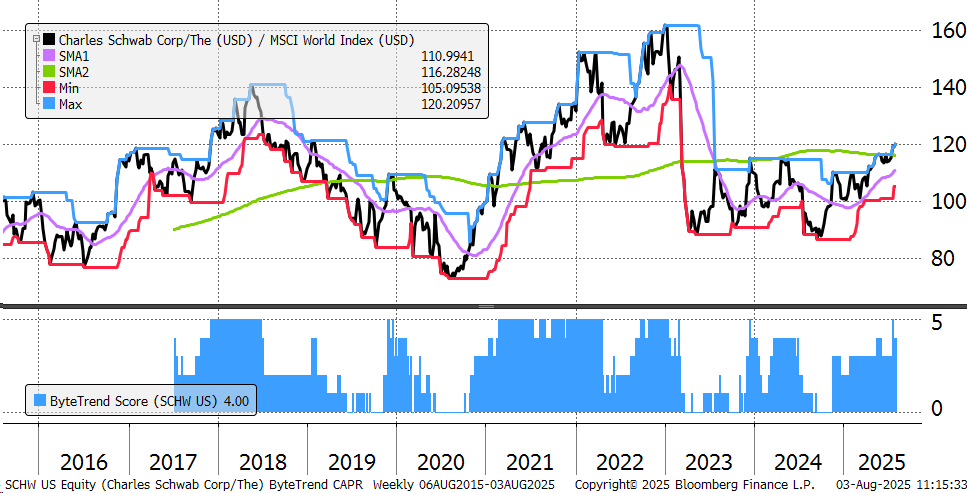

| SCHW | USD | The Charles Schwab Corporation |

| DASH | USD | DoorDash, Inc. |

Samsung has only matched the world over ten years but has recently turned up. The Galaxy S25 series are seeing high demand, alongside its legacy DRAM chips. The analysts are upgrading. It’s a shovel provider to the AI boom on an undemanding 13x PE for next year.

Samsung Electronics

Charles Schwab has been enjoying this bull market. Record profits were announced on their $9.4 trillion of client assets. This recovery comes following their mishap on holding longer dated treasuries as reserves in 2022/3. The analysts are bullish about this high beta stock.

Charles Schwab